‘Extreme pressure’: Interest rates bite

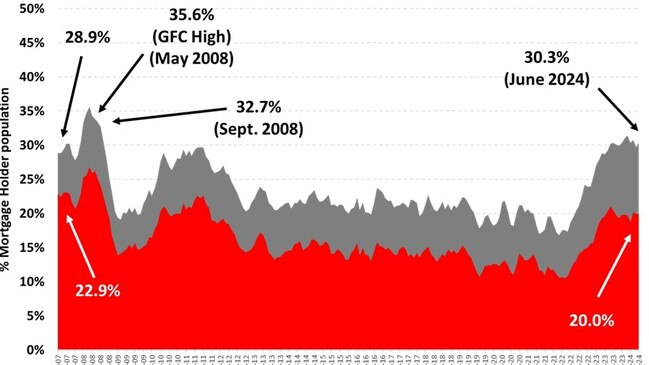

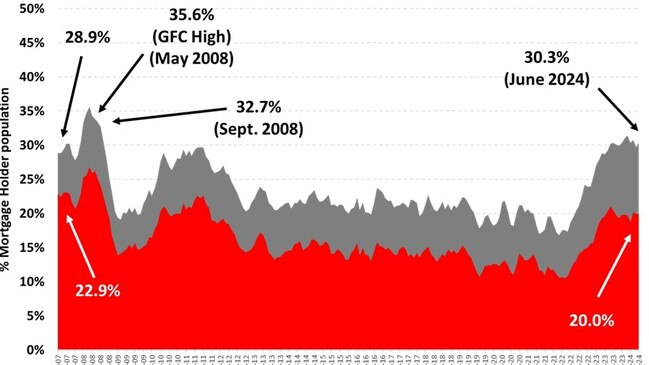

Aussies are being hit with “extreme pressure” from the cost of living crisis with millions facing an impossible choice.

Aussies are being hit with “extreme pressure” from the cost of living crisis with millions facing an impossible choice.

The Australian sharemarket has lifted to break a three-day losing streak on Tuesday on the back of an tech-led Wall St rebound.

One of Australia’s biggest banks has just delivered a big gift to Aussies desperate to lock down a home of their own.

The fallout from the CrowdStrike global tech outage and US President Joe Biden’s decision not to run again have helped push down the Australian sharemarket on Monday.

There’s bad news ahead for Australians trying to buy a new home, with a construction downturn set to hit and further amplify price pressures.

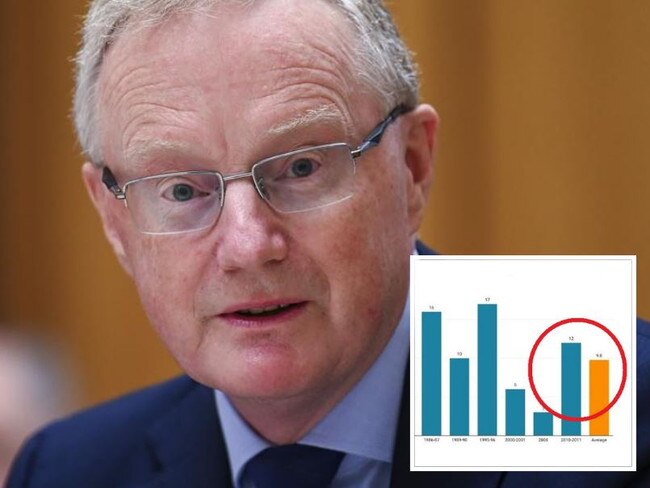

The peak construction union has been slammed over its push to ensure union representatives are appointed to Australia’s most powerful economic institution.

With the Aussie dollar skidding to a nine-month low, economists are warning that Australia’s slowing economy and a deteriorating outlook in China mean further falls are likely.

One item is becoming increasingly unaffordable for Australians, and with prices expected to climb even higher, they may abandon it altogether.

Australia is facing a devastating financial disaster – and money guru Mark Bouris has warned things will get nightmarish within months.

Unexpected news from China and Japan helped the ASX record better than expected results on Tuesday.

As Aussies battle spiking mortgage costs, one of the big four banks has reported a $1.9bn profit.

The RBA toyed with the idea of raising the cash rate again this month, before ultimately deciding to keep it steady.

The Greens have hit out at the outgoing Reserve Bank governor over his support for the big banks while Australians are facing a worsening housing crisis.

They’re questions we all want answered – how long rates will stay high, when they’ll be cut and by how much. But the news isn’t good.

Original URL: https://www.ntnews.com.au/business/economy/interest-rates/page/82