QLD director incurs 5-year ban over unpaid $2m debt from collapsed companies

An Australian man has been caught engaging in a phoenixing operation multiple times while avoiding nearly $2 million worth of debts.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

An Australian man has been caught engaging in a phoenixing operation multiple times while avoiding nearly $2 million worth of debts.

On Tuesday, the corporate regulator, the Australian Securities and Investments Commission (ASIC), announced that a Queensland man has been banned from running a business for five years because of his phoenix activities.

A phoenixing operation is when a company deliberately goes into liquidation then starts again under a different name, essentially rising from the ashes like a mythical phoenix, to wipe away its debt.

Aaron Luke Vasicek, who ran four tyre companies that collapsed in Tasmania, cannot act as the director of any other business until January 2028.

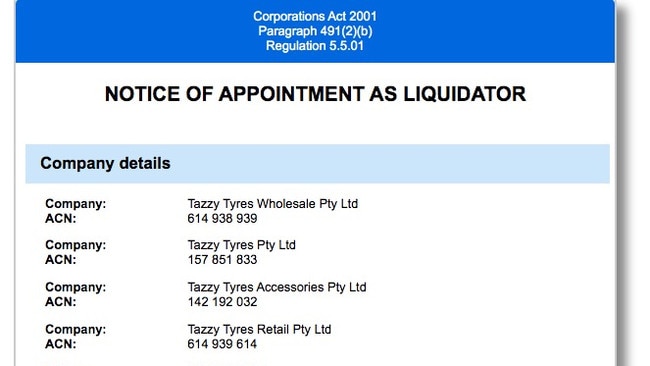

From 2010-2018, Mr Vasicek ran four companies — Tazzy Tyres Wholesale, Tazzy Tyres Accessories, Tazzy Tyres Retail and Tazzy Tyres.

All of those business failed.

Assets were stripped out of two of the companies and transferred to other businesses.

According to ASIC, Mr Vasicek “transferred the assets of Tazzy Tyres Accessories and Tazzy Tyres to other companies for no consideration”.

That was despite the businesses racking up a substantial debt of $1,944,418 to unsecured creditors.

Of the nearly $2 million Mr Vasicek’s businesses owed cumulatively, the Australian Taxation Office was the largest creditor with a $855,121 debt.

ASIC noted that the appointed liquidator of the four collapsed companies was crucial in providing enough evidence in getting the Queensland boss banned.

Barry Hamilton of Barry Hamilton and Associates lodged statutory reports about Mr Vasicek breaching his director duties through phoenixing and failing to maintain proper financial records for all the companies.

ASIC said it used these reports to suspend the director.

Mr Vasicek has the right to appeal ASIC’s decision to disqualify him.

News.com.au contacted him for comment.

Phoenix practices directly cost the economy between $2.85 billion and $5.13 billion annually, according to a report commissioned by the Australian Taxation Office in 2018.

An estimated one in 10 collapsed businesses are part of a phoenix operation, according to industry experts.

John Winter, CEO of the Australian Restructuring Insolvency and Turnaround Association (ARITA), previously told news.com.au that the current economic circumstances were ideal for shady phoenix operators.

“The environment right now is the perfect storm for phoenixing, particularly in construction, their margins have been wiped out. Desperate people will do desperate things. The likelihood of phoenixing — we haven’t seen circumstances like this for a long time,” he said.

“This has been around for so long. It happened to my parents in 1974, they lost everything to a dodgy phoenixing builder, the fact that this still happens is a bit of a sad indictment.”

Mr Winter is hopeful that phoenixing will become harder to get away with in the future after ASIC introduces a digital identification number for company directors.

The director ID, a unique 15-digit identifier, would make sure companies were being run by real people through being connected to a government account, and it would also allow the system to flag any unusual occurrences, such as a possible phoenixing operation.

Directors had to apply for the ID at the end of last year.

alex.turner-cohen@news.com.au

Originally published as QLD director incurs 5-year ban over unpaid $2m debt from collapsed companies