‘Falling even faster’: Grim iron ore call as Chinese economy falters

Australia is at the mercy of the price of one key export, and one move from China could cause it to wreak havoc on our economy.

Mining

Don't miss out on the headlines from Mining. Followed categories will be added to My News.

We are at the mercy of the iron ore price.

It goes up, Australia soars. It falls, Australia gets down in the dumps.

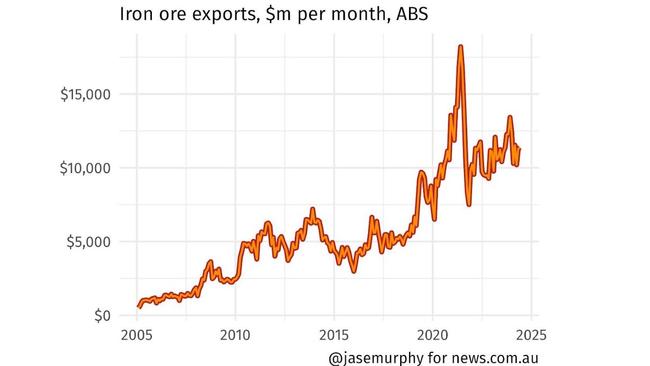

This country exports absolutely wild quantities of the stuff. As the next chart shows, more than $10 billion dollars worth of red dirt sails away from our shores each month.

Now usually in economics, there’s a trade-off between price and quantity.

If the price is low, you can export a lot, and if the price is high you can only export a little. But for Australia in the last few years there’s been no trade off at all, no downside. We’ve been selling mega boatloads of iron ore at mega prices. It’s been a time of ridiculous plenty.

Up in the Pilbara, giant iron ore boats that weigh 250,000 tonnes are arriving every few hours, filling up and sailing away, usually to China. China takes about 80 per cent of our iron ore, and makes it into steel. (Iron ore turns to steel if you heat it up enough and add just a little bit of carbon).

Iron ore is a necessary ingredient for steel. And steel is needed for cars and other things. We don’t tend to make much of our iron ore into steel here, and we certainly don’t make cars any more.

When we export iron ore it goes to China and they transform it into steel and then into things the whole world uses.

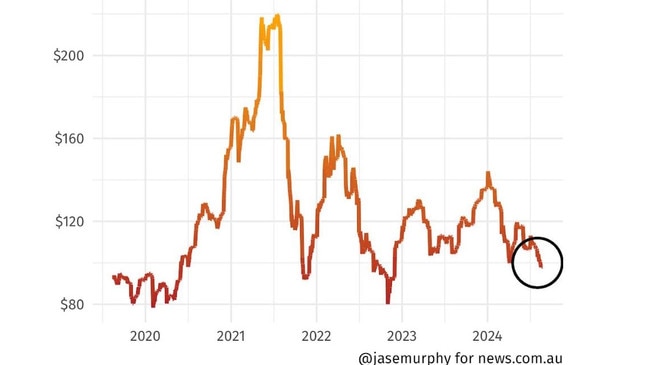

When they want a lot of steel, the price tends to go up. As the next chart shows, that happened back in 2021. But when they don’t want so much steel, the price tends to fall.

That’s what we are going through now. Futures prices have dropped below $US100 a tonne.

Price fall

When it falls, two main things happen.

1. Big iron ore companies make less profit and pay less profit to shareholders, who get less income,

2. Their lower income means they pay less tax, so revenue falls. Any budget surplus gets smaller and budget deficit gets bigger.

The fall in the iron ore price is expected to put a $3 billion ding in our budget. Not a huge amount, but it could be the difference between a sliver of surplus and a sliver of deficit.

Treasury

I was at Treasury back in the day, when the iron ore price first started going up. Back when China was a poor country, but growing its economy at more than 10 per cent a year.

In those days, Treasury assumed the iron ore price would be stuck at $US30 a tonne. The price turned out to be higher than that and “rivers of gold” started to flow into the government’s coffers.

It made the life of the government at that time very easy. They gave out tax cut after tax cut and there was no real need for fiscal discipline of any kind.

Now China’s growth story has peaked (they are hoping and wishing for 5 per cent growth a year), and if they surprise us, it will probably be by growing more slowly than we expect, not faster.

In the most recent budget, the assumption was iron ore prices would slowly decline to $US60 a tonne by 2025, but they are falling even faster. The hit to revenue is modest for now, but if iron ore prices keep falling, it means everything the government might like to do is at risk.

Where does China go next?

The Reserve Bank of Australia (RBA) blames China’s economy for the downturn in iron ore, and in its most recent Statement on Monetary Policy, the RBA said the Chinese government isn’t doing much to turn things round.

“At China’s recent ‘Third Plenum’ (where authorities outline their long-term economic and political reform agenda) little was outlined to address the ongoing downturn in the property sector and lift sentiment in commodity markets,” the RBA said.

The China miracle can’t last forever. But so far it has lasted for three decades – and anyone who has predicted its end has looked like a fool.

China is now a middle-income country, like Malaysia. Often countries get stuck at that point, unable to make it to high-income status.

Will China suffer an enormous reversal soon?

There are certainly signs it might. The real estate sector has melted down (this is one reason they don’t need so much steel any more, because cranes aren’t lifting girders into place to make new apartment buildings any more). But they’ve had one blessing: no major financial crisis.

The kind of financial meltdown you’d get in the west if real estate collapsed has not eventuated in China. Is that luck or good management?

If it’s just luck, then they might not be able to hold off on a financial crisis forever.

And if China melts down, the iron ore price will tumble, and the iron ore god will become a vengeful one, wreaking havoc on our economy.

Fingers crossed the Chinese know what they are doing.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology

Originally published as ‘Falling even faster’: Grim iron ore call as Chinese economy falters