Horror outcome after retailer’s $45m collapse

It racked up losses totalling $66.7m in the last 19 months and now employees, customers and creditors are in for an even bigger shock.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

Almost 460 former employers of Godfreys may receive just 73c in the dollar for outstanding money owed to them after the vacuum cleaner retailer collapsed earlier this year, while creditors seeking back $45 million in debt will get nothing.

In January, the 90-year-old retailer fell into administration and attempts to find a buyer to resurrect the company failed after it had struggled against competition from larger rivals like Harvey Norman and Amazon

It resulted in all 160 stores being closed and online operations shutting down at the end of May, while approximately 635 staff were set to be left jobless.

Employees are owed more than $10 million including annual leave, payment in lieu of notice, long service leave and redundancy pay, a report from administrators noted.

Meanwhile, 25 customers had been left $18,000 out of pocket, the report revealed.

The company’s management blamed reduced consumer income caused by higher inflation and increasing interest rates and a shift by customers to cheaper alternatives.

They also pointed to an inability to increase prices due to competition and higher finance costs due to the need to increase borrowing to fund operating losses and finance franchise acquisitions.

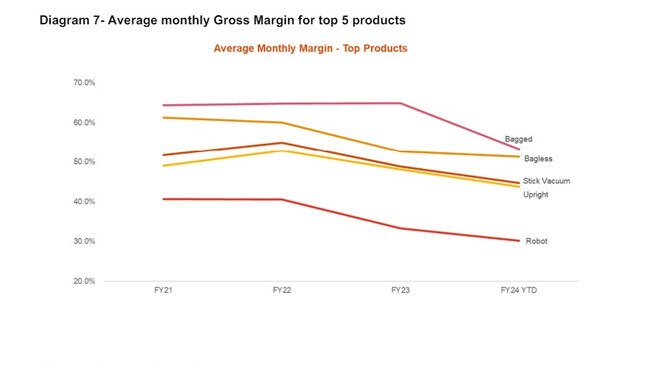

Management also pointed to a “shift in sales product mix, where sales of high margin products declined especially stick vacuums and were replaced with sales of lower margin generating products including robots”.

Godfreys had been losing significant amounts money as its financial performance “deteriorated" noticeably in 2023 and 2024, an administrators report filed with ASIC revealed, with losses worsening to $44.3 million in 2023.

In the seven months to January 31, Godfreys racked up losses of $22.3 million, the report said.

“Declining sales volumes coupled with increasing costs over a number of categories negatively

impacted the group’s margins and resulted in losses totalling $66.7m in the last 19 months,” the report read.

Sales notably decreased by 9 per cent and actual average monthly sales revenue was $1.3 million lower in the 2024 year to date compared to the 2023 financial year, the report added, while Godfery’s operating expenses were $18.2m greater than gross profits.

PwC’s report attributed Godfrey’s demise to a reduction in sales, an increase in the cost of acquiring stock, rising freight costs, increased costs from wages and rents, an inability to reduce head office costs and failure to close poor performing retail stores to stem losses.

It also noted the average cost of stick and robot vacuums rose by 8 per cent and 26 per cent respectively.

“In addition, since around financial year 2021, the group acquired numerous franchise stores to be converted to operate as group owned stores, which exacerbated the group’s decline in trading performance,” the company’s administrators, Craig Crosbie, Robert Ditrich and Daniel Walley of PwC said.

“Most of the franchise stores acquired ultimately became loss making.”

Store closures were also not viable, the report noted.

“It is noted that the group is unlikely to have had sufficient financial resources to fund a store closure program that would have required redundancy and other employee entitlements to be paid, in addition to compensation to landlords for any breach of leases,” the administrator’s said.

The report showed that there were 36 franchise stores that had been bought out in the past three-and-a-half years for a combined cost of $27 million.

It also revealed that 264 creditors collectively owed almost $45 million won’t see a cent after the company’s demise and these include vacuum cleaner manufacturers TEK, Bissell, Electrolux and EcoVacs, and a number of landlords. The Australian Taxation Office is also owed $883,000.

PwC presented three options to creditors in its report — recommending against liquidation of the company’s assets and instead encouraging a deal with a secured lender, 1918 Finance.

The report found under a liquidation, a “low” estimate of 73 cents in a dollar would be given that employees owed entitlements.

Despite 55 parties expressing an interest in Godfreys, 26 being provided with a summary information pack, data room access and sales process instructions and six offers – a buyer could not be found for the retailer, the administrators noted in their report.

They found some parties lacked the ability to find funding, while other offers were of “poor or low value”.

Godfrey’s, one of the “world’s largest vacuum cleaner” retailers, had opened its first store 1931, and at the time of its collapse the business operated 141 stores, with another 28 outlets run by franchisees.

sarah.sharples@news.com.au

More Coverage

Originally published as Horror outcome after retailer’s $45m collapse