Credit Suisse shares plunge to historic lows as European banks take a hammering

Shares in major investment bank Credit Suisse plunged by nearly 30 per cent overnight as the financial institution teeters on the brink.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Shares in major investment bank Credit Suisse plunged by 24 per cent overnight as the financial institution teetered on the brink.

Trading in Credit Suisse, the world’s seventh largest investment bank, was suspended several times as the stock plummeted, sparking a worrying ripple effect as shares in other European banks also plunged.

Stocks in the Swiss bank fell to 1.68 Swiss francs – the lowest price in its history.

Credit default swaps for Credit Suisse — the cost of insurance against default — are nearing distressed levels.

The crisis was sparked when Saudi National Bank chairman Ammar Al Khudairy ruled out investing any more funds in the company. He said regulation prevented the Saudi bank from increasing its 9.9 per cent stake above 10 per cent.

It comes as the CEO of major investment firm Blackrock said the collapse of Silicon Valley Bank (SVB) could be the beginning of a “slow moving crisis”.

Credit Suisse Chairman Axel Lehmann told finance website Bloomberg on Wednesday that the bank would not need “state assistance” to stay afloat as it had “already taken the medicine”, referring to changes made after it reported an $8 billion loss for 2022.

The US Treasury Department said it was monitoring the situation at Credit Suisse.

Stocks in France’s Société Générale and UBS fell by more than 10 per cent in a troubling cascade.

Shares of Germany’s Deutsche Bank fell in value by 6.4 per cent, Swiss bank UBS plummeted 6.2 per cent, Spanish bank Santander’s share dropped 5 per cent and UK bank Barclays fell by 6.5 per cent.

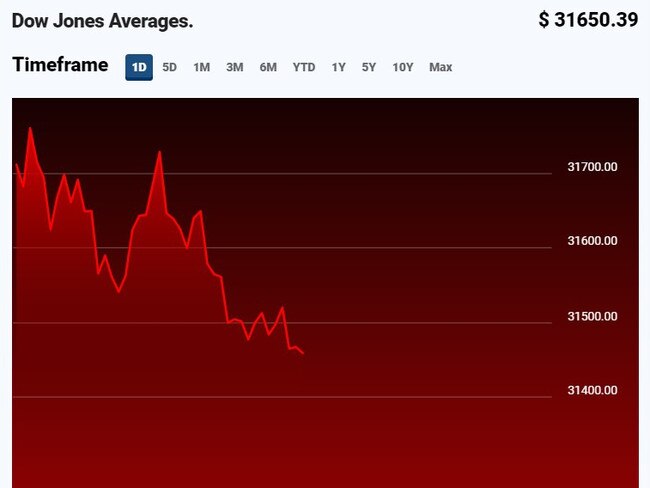

Britain’s FTSE 100 share index fell by 3.8 per cent with New York’s Dow Jones index down 1.8 per cent.

Credit Suisse 1.99 pic.twitter.com/rvqMPz3fkZ

— Jonathan Ferro (@FerroTV) March 15, 2023

‘Slow moving crisis’

Susannah Streeter, head of money and markets at Hargreaves Lansdown, warned the banking crisis was taking “another ominous twist”.

“The worry is that banks sitting on large unrealised losses in their bond portfolios might not have sufficient buffers if there is a fast withdrawal of deposits,” she said.

“Although the biggest players are judged not to be at risk, thanks to the chunky layer of capital they are sitting on and the stable nature of their deposits, the nervousness is palpable.

“A game of whack a mole seems to be emerging, and problems are popping up elsewhere in the world.”

Larry Fink, the CEO of investment firm Blackrock said the bank problems were the “price of easy money” as interest rates began to rapidly rise.

He added that SVB’s and Credit Suisse’s woes could be the beginning of a “slow rolling crisis”.

“It’s too early to know how widespread the damage is,” Mr Fink said in a note to investors.

“The regulatory response has so far been swift, and decisive actions have helped stave off contagion risks. But markets remain on edge.”

Credit Suisse under pressure

Investors are rapidly losing confidence in Credit Suisse after the chairman of its largest shareholder – Saudi National Bank – said it would not plough further funds into the ailing financial institution.

Saudi National Bank owns 9.9 per cent of Credit Suisse and its chairman Ammar Al Khudairy said it could not increase its funding as it is not allowed to own more than 10 per cent of the bank under regulatory rules.

“Where one big shareholder goes, others may follow. Credit Suisse now has to come with a concrete plan to stop outflows, and do it fast,” IG analyst Chris Beauchamp told AFP.

Neil Wilson, chief market analyst at trading firm Finalto, said it seemed there were “increasingly worried investors and counterparties looking at Credit Suisse”.

“If Credit Suisse were to run into serious existential trouble, we are in a whole other world of pain. It really is too big to fail.”

🔴 Credit Suisse share trading halt after dropping more than 15%

— Raphaël Bloch 🳠(@Raph_Bloch) March 15, 2023

BNP Paribas : -8%

Société Générale : -8%

Deutsche Bank : -6%

Unicredit : -6%

Santander : -5%

It comes after Credit Suisse admitted to a “material weakness” in its reporting procedures for the 2021 and 2022 fiscal years.

The investment bank lost $8 billion in 2022. It said its inability to design and maintain effective risk assessments in its financial statements is a cause for concern, and the bank is now making changes.

“The news couldn’t have come at a worse time when the banking sector is already under pressure,” Raffi Boyadjian, lead investment analyst at XM, said.

Idea SVB collapsed because of diversity goals ‘laughable’

The former head of US investment bank Goldman Sachs has rubbished suggestions SVB collapsed because it had some non-male, non-white and non-heterosexual people on its board.

SVB had noted its board included one black and one LGBTQ person and was just under half female.

Florida Governor Ron DeSantis, who is being touted as a possible presidential candidate, said SVB’s diversity, equity, and inclusion (DEI) programs were to blame.

“They’re so concerned with DEI and politics and all kinds of stuff, I think that really diverted from them focusing on their core mission,” he told Fox News.

But Lloyd Bankfein, formerly of Goldman Sachs, told CNN that was “unlikely”.

“I’m not an expert in mass psychology, but I think that’s very unlikely and I think frankly it’s a bit laughable.”

Credit Suisse CEO Ulrich Koerner earlier insisted the collapse of SVB would not affect his bank, saying all had been “calm” since it went under.

“It’s a very different situation, we are following materially different and higher standards when it comes to capital funding, liquidity and so on,” Mr Koerner told Bloomberg.

Chairman Mr Lehmann has however waived his own $1.6 million bonus because of the bank’s “poor financial performance”.

Carlo Franchini, head of institutional clients at Banca Ifigest in Milan, said he believed Credit Suisse was too big to be allowed to fail.

“Markets are wild. We move from the problems of American banks to those of European banks, first of all Credit Suisse,” he told Reuters.

“This is dragging lower the whole banking sector in Europe. The shares accelerated losses after the Saudis (commented).

“I believe Credit Suisse’s crisis can be solved and the bank will not be let to go belly up.”

Originally published as Credit Suisse shares plunge to historic lows as European banks take a hammering