Building costs surge as shortages take high toll

The largest spike in construction costs since the introduction of the GST is expected to be followed by more pain next year.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Surging demand for home renovations and new builds – and major materials shortages – is leading to the steepest jump in construction costs in almost two decades.

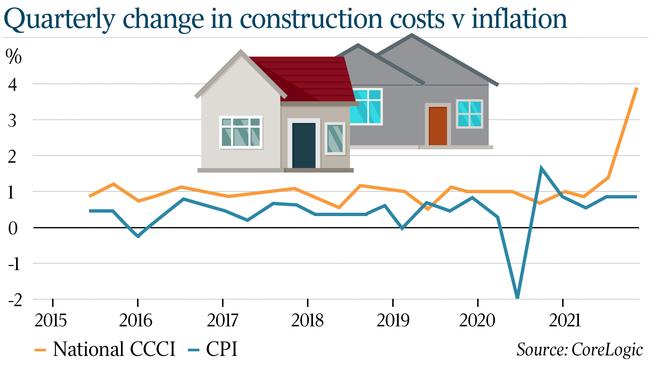

Those costs rose 3.8 per cent in the three months to September, according to the Cordell index – the most comprehensive survey of labour, material and subcontractor expenses – substantially faster than the overall inflation rate.

And the rising costs will begin to hit new-home building within months, the residential construction industry is warning.

“The increase in the cost of materials has not flowed through to an increase in costs of a new home as yet, but that will occur over the course of the next year,” said Tim Reardon, chief economist at the Housing Industry Association.

“If builders incur those fixed costs within contracts, as new contracts are written they will include the new materials and labour costs … those costs will be transferred through to consumers.”

The Reserve Bank, in a statement of monetary policy released last Friday, warned that the cost of new home construction was rising “sharply”, and “driving much of the increase” in inflation.

“Price increases also reflect a surge in construction activity in response to policy inducements – residential building commencements have been growing at their fastest pace since the early 2000s, and capacity utilisation in the construction industry has been high,” the bank said in its statement.

The new Cordell index figures, released by analysts at CoreLogic, show annual construction costs have risen 7.1 per cent, the highest growth since March 2005 – when the measure hit 7.3 per cent.

The NSW index recorded its highest quarterly growth rate – 3.8 per cent in the three months to September – on record. Inflation in that period rose by 0.8 per cent, according to official figures.

The building materials shortage and continued demand for home construction, however, has become a boon for major suppliers including James Hardie, which this week raised its guidance for the financial year from between $US550m ($746m) and $US590m to $US580m-$US600m.

The fibre cement and cladding supplier’s net profit more than doubled to $US271.5m in the six months to September 30.

Bob Richardson, chairman of the Australian Construction Industry Forum, said the most significant challenges were the shortages of materials and skilled trades, as well as broader supply chain disruptions.

“With international borders reopening, immigration resuming and restrictions on movement interstate lifting, this will improve the constraints on supply, especially in the states where demand growth is strongest,” he said.

The rising construction costs, according to the RBA, are partly due not only to rising global input costs but also the strong demand induced by the federal government’s HomeBuilder program.

“Despite applications for HomeBuilder having closed earlier in the year, payments of grants are expected to continue for some time,” the RBA said on Friday.

Tim Lawless, research director at CoreLogic, said the surge in housing approvals, which peaked in March, had progressed to construction, causing widespread demand for materials and trades.

And that was putting even more pressure on the building industry, which was dealing with a severe shortage of timber and other construction materials.

“The quarterly rate of growth in construction costs is happening everywhere and is not restricted to one city or state, it’s a national trend,” Mr Lawless said.

“There was a much bigger increase in our index when the GST was introduced. However, outside of that structural adjustment this is by far the biggest quarterly change on record. This would be the largest market-driven increase we’ve seen.

“For anyone who is looking to build or to renovate, or for someone who owns a business involved in the residential construction industry, it means they are all likely to be facing significantly higher costs.”

Mr Lawless said that while approvals had eased since peaking in March, Australia was in the midst of an extended period of heightened residential construction activity, and that was likely to flow through to higher costs for the consumer. “This doesn’t look like a short-term spike – the surge in construction costs is due to the amount of activity that’s been approved at a time when we can’t import more skilled labour and are facing significant supply chain disruptions,” he said.

In its Container Stevedoring Monitoring Report released last week, the ACCC noted that Covid-19 had “derailed” the global container freight supply chain, with a surge in demand for containerised cargo and extreme congestion causing major disruptions and delays. The resulting shortages of timber, steel and other metal products have delayed local projects and increased the cost of building materials.

According to Australian Bureau of Statistics’ latest producer price index, timber, board and joinery costs rose 5.3 per cent in the September quarter, while the cost of aluminium windows and doors increased by 7.9 per cent and steel beams and sections were 11.1 per cent more expensive.

Mr Reardon, of the HIA, said demand for new homes was likely to outstrip the supply of labour and materials well into next year, leading to even higher costs.

“I don’t think that we’ve seen the end of this price escalation cycle – it’s not just a domestic issue, it’s a global issue,” he said.

More Coverage

Originally published as Building costs surge as shortages take high toll