Bank account drained of $44k in 25 minutes

A Melbourne woman has revealed the “disaster” she found herself in as scammers drained her life savings, including while she was in her bank branch.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Gay de Beer was working on her laptop when her screen went black and a message popped up that she had a major virus.

Little did she know this would turn into a nightmare that would see her lose her life savings — drained from her Bendigo Bank account in a matter of 25 minutes.

“It was a disaster for me,” she told news.com.au.

The Melbourne woman had called the number that claimed to be from Microsoft, which popped up to alert her of the virus on her computer in May.

She was told someone was trying to get into her PayPal account and her debit card details had been leaked too.

“Maybe I was bulldozed but I kept on listening and I asked if it was scam,” she said.

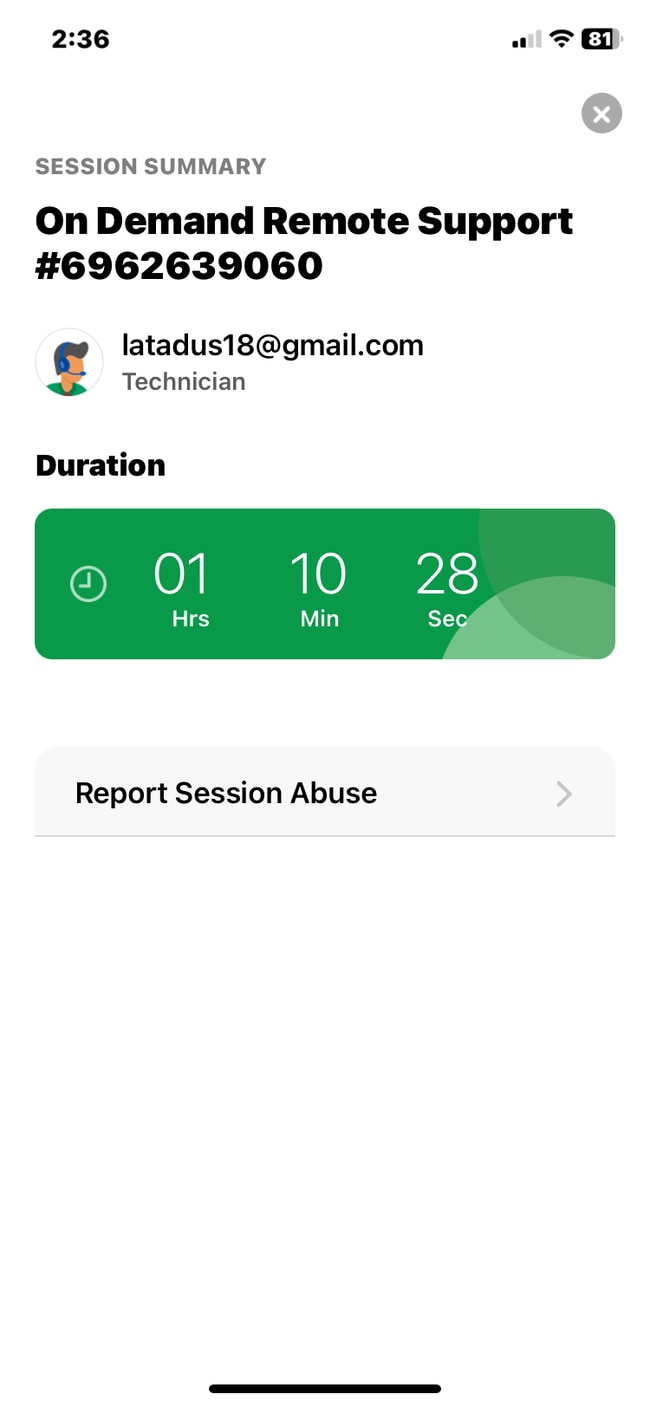

“I gave them access to my computer and they said they would put a stop to it and I was watching what they were doing.”

Ms de Beer had fallen victim to a remote access scam. From 12.26pm to 1pm the scammers transferred out the entirety of her lifesavings — all $44,000.

However, she realised the grave situation while the transfers were still being made and said she rushed out the door to a Bendigo Bank branch just five minutes down the road.

She is angry that at least the final transaction wasn’t stopped as she was in the bank branch while it was happening.

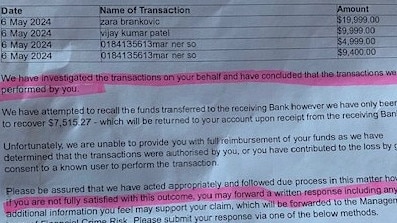

She is also critical the funds in some instances were transferred with numbers and letters that made no sense as the name of the transaction. She can’t understand why Bendigo Bank’s systems did not pick up the unusual fraudulent activity.

Tragically, the loss of the funds has left her suicidal, she said, claiming there has been no empathy from Bendigo Bank over the fact she has lost her lifesavings.

“That was my safety for paying for my car and rent, you name it, I do a little bit of bookkeeping and ride share to supplement my pension,” she said.

“Otherwise I have nothing and no one and I have no family in Australia.”

The 73-year-old is absolutely scathing that one of the transfers was made into another Bendigo Bank account, according to what police told her, yet only $7500 of the funds have been recovered.

She said the four transfers were amounts of $19,900, $9900, $4900 and $9400.

Ms de Beer is also critical that it appears scammers just get away with their crimes.

“I’ve got the names of the two accounts that the money was transferred into, so why can’t the police track these people down and get the money back?” she asked.

“Bendigo Bank said I was totally and wholly responsible for the transactions as I gave them access through my biometrics. I’m absolutely sh*tting myself thinking I have lost all my money.”

Have you been a victim of a scam? Contact sarah.sharples@news.com.au

She has been badly impacted by the experience.

“My mental health has gone to the wall, every time I need to do something I need to think I can I afford to do this? I’ve had problems with my back and can’t afford to do ongoing treatment as its $80 a pop and I don’t have money on hand,” she said.

“That money was to service my car and live on for what is rest of my life and now I have nothing.

“I’m on the pension and get $540 a week and my rent is $270 and that is my only permanent income.”

She has taken her case to AFCA and in a recent conciliation meeting was offered a goodwill payment of $2000 by Bendigo Bank, which she has rejected.

Banks are required to pay AFCA money as part of the complaints process.

“Why don’t they put the money back in my account rather than paying AFCA? The profit Bendigo Bank made in the last six months just makes you shiver.

“They should have a contingency fund for when situations like this occur as it’s caused mental anguish.”

For the 2024 financial year, Bendigo and Adelaide Bank reported profit after tax of $545 million up 9.7 per cent for the year.

The bookkeeper is also critical that the transfer limit can be increased with a “click of a button” rather than imposing strict security systems, adding she had never transferred such large amounts of money in the history of her account.

“They upped the limit to $50,000 and I haven’t even got $50,000,” she added.

Ms de Beer is also scathing that Bendigo Bank refunded Australian comedy pioneer Rod Quantock his savings of $30,000 after he transferred the money into a scammer’s account when he was told he had been hacked. The goodwill payment only came after he spoke out to the media.

“They paid Rod the $30,000 he lost and he did it himself. It was cut and dried that he transferred the money into the account. This has set a precedent,” she added.

“Mine went out in four lots but I wasn’t the one transferring it.

“I really am at my wits end and feel that these monies should be reimbursed and not just offered a measly $2000.”

Another Bendigo Bank customer Sylvie Leber also fell victim to a similar scam in March this year losing her lifesavings of $20,000,

Her daughter has been left furious, arguing that scam victims are treated appallingly as they are accused of being careless rather than classified as victims.

A Bendigo Bank spokesperson said it protects the privacy of its customers and does not comment on specific matters.

“Bendigo Bank takes cyber security very seriously, protecting our customers and safeguarding our systems with a variety of cybercrime prevention methods. By working together with our customers, we can even further reduce the incidence of scams and fraud,” they said.

“It is important customers take steps to protect themselves and do not share their passwords or allow someone they don’t know or trust to log in to their computer remotely, as it is extremely difficult to recover money that has been transferred to scammers.”

Bendigo Bank attempts to recover funds lost to scams wherever possible and it goes without saying when the bank is at fault, we will reimburse customers for the loss of funds, they added.

“Each instance of fraud and financial crime is unique, and every scam loss is treated with equal care and consideration. Goodwill payments are sometimes made at the discretion of the bank and may take into account a variety of factors.”

Bendigo Bank continues to work with our financial sector peers, fintech companies, government, regulators, and law enforcement agencies to combat what is an organised criminal activity, they added.

“The Bank’s security staff remain vigilant and work closely with Australian cybersecurity agencies, intelligence, and technology partners to detect any malicious or abnormal behaviour,” they said.

“In the financial year ending 30 June 2024, the Bank stopped $34.4 million in fraudulent transactions. The Bank has tightened transaction rules blocking high-risk payments to cryptocurrency exchanges, removed all unexpected links from SMS messages and significantly increased the size of its fraud prevention and response team.

“The bank has added more than 400 phone and fax numbers to our telco provider’s ‘do not originate’ list that will prevent scammers from impersonating our people.”

Bendigo Bank has also recently introduced advanced security tool, NameCheck, which is now being used to screen all payments made by Bendigo Bank and Up customers whenever they enter the BSB and account number for a new payee, they said.

sarah.sharples@news.com.au

Originally published as Bank account drained of $44k in 25 minutes