ASIC drops probe into Pallas Group, citing wholesale investors, despite concerns

The corporate regulator has dropped a probe into Pallas Group, citing its wholesale investor mix, despite concerns from investigators about the conduct of the company.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

The corporate regulator has dropped a probe into high-profile Sydney eastern suburbs financier Pallas Group, despite serious concerns from investigators, with senior managers deciding the boutique property operator’s investors could look after themselves.

The Australian understands the regulator was concerned about Pallas’s disclosures to investors, with memorandums reporting sales but failing to disclose their links to related parties, while rebates on sales failed to be included in calculations of total returns from a string of projects.

But when the matter came up for review, senior figures within the Australian Securities & Investments Commission ordered investigators to dump the probe, citing Pallas’s wholesale investor backing and the limited resources of the agency.

This came as ASIC was weighing up several Pallas property schemes it had concerns about. The Australian is not suggesting any wrongdoing, only that the regulator raised concerns about the property group’s activities.

The move to dump the investigation came as Pallas faced funding calls over its long list of projects, as investors piled into new property plays and the Double Bay-based business tapped lenders for more cash.

Pallas has portrayed itself as a success story of the property development crunch, with an associated development arm, Fortis, rolling on with projects worth billions, and Pallas ramping its lending up to $1.8bn.

But behind the scenes, parts of the business have been under pressure, including from regulators who have now pulled back after initially showing concerns about the group.

As previously reported in The Australian, Fortis, the development arm of Pallas, in June 2022 reported 60 per cent of units in the group’s Mona development in Darling Point had been sold.

This was despite the group also issuing an investor memorandum at the same time showing just eight of the 23 units in the building had been sold.

Fortis has since struggled to offload lots at Mona, which has been hit with delays amid plans to complete the build by the third quarter of this year.

CBRE recently kicked off a sales campaign for apartments at the seven-level site, offering a 50 per cent rebate on stamp duty and a guaranteed 6 per cent rental yield.

Mona is one of several big builds launched with much fanfare by the developer, before facing delays, supply shortages, and the loss of key contractors.

In July last year, Fortis’s Gaden House in Double Bay was hit with delays after the collapse of key engineering contractor SMLXL.

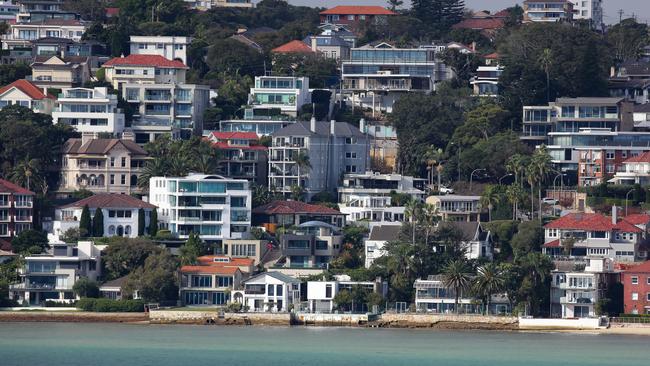

Pallas, which has reshaped the Sydney skyline with several boutique property developments in harbourside suburbs, has attracted a hefty list of wealthy backers as well as many winners from Sydney’s property boom.

Businessmen including Gerry Harvey of Harvey Norman and Morgans principal Rob Fiani have been investors. Canberra property developer David Kenyon is understood to be one of the largest backers of Pallas.

Mr Kenyon, of the Goodwin and Kenyon Group, is a major property player in Canberra, involved in a number of prominent developments in the capital.

A spokesman for Mr Kenyon told The Australian “he has no interest in discussing his investments with you”.

In the wake of its decision to drop its investigation, ASIC’s enforcement team contacted Pallas, sending the Sydney-based property developer and funds manager a letter of no further action.

This came after the regulator wrote to the property group, outlining concerns about its treatment of funds held on trust and statements to investors.

ASIC defended its move to drop the investigation into Pallas, with the agency facing questions over what matters to prioritise amid limited resources for litigation.

The Australian understands an investigator who worked on the Pallas investigation quit following the move to pull the probe.

An ASIC spokesman told The Australian the regulator selected matters for enforcement “that send a strong deterrence message and address the areas of greatest consumer harm”.

“ASIC’s decision to pursue matters is based on the circumstances of each individual case and the evidence available to us,” he said.

“When making inquiries, we may address apparent misconduct by writing to persons of interest directly outlining our concerns.”

ASIC said it had made misconduct surrounding property schemes a priority, including taking action against Sasha Hopkins and winding up A Team Property Group and MKS Property.

“We continue to monitor this sector and have several ongoing investigations, which are focused primarily on harm to retail investors,” he said.

A Pallas spokeswoman said the company was contacted by ASIC “to inquire about the content of a single media article published on 16 April 2023”.

“Pallas Group’s response highlighted a number of errors in that article. Subsequently, ASIC wrote to Pallas to say that it had concluded its review and did not propose to take any further action,” she said.

“This letter did not contain any finding of wrongdoing, any guidance or any warnings to any company or person.

“Other than these letters, there were no other communications between ASIC and Pallas Group, or any of its directors or shareholders.”

Pallas has heralded its returns, noting it has paid back $280m plus to investors in interest and equity returns.

The group offers investors a range of schemes touting returns starting from 7.5 per cent on its FM trust and climbing to 13.8 per cent on the group’s second and first mortgage funding scheme, with bespoke funding options offering even higher returns.

But the group’s last set of accounts showed the group pulled in just $6.6m in profit in the 2022 financial year, as $41m in interest costs weighed on the $63m in borrowing income enjoyed by the lender.

The profit driver for Pallas is the fees clipped from its lending book, with Pallas pulling in $26m in 2022 from its efforts. The group had faced a choppy profits outlook. Pallas chair Patrick Keenan told The Australian last year the group was projecting a pre-tax profit of $20m, but this had sunk to just $9.6m by the time the lender ruled off its accounts.

A Pallas spokeswoman said Mr Keenan’s statements were correct when he made them in April, noting the adjustment came after the group’s auditors EY requested the company amortise $3.3m in cash received in fees over the year to be recognised in 2023 and 2024.

Pallas has benefited from its access to ratings agencies and wealth management platforms, helping the company raise millions from almost 800 investors.

This has allowed Pallas Capital to extend almost $1.79bn across 250 loans, with many going to other players in the property market.

Fortis has also been a massive beneficiary of the cash flowing into the funds arm.

The move to pull the ASIC probe into Pallas came as the property developer faces several cash calls on its sprawling pipeline of projects.

At its peak Fortis is understood to have captured almost 70 per cent of Pallas’s balance sheet, with its director Charles Mellick, charged with the building operations of the firm, making a number of acquisitions.

However, Fortis has since shifted its debt load on to other operators.

Do you know more? Email rossd@theaustralian.com.au

More Coverage

Originally published as ASIC drops probe into Pallas Group, citing wholesale investors, despite concerns