Trump poses ‘dramatic’ risk for Australia

There are increasing warnings that Australia could be plunged into a nightmare scenario if Donald Trump becomes president and a battle emerges with China.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

A Donald Trump presidency could kick off a bitter trade war between the US and China which would have a “dramatic” impact on Australia, including the real risk of recession.

It comes at a time when China’s economy is struggling to grapple with worsening conditions from the continuing meltdown of its property market, slowing growth and a decline in consumer spending.

What’s even more alarming is how heavily dependant Australia is on China – the world’s second biggest economy – and any further shocks will be keenly felt here particularly with Mr Trump’s tariff threats and the “insane” reliance on it as a trade partner, according to experts.

One of Mr Trump’s signature economic policies is his plan to impose tariffs on imports from all nations.

China will be whacked with a 60 per cent tariff on imports, prompting concerns about a trade war and higher costs.

Many might believe the huge Chinese tariff Trump is planning to slap on the country would have nothing to do with Australia but that’s not the case, said The Australia Institute’s chief economist Greg Jericho.

“It might not seem like it was going to hurt Australia as it’s the Chinese imports getting a 60 per cent tariff and that would hurt the Chinese economy but that is going to affect exports to China,” he told news.com.au.

“If there is a major trade war, we wouldn’t be able to find other markets to take our minerals to make up for the drop in demand in China.

“It certainly would be something that the government and Reserve Bank would be very mindful of, and I would suggest undergoing a lot of diplomacy, and getting ready for that should Trump win to try and forestall any hiking of tariffs as it would certainly effect us quite quickly.”

Backlash against China

China also isn’t immune to the wider impacts happening internationally that are hitting economies including disruptions from the war in Ukraine and the Middle East, but it’s move to become an even bigger global player is also backfiring, according to Strategic Analysis Australia founder and director Michael Shoebridge.

“Part of it though is China’s policy on wanting to be less dependant on other economies and make other economies more dependant on it, but it is finding it harder to implement and it’s causing a growing reaction in Europe, the US and other democratic economies,” he said.

Trump’s huge tariff plan is an obvious response, but it’s also evident in the electric vehicle inquiries going on in Europe as they investigate China’s moves to try and “kill the local industry”.

But it’s not just the tariffs that are sounding alarm bells as China’s economy is plagued by problems including a marked slowdown.

“I think certainly there are concerns that the growth is slowing to levels that are lower than would signal a healthy economy and that is a concern and of course it has ramification for Australian given our dependency on China for exports for iron ore and lithium and coal,” Dr Jericho said.

“These are things that China are going to want less of and if their economy slows it will certainly have reverberations on Australia’s economy.”

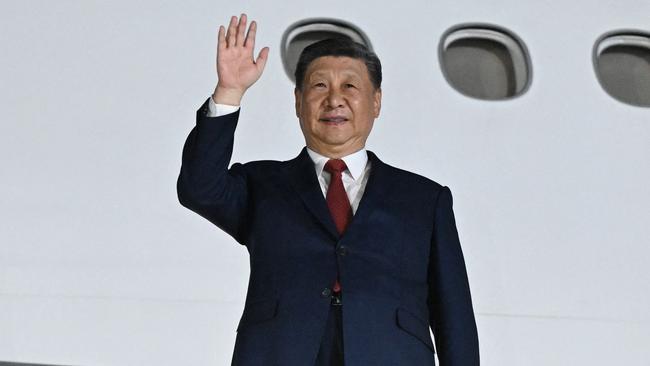

Chinese President Xi Jinping is also to blame for the economy’s “mess”, particularly when

“overly powerful authoritarians” can’t admit there has been “any failure and his plan to keep doing what he is already doing which has led to these problems”, according to Mr Shoebridge.

He said this includes hobbling the Chinese tech sector to prevent its growth in Western markets, the Chinese real estate and construction woes and its export war.

“No one can tell him its failing unless they want to be arrested on corruption charges and spend quality time in the Chinese penal system,” he added.

Australia one of the most vulnerable

A recent report from the Organisation for Economic Co-operation and Development (OECD) revealed “how vulnerable Australia is to trade shocks around the world because of our dependence on China”, Dr Jericho added.

“Australia and South Korea suffer the most from China slowing,” he said.

“I think those in the Reserve Bank and Treasury would have eyes on what is going on in China even if popular media coverage is focused on the craziness of US election, We shouldn’t take our eyes off the US election and if Trump gets in and puts a 60 per cent tariff on China’s economy it will hurt and it will hurt Australia’s economy even more.”

Australia would suffer the second-largest national income fall in the world if trade tensions with China worsen and more countries move to manufacture in house, the OECD report warned.

Meanwhile, Mr Shoebridge is scathing of current Australian policy, calling out the government for “celebrating political stabilisation “ and then talking up the China trade policy – something he describes as “strategically insane”.

“The government should be diversifying away from this risky economy,” he commented.

“It’s risky on sheer economics let alone political grounds. There is deep contradiction in Albanese policy in spending $370 billion on nuclear subs to deter an aggressive China and then talking up our trade relationship”.

He said its increasingly clear that the world’s two biggest economies, the US and China, are moving away from global trading, which will only be accelerated if Mr Trump takes a second presidential term.

“The US are making any Chinese business wanting to export and sell into the US pay more and make it harder to do business and President Xi’s policy is to drive American and other foreign businesses out of China unless they hand over all their intellectual property to potential Chinese competitors – both countries policies are leading to economic decoupling,” he said.

Australia needs to move quickly or there could be dire economic consequences, he added.

“It could push Australia into recession if we continue to have blind faith in free trade and think growing economic dependence on China is a good strategy. If we insist on being snow blind while the world changes – that will lead to trouble,” he said.

Australia’s billion-dollar darling export under threat

Trump’s tariff threat couldn’t come at a worst time for China too as it struggles with a sluggish economy, particularly in construction which has previously been a massive driver for growth in the country.

Yet China’s property market is also big money driver for Australia’s economy with iron ore raking in $124 billion last year and set to jump to $131 billion this year.

But the Chinese property market crisis has continued over the past three years, kicked off by embattled Chinese property juggernaut Evergrande which finally plunged into liquidation earlier this year, owing over $498 billion.

There’s no signs of the crisis ending either. Construction in China in May had plummeted by 80 per cent compared to the same time four years ago, while property developers funding slid by almost 25 per cent in the first half of the year.

This raises alarm bells for Australia.

“Because a lot of materials are used to build apartments and those apartment towers, it requires minerals from Australia to be made into steel. Its certainly an issue and not one that is wholly unsurprisingly as the Chinese property market boomed so greatly it was unsustainable to continue at such a level,” Dr Jericho said.

“That is another thing in the column of concerns about Australia’s economy and sustainability and things that occur in China and America.

“Because if Australia is not supplying things that are going to be used in the Chinese domestic economy we would like to be supplying things that China is making and exporting around the world, especially America.”

The Chinese people are also walking away from investing in property after being promised it was a guaranteed profitable investment, Mr Shoebridge said, yet instead have been watching the industry implode.

“Chinese consumers lost faith in property investment and it’s been rippling through local government finances and state banks,” he noted.

“The idea that China can export its way out of this mess is troubled by economic headwinds that the rest of us are experiencing.”

But Mr Shoebridge said when the golden days of Australian iron ore exports come to a halt is uncertain as President Xi will continue to “force companies to building stuff that no one wants to buy for some time”.

“So predicting a particular moment that iron ore will collapse will remain a fool’s game,” he said.

“Structurally the property market is slowing down and there is massive excessive capacity so demand for imports like steel has to fall.”

Meanwhile, Chinese consumers have turned to saving rather than spending.

Luxury brands are suffering from China’s slowdown with LVMH the company that owns the likes of Louis Vuitton, Bulgari and Dior, alongside others like Hugo Boss and Burberry Group hurt by Chinese consumers reluctance to spend.

LVMH reported sales in the region that includes China dropped 14 per cent in the second quarter, while Swatch Group revealed China sales plunged 30 per cent in the first half of the year and as a result its cutting production.

From an Australian context, BHP Group and Rio Tinto are among the companies that earn more than 40 per cent of their revenue from China.

Australia teeters closer to recession

Trump has also signalled a 10 per cent tariff, which would hit Australian businesses, as claims it would protect US businesses from nations who are out to “steal our jobs” and “steal our wealth”.

Dr Jericho warned outside international politics influence, Australia’s economy is already showing signs of being under strain with the unemployment rate rising.

A report from ANZ revealed unemployment could rise to 5 per cent by the end of next year.

“If that was to occur, I would say Australia would be in recession, so the risks are very much there,” he said.

“That’s why the Reserve Bank should be hesitant to raise interest rates as we know household spending has been low, we know job growth in private sector has been very weak in the past six months. That is all pointing to an economy that has really slowed due to 3.25 basis point in interest rates rise.

“The risks are already there of recession but if we see a trade war break out I think those risks rise rather dramatically.”

Originally published as Trump poses ‘dramatic’ risk for Australia