Cost of living prompts new move towards Australians accessing their wage earlier than payday

More cash-strapped Australians are turning to cash advance loans and wage advance products to help manage cost of living pressures. See the warnings and how it works.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

More cash-strapped Australians are turning to cash advance loans and wage advance products to help manage cost of living pressures.

Financial counsellors across the country have seen an uptake with many also facing Buy Now Pay Later debts and small credit loans at the same time.

Kirsty Robson, a financial counsellor with National Debt Helpline working at Victoria’s Consumer Action Law Centre said clients having trouble with wage advance products are almost always having trouble with other small-amount credit products.

“The problem is, though, they don’t have the same recourse in terms of hardship support or an appropriate affordability assessment,” Ms Robson said.

“Often these companies don’t even have a phone number listed and are impossible to get a hold of for help.”

Leasa Mayes, a financial counsellor with CARE Financial Counselling in the ACT, said the number of clients with wage advance loans had definitely increased in recent months.

“I have seen several clients with wage advance over the last three months, but before this I had barely heard of them,” Ms Mayes said.

“Most people have more than one, and a couple of them have three.

“I find those clients usually also have other Buy Now Pay Later products and have reached their maximum balance, and those who’ve resorted to wage advance usually reach a crisis point and often stop paying everything.”

The growing issue with debt comes as Australia’s cloud-based HR, payroll and benefits platform Employment Hero has developed a new app within its system where one million workers across 200,000 businesses can now request up to $250 from their wage early to help them pay for their outgoing expenses, without incurring credit or interest.

The new system, titled InstaPay, is being rolled out through its new app called Swag, which has been adopted by businesses including C!NC, Hazel Home Care and ColourWorks.

Although the pay advance comes at a small fee, Swag’s weekly withdrawal limit of $250 prevents employees accessing their full wage and ensures they receive something on payday so PAYG is covered.

Employment Hero’s Managing Director of Payments and Benefits, Rob Dunn, said InstaPay has a different approach to other pay advance services like BeforePay, CommBank AdvancePay, MyPayNow and Wagepay that offer fast loans with repayments required.

“We prioritise giving people access to an asset they are already owed, their earned pay,” he said.

“This allows for a responsible and efficient approach using existing pay systems and eliminates the need to chase individuals for repayment or engage in debt collection efforts. “With InstaPay, Employment Hero can make informed decisions about distributing wages based on accurate payroll data.

“By granting employees early access to their own earned wages before payday, InstaPay ensures a responsible financial experience devoid of credit, loans, interest, or late payment fees. It’s important to note that InstaPay should not be associated with other fast-money apps that ensnare users in harmful cycles of debt.”

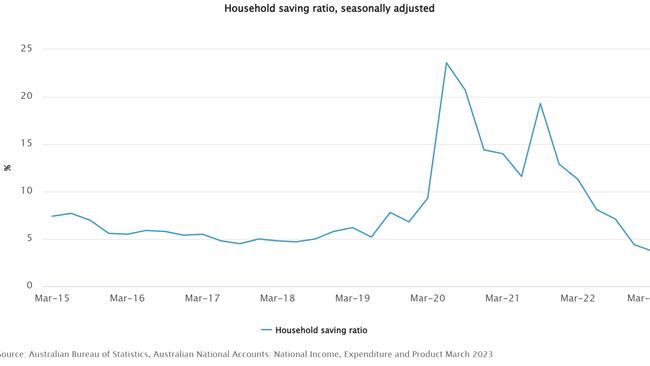

The move to advance pay options come as Australians’ household savings fell to a 15-year low, with ABS National Accounts data showing the saving ratio plunged from 4.4 per cent in the December quarter, to 3.7 per cent in March — the lowest level since June 2008.

Research by credit bureau Experian further revealed a 54 per cent increase in new credit card inquiries in the past two years, and 42 per cent rise for BNPL debt and a 36 per cent jump in personal loans.

New YouGov research also found of those with outstanding short-term debt, more than half have missed or been late on a financial payment.

It found almost half (46 per cent) of Australian employees said they are often (18 per cent) or sometimes (28 per cent) unable to pay recurring expenses such as rent, groceries or utilities before payday.

“Employees do need to remember that their next payday will be slightly lower, as the InstaPay amount they received early plus the $3/$4 fee will be deducted. Employees need to keep this in mind when managing their finances for their next payday,” Mr Dunn added.

Financial coach Rebecca Maher, co-founder of MoneyHappy, warned pay advance services didn’t come without risk.

“The biggest potential risk is that the product becomes a financial crutch for people, instead of a lack of funds or money management issues becoming the impetus for real financial behaviour change,” she said.

South Coast Party Hire Director, Erin Johnston, said the app was a “game-changing” incentive for her NSW employees.

“As a smaller business, we are financially constrained in comparison to bigger businesses who have more budget to offer larger and more lucrative incentives and benefits,” she said.

“It works for our staff as many work on a more casual and seasonal basis. InstaPay is really helpful and sees them through.”

More Coverage

Originally published as Cost of living prompts new move towards Australians accessing their wage earlier than payday