Acorns micro-investing app is about more than getting rich quickly

THINK an app that invests your small change will turn you into a tycoon? You couldn’t be more wrong.

Business Technology

Don't miss out on the headlines from Business Technology. Followed categories will be added to My News.

WHEN people heard about Acorns, a micro-investing app that employs a team of experts to throw your money into stocks, thousands jumped on the chance.

Having no idea about the stock market no longer mattered, you could just throw a few hundred into the app and let the experts do the rest.

And for young people — Acorns’ biggest demographic — it was a dream come true.

Since it hit Australian shores in February 2016, more than 550,000 people have downloaded the app and the company is managing more than $150 million in funds.

But if you’re a millennial thinking that putting a few hundred in there is going to make you rich in a few years, the company’s managing director George Lucas insists you’ve got it all wrong.

“It’s not really about the return, it’s about learning to save. This is a new paradigm, so if you want the best fund manager and are thinking about trying to get the best returns in the world then Acorns isn’t the best place to put your money,” Mr Lucas said.

The Acorns Australia boss isn’t afraid to tell customers to go to a bank or call up a fund manager if that’s what they think the app’s function is.

“If you just want your money to sit somewhere, you’re far better off using a bank account than the Acorns app because with us, your money is at market risk,” he said.

“And if you have a short-term goal, cash is always going to be the king or if you don’t want to learn about markets and stuff.

“We’re very clear we’re not a get rich scheme or the best fund manager in the world,” he added.

Mr Lucas’ brutal honesty is exactly why people have become so enamoured with the micro-investing app.

When a news article fin September last year suggested Acorns was “daylight robbery” and “ripping Millennials off”, hundreds of its Aussie fans jumped to its defence.

“That’s one of the scariest things — how engaged our customers are with the app. It’s a really good thing they’re so engaged because it means when we have market corrections we can communicate to them and they understand,” Mr Lucas said.

But there is one specific way outsiders or people who hear about the stock investment side of the app have misunderstood.

Specifically, how Acorns needs a minimum investment amount to make its fees worthwhile.

The app costs $15 a year, or $1.25 a month, to cover operations.

“On average, we’ll do five direct debits a month to each client. That costs us money, it’s not free, we don’t get that for free from a bank. It actually costs us a lot of money to run it,” Mr Lucas said.

While Acorns doesn’t openly market the average return each user gets, at the moment the average user is making 13.9 per cent per annum.

Meaning, for anyone wanting to throw $100 or $200 in there, they’ll be struggling to see any returns at all.

“If your aim is to put $100 in and stop, it’s not worthwhile. If your aim is to let the app run its saving functionality and say after two months, you’ve got $100 and after four months you’ve got $200, you’re learning to save money that you didn’t know you could save,” Mr Lucas said.

However, the app’s average user does understand the amount they need in the app to make it worthwhile.

The average amount of money people invest in the app is $1100, which could see returns of more than $150 a year.

BRANCHING OUT

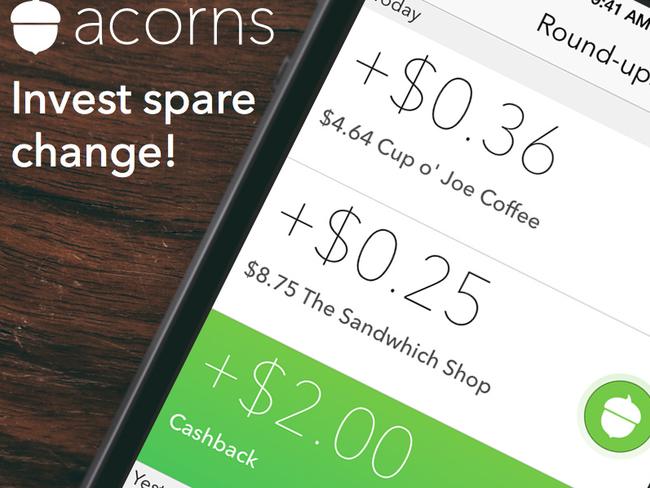

The most popular part of Acorns is its roundups feature — where users can agree to round up all of their eftpos transactions to the nearest dollar.

For example, if you’re buying a coffee for $3.40, the app rounds that figure up and invests 60c into your choice of exchange-traded funds.

One Acorns user, who didn’t wish to be named, said the $1.25 is “hardly very much” when it comes to the popular feature.

“I only use it for roundups,” the Acorns user said.

“In about six weeks, my account has $70. It’s hardly a lot of money but should be a few hundred by the end of the year. It’s such a small amount, you don’t even notice it’s missing from your account.”

While Mr Lucas said the rounds-up feature is a great part of the app, it’s not where the company’s focus is — or where the customers should be if they want to save.

“Generally they start off with the roundup feature but eventually realise if they want to get to a goal, then they’re probably going to have to save another $5 or $10 a week,” he said.

“So, while it’s a great value add, it’s not really what we’re about. We’re more about financial literacy,” Mr Lucas added.

The unusual finance app, which was created in 2012 as a way to entice first-time investors to the stock market and encourage them to understand its ups and downs — is also branching out into other financial products.

This week, the company announced it was starting its own superannuation fund, Acorns Grow Australia, that will be available in March and completely integrated into the app.

“The millennial generation, which our user base skews heavily towards, have traditionally been viewed as poor savers, but we don’t believe that stereotype,” Mr Lucas said.

“Hundreds of thousands of young people are building up a level of savings for retirement. Similarly, we’re often told Millennials do not engage with their superannuation, but we are confident we can also bust that myth,” he added.

And clearly, sorting a super fund has never been more important.

Earlier this month, Dominic Aarsen, an entrepreneur and founder of Make The Most of Your Money, said taking years to sort super can leave young people thousands of dollars out of pocket.

“Just by looking at your super fund in your 20s rather than your 40s or 50s can mean a difference of around $87,000. You could easily be looking at a $100,000 difference in your super fund account depending on how and when you sort it,” Mr Aarsen told news.com.au.

“Most people don’t want to work until they’re 80 or 70 and you won’t have to if you do the small things right, right now,” he added.

Originally published as Acorns micro-investing app is about more than getting rich quickly