Scott Pape salutes flood-ravaged community, examines insurance

Insurance questions are flowing to Barefoot Investor Scott Pape ahead of his book launch that focuses far beyond the big cities.

Barefoot Investor

Don't miss out on the headlines from Barefoot Investor. Followed categories will be added to My News.

I was standing in the middle of the main street, staring up at the tops of the buildings.

Locals passed by, giving me strange looks.

What I was doing was trying to picture an ocean of water on the very spot where I was standing … because that’s what happened in Lismore in February.

“We were expecting water to reach 1.3 metres”, said Sarah, the owner of the 40-year-old Lismore Book Warehouse, when I met her. “That was the highest the floods had ever reached before.”

This time, the water reached a peak of … 14.3 metres in her store!

That day Sarah lost $215,000 worth of books, none of which were insured.

The next day she got in her boat and started searching for and rescuing people in her community.

“We’re not a rich area, but we stick together”, she says.

Sarah used Google Maps to get around, yet the roads she normally drove on were now as much as 5 metres below her, underwater. “Cows were coming past us with their heads bobbing up and down as they were swept downstream to their deaths.”

It was total, utter devastation.

“You know, at the time, I didn’t know whether Lismore would make it through”, Sarah told me.

And when the water eventually subsided the true scale of the destruction – and the rotting stench – became clear. The place looked and smelled like a rubbish tip for months.

The Lismore library had lost 30,000 books, and has never reopened.

“I knew that Lismore needed a bookshop”, she said.

And so, with the determination of a small-business owner with her back to the wall, Sarah and her loyal team spent the next four-and-a-half months slogging away putting the family-owned bookstore back together.

“I’m just really proud we’re here today”, says Sarah.

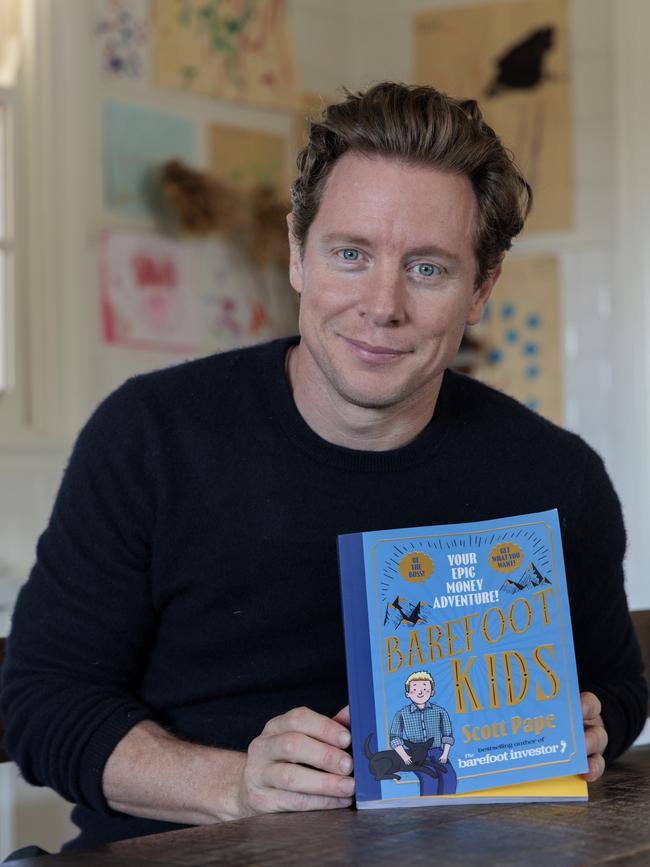

So when my publishers were drawing up plans for the official launch of my new best-selling book, Barefoot Kids, they asked whether I wanted it to be held in Sydney or Melbourne.

“Neither”, I said. “I want it in Lismore.”

Yes, I’m really proud to say that I will be hosting my official book launch at the Lismore Book Warehouse this Thursday night (tickets are limited, and only available to locals – RSVP here).

Tread Your Own Path!

P.S. Straight after the book launch from 7pm, I’ll be heading over to a local pub (Hotel Metropole) to host a “Beer With Barefoot”, with a serious purpose. If you are a local and are struggling financially, please come along and let me (and a few of my financial counsellor mates) help you sort things out. It’s totally free. It’s totally independent. It’s totally confidential. And I’ll totally shout you a beer.

The $67,000 Insurance Policy?

Scott,

My husband and I are in our early fifties and earn $100,000 combined a year. We paid $67,000 this year for life insurance, including critical illness and income protection. And we have now been notified that my husband’s super is all depleted as the payments were auto-deducted from his super! We thought everything was okay, as we have been with our financial advisor for 28 years. Now we don’t know where to go to get out of this costly mess. Please help!

Renae and Peter

Hi guys,

You have every right to feel stressed, and as angry as an alpaca!

My advice?

You need to get a bit of alpaca attitude and stomp and hiss and spit until you get this sorted.

On your income – and presumably your super fund balance – it is totally unacceptable to be paying $67,000 for an insurance policy. It’s absolutely ridiculous. It’s simply draining your super fund.

Now I understand I’m only getting your side of the story, but if your financial advisor of 28 years has overseen this – and profited by pocketing thousands of dollars in trailing commissions – they should be held accountable.

Here’s what I’d do if I were in your shoes.

First, gather up all your supporting documents: insurance records, emails from your advisor, statements of advice (SOAs) and payment records.

Second, write about the emotional toll this is having on your family. Be as raw and emotional as you want. Bleed on the page. Get it all out.

Third, bundle it all up via email and take the following four steps: 1) Email it to your financial advisor’s compliance department ‒ you’ll get the contact details in their Financial Services Guide (FSG); 2) Lodge a complaint with the Australian Financial Complaints Authority (AFCA) at afca.org.au; 3) Send it to a good lawyer; 4) Finally, send it to the compliance department of the insurer you paid $67,000 to.

Remember: be an alpaca. Hiss, spit and bite if you have to. Don’t take a backward step.

FOGO the Radio Waves

Hey Scott,

So they’re building a nice 40-foot NBN tower in our street. I’m not happy. The health risks and environmental risks are huge, plus property prices are also negatively affected as who wants to live near that? If we were in the suburbs I might expect this, yet we’re not. We bought 10 acres in the Gold Coast hinterland for the healthy lifestyle, and our street is full of families and kids. Never did I expect an NBN tower to pop up. The guy who’s allowing it on his property will be getting paid a pretty penny for it I’m sure. So what can we do? My initial thought is to sell and get away as quickly as possible. Or do we rent it out to someone who’s brave enough to live near this tower?

Sarah

Hi Sarah,

Seriously?

Look, I’m not going to weigh in on the health risks argument (however, next week I know I’ll get at least 150 emails from people who will).

Yet what I am picking up are your personal radio waves, and it’s clear you’re stressed to the max.

It’s kind of like having Clive Palmer move in next door. He’s probably not going to hurt you, yet watching him drag his overstuffed FOGO bin to the curb each Wednesday night isn’t exactly a selling point for your street.

You’ve said that your initial thought is to “sell and get away as quickly as possible”. That’s your gut talking, and here’s a tip from Clive – you should listen to it.

Look, life is too short to live in a place that brings you constant anxiety.

After all, what’s going to kill you is the stress … not the radio waves.

Have a Beer With Me

Hi Scott,

Thank you so much for last week’s column about helping the pensioner with the insurance claim. I live in South Lismore and I’m still waiting for my insurance payout, and it is increasingly difficult to get any information from the insurance company. Your column has given me the much-needed incentive to keep fighting for what I am entitled to, not what they think I should settle for!

Elise

Hi Elise,

You are exactly the type of Lismore local I want to meet this Thursday night!

If you can, please come to my book launch, or my community event at the Hotel Metropole at 7.00pm (RSVPs are required for both, see below). Please spread the word with your friends. As someone who’s lived through a natural disaster myself, I know I can help.

The Official Barefoot Kids Book Launch

Where: The Book Warehouse Lismore,

109 Keen Street Lismore, NSW 2480

Date: Thu, 10 November

Time: 5.00pm to 7.00pm

RSVP required

Book your spot here barefootkidsbooklaunch.eventbrite.com

Beer with Barefoot Financial Counselling

Where: Hotel Metropole Lismore,

98 Keen St, Lismore NSW 2480

Date: Thu, 10 November

Time: 7.00pm

RSVP required

Book your spot here beerwithbarefoot.eventbrite.com

DISCLAIMER: Information and opinions provided in this column are general in nature and have been prepared for educational purposes only. Always seek personal financial advice tailored to your specific needs before making financial and investment decisions.

Ends.

Barefoot Kids: Your Epic Money Adventure! (HarperCollinsPublishers) RRP $32.99

If you have a money question, email scott@barefootinvestor.com.

More Coverage

Originally published as Scott Pape salutes flood-ravaged community, examines insurance