Almost one third of Aussies believe they’ll need more than $1 million to retire

It’s the magic number many of us are striving to reach – but it turns out the real goal could be easier to achieve than we think.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Almost half of us are convinced we’ll need more than $1 million for a comfortable retirement, but experts say that in reality, we might not actually need that much.

It’s no secret Australia’s cost of living is high, making it tough for many of us to make ends meet right now, let alone prepare for the years to come.

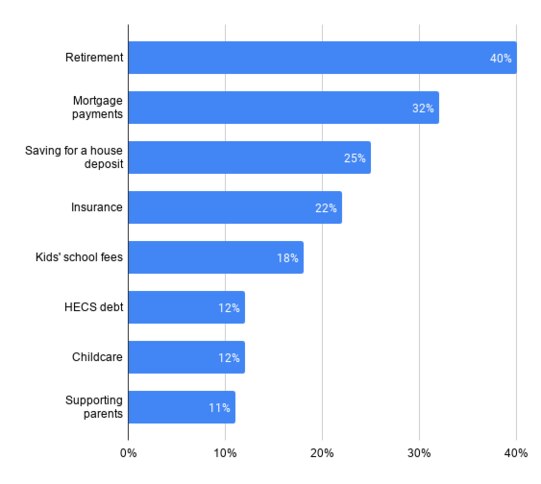

And according to news.com.au latest Cost of Living Survey, retirement is now one of the biggest financial pressures weighing on Australian minds.

The survey, which ran in February, asked readers’ to share their biggest household money worries.

The results are in and news.com.au has now kicked off the The Money Project, revealing the biggest money challenges facing Australian households and offering practical help on how to get your finances in shape for 2021.

More than 10,000 people responded to the latest survey, with retirement jumping to the top of the list of future costs respondents are most intimidated by, climbing from second position in 2019 and fourth position in 2017.

Half of respondents think they will need upwards of $750,000 to retire, with 29 per cent believing they will need more than $1 million.

However, according to the Association of Superannuation Funds of Australia (ASFA), the country’s peak policy, research and advocacy body for Australia’s superannuation industry, if you want a “comfortable” lifestyle – with the occasional overseas holiday and the ability to dine at restaurants and buy nice things – you’ll need a lump sum of $640,000 for a couple and $545,000 for a single person.

But, according to Sydney University Professor of Finance Susan Thorp, retirement can never be considered a one-size-fits-all.

Busting the Super myth

“ASFA calculate a “comfortable” retirement standard by adding together components of spending for a typical retiree household. The comfortable standard for a couple assumes spending of about $60,000 a year. In reality, most retired households have not spent at this level,” she says.

“Most people think of a comfortable retirement as one where they’re able to (more or less) maintain their pre-retirement living standard. How much we need to save to achieve that depends on our income, other assets and access to the Age Pension, so it doesn’t make sense to choose one lump sum for everyone.”

Meanwhile Sandra Buckley, CEO of national advocacy and networking group Women in Super points out that because women tend to take time out of paid work for parental leave and also have reduced earnings due to part-time work, the ASFA figures could be particularly overwhelming for women.

“The median super balance for women on retirement is $122,848. We need to shift the dialogue to creating awareness that even small balances can help as many women will receive the Age Pension in retirement and adding super to that can mean the difference between living a dignified retirement with some financial choice, effectively lifting them above the poverty line,” she says.

RELATED: New biggest expense for Australians

Get to know your Super

The best way to start growing your super balance, adds Ms Buckley, is by practising good super hygiene.

“Become familiar with your superannuation balance, make sure you are receiving the super you are entitled to, consolidate super accounts if you have more than one (first ensuring you will not lose insurance coverage), check the fees you are paying and the performance of your fund,” she advises, adding, “If your fund is not up to scratch, then do not be afraid to move your super.”

Ms Buckley said it’s important to know what super payments you’re entitled to and when.

“Super is not paid unless you earn more than $450 a month from one employer, nor is it compulsory for the self-employed or paid during parental leave,” she says.

“Creating awareness of the value of super and the importance of all Australians receiving super is important. Start by asking your local MP why super’s not paid during parental leave like it is on annual or sick leave!”

RELATED: How much you need to earn to be happy

Build up your Super

Both Ms Buckley and Professor Thorp also recommend making voluntary contributions to your super, in addition to the current legislated rate of 9.5 per cent that your employer pays.

“Any additional savings make a difference. It’s a question of balancing our current needs with our future needs,” says Professor Thorp.

Meanwhile, Ms Buckley recommends that women set aside an extra seven to eight per cent on top of their employer’s contributions.

“Women actually need to put away 17 to 18 per cent to cover the time they tend to take out of the paid workforce for parental leave, lifetime caring responsibilities and also reduced earnings due to part-time work,” she says.

“So, any additional money that can be put aside will help increase savings for their retirement. And it’s never too late to invest in your Super, every extra dollar can count. The superannuation tax concessions (or low income super tax offset if you earn less than $37,000 a year) make it worthwhile to put some money aside when you can.”

RELATED: Clever tricks to ditch pesky bill hike

Read more stories about the Cost of Living here.

Originally published as Almost one third of Aussies believe they’ll need more than $1 million to retire