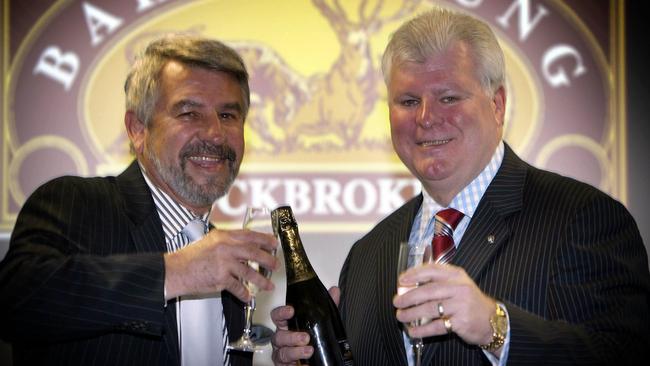

Baker Young’s Alan Young and David Baker to sell firm to Equity Story in multi-million dollar deal

One of SA’s best known stockbroking firms will be sold to an ASX-listed advisory company as part of a multi-million dollar deal.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

One of Adelaide’s best known stockbroking firms will be sold to an ASX-listed investment advisory, research and media company as part of a multi-million dollar deal.

Baker Young has struck an agreement with Sydney-based Equity Story, which will take over the firm established by joint managing directors Alan Young and David Baker in 1985, bringing to an end 40 years of family ownership.

Equity Story will pay $3m upfront, and a $1.2m earn-out contingent on Baker Young meeting certain performance measures over a 10-month period following the transfer of ownership.

Mr Young and Mr Baker will also each receive 5 million escrowed options to purchase Equity Story shares at 5c per share.

Equity Story shares are currently trading at 1.8c, giving it a market capitalisation of about $3m.

As part of a binding heads of agreement, Mr Young and Mr Baker will remain with the group in “key roles to ensure a seamless transition”.

“We’ve spent four decades building Baker Young on a foundation of trust, personalised service, and consistent performance,” the pair said in a joint statement.

“Joining Equity Story allows us to continue that tradition while expanding our reach, resources, and digital capabilities. We’re energised by the vision ... the EQS team are pursuing, and we’re proud to be a part of it.”

Mr Young and Mr Baker joined forces in 1985 to establish Baker Hindmarsh Partners, which went on to become Baker, Young & Hindmarsh and later Baker Young in 1990.

The firm has grown to $700m in funds under management across 6000 client accounts, including $180m under discretionary management via its individually managed accounts.

It also provides capital raising and advisory services to corporate clients, and last financial year generated a total of $4.5m in revenue across its divisions.

Established in 2014 and listing on the ASX in 2022, Equity Story provides sharemarket research, education and trading information to subscribers via written content and a podcast offering, and also offers members access to investment opportunities and funds management services.

Dubai-based wealth management firm Capital Haus acquired an 11.6 per cent stake in the company last month, with its founder Brendan Gow later joining Equity Story as executive chairman.

Mr Gow said the Baker Young deal was part of the company’s refreshed acquisition strategy aimed at capitalising on the exit of financial advisers from the industry.

“Baker Young is an ideal strategic fit. This acquisition exemplifies our thesis of consolidating high-quality advisory practices under a forward-thinking brand,” he said.

“As the advisory sector faces generational change and regulatory pressures, we see a clear opportunity to partner with legacy firms ready for scalable, tech-enabled growth. We look forward to integrating Baker Young’s excellent team and service model into the EQS family.”

The acquisition marks Equity Story’s entry into retail stockbroking, and it’s planning a national expansion under the Baker Young brand.

Equity Story said it would introduce a profit-share model for Baker Young staff, in an effort to attract more advisers as the company expands.

The deal remains subject to due diligence and several other conditions.

More Coverage

Originally published as Baker Young’s Alan Young and David Baker to sell firm to Equity Story in multi-million dollar deal