‘Remarkable’ profit turnaround for Qantas, CEO Alan Joyce reveals

Qantas CEO Alan Joyce has revealed the airline has made a “remarkable turnaround” in profit for the first half of the financial year.

Qantas CEO Alan Joyce has revealed the airline has made a “remarkable turnaround” in profit.

On Thursday, Mr Joyce addressed the media for an update on trading, announcing a prediction of underlying profit before tax of between $1.2 billion and $1.3 billion for the first half of FY23.

It’s based on forward bookings, current fuel prices and latest assumptions about the second quarter of the financial year.

It comes after $7 billion in accumulated losses since 2020 and a year of troubling times from staff shortages, increased flight cancellations and baggage mishandling.

“The main drivers have been strong travel demand both domestically and internationally,” Mr Joyce said.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

He said domestic travel demand remains strong across all categories.

“Revenue intakes for business purposes are over 100 per cent of pre-Covid levels and leisure intakes have further strengthened to over 130 per cent,” Mr Joyce said.

Qantas Loyalty expects to post record earnings for the first half and is on track to reach its FY23 earnings before interest and tax (EBIT) target of $425-450 million.

However, the broader operating environment continues to be impacted with high fuel prices and high inflation, as well as higher interest rates having an influence on consumer confidence.

Mr Joyce said the Qantas Group’s fuel bill is expected to be over $1 billion this year.

It is currently around 75 per cent higher than pre-Covid costs. It was around 60 per cent higher than pre-Covid levels in August this year.

“Usually in the aviation industry it’s passed on to the consumer,” he said.

“There’s an increase in international airfares worldwide and they have to be up because we are seeing fuel at 76 per cent higher than pre-Covid.

“There’s still a lot of airfares out there that are very cheap, higher than before Covid but we expect that with elevated fuel costs.”

Mr Joyce announced Qantas and Jetstar will have its largest joint sale of the year starting today, with more than one million fares across 67 domestic destinations.

Jetstar will start from $35 one-way and QantasLink at $99.

Qantas performance

During the media conference, Mr Joyce also addressed the Group’s operation performance saying it is now “around pre-Covid levels in the first half of October”.

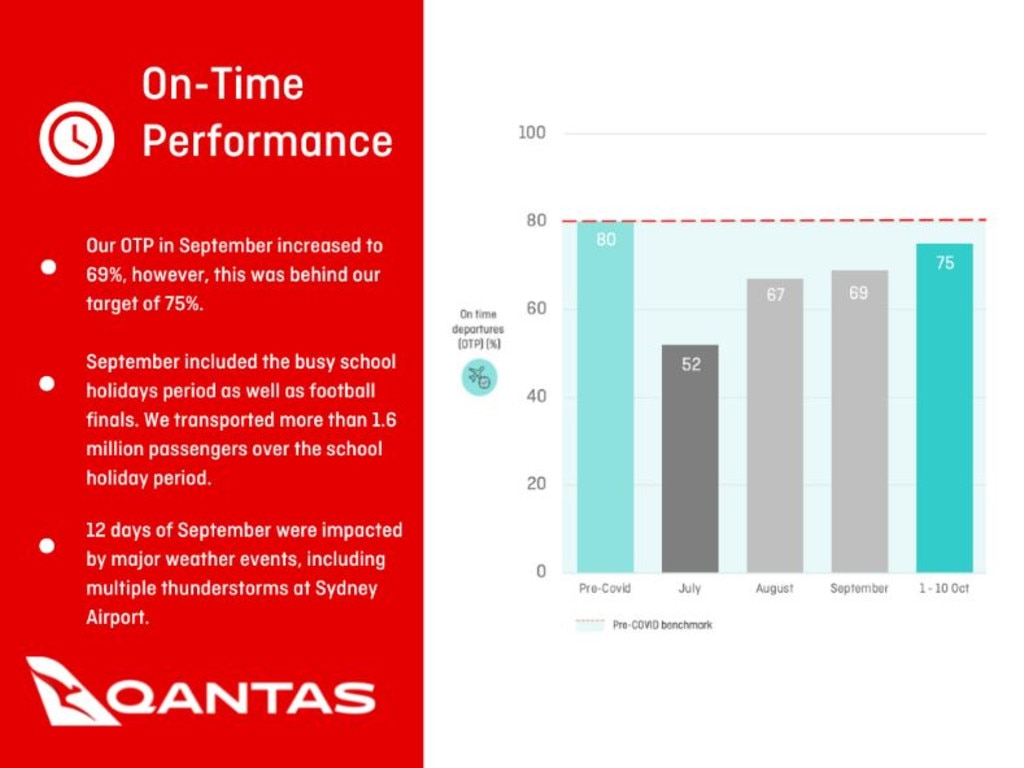

He said there has been a “continued improvement” in domestic on-time performance from 54 per cent in July compared to 75 per cent in October.

“September was impacted by extreme weather events but despite that, we are almost back to pre-Covid levels of performance,” Mr Joyce said.

He also had a sly dig at competitors in terms of on-time performance when asked about some of the continued customer service issues faced by Qantas.

“These issues we are having are industry-wide issues. In fact, our performance is better than our competition in Australia. In a recent Skytrax survey Qantas rates fiftth best airline in world and I believe Virgin was about 43. There’s light years between our service and the competition.”

During September, which included the school holiday period, 69 per cent of flights departed on time.

“While this was ahead of our main competitor, the performance was below our September target of 75 per cent, also partly impacted by extreme weather and air traffic control limitations.”

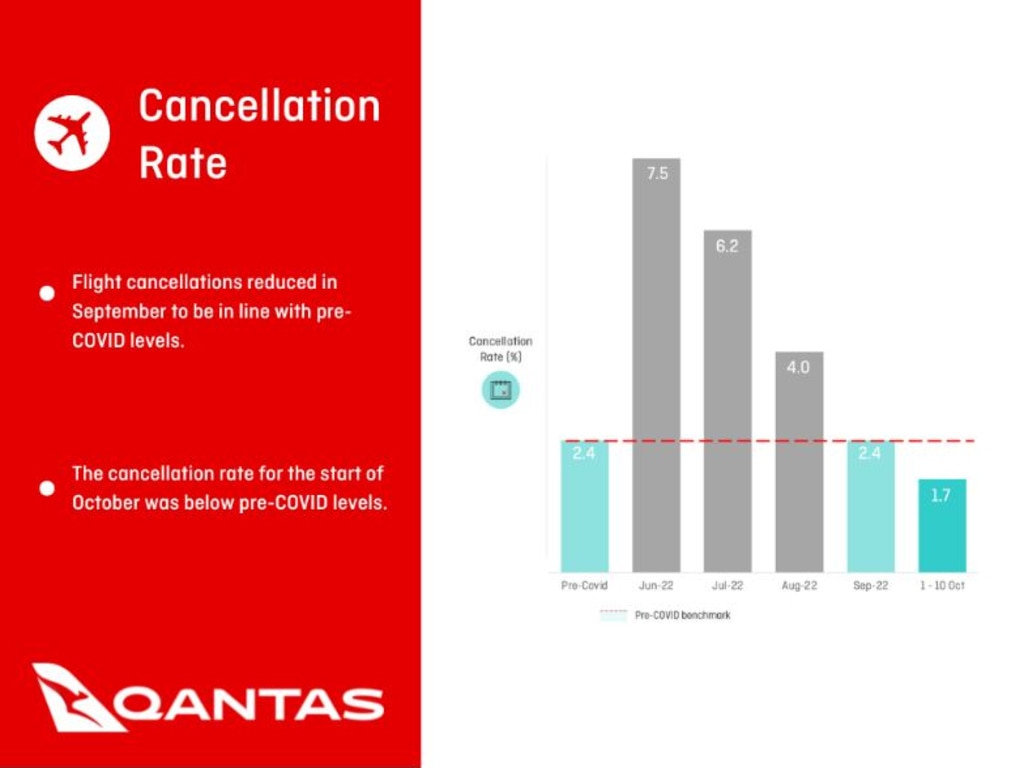

Qantas’ cancellations have fallen from 4 per cent in August to 2.4 per cent in September.

And so far in October, 1.7 per cent of flights have been cancelled.

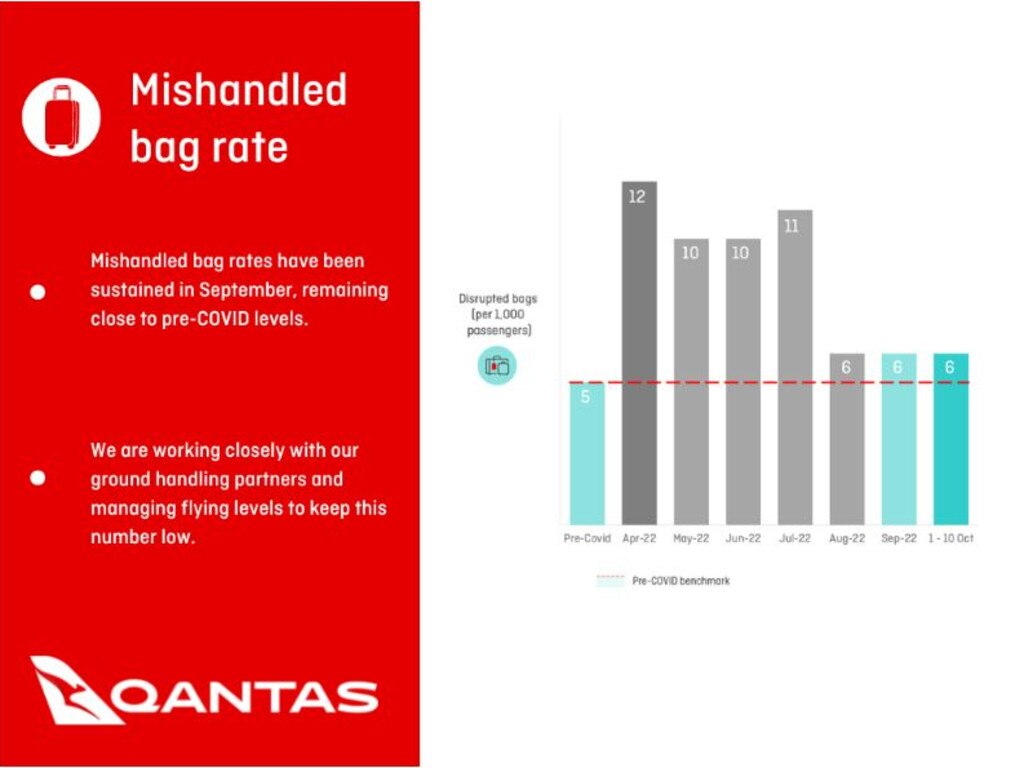

Mishandled bags remained low at 6 per 1000 passengers in September and into October, according to a Qantas statement.

“Qantas is continuing to invest in extra resourcing in our operations to provide a buffer against the challenges that impacted reliability earlier in the year, including unexpected sick leave spikes and supply chain delays for aircraft parts,” the statement said.

“A further $200 million will be invested until the middle of next year in rostering additional crew, training of new recruits and overtime in key areas such as contact centres.”

Mr Joyce also addressed the reduction of domestic flying – an announcement he made in the full-year results in August.

He said it was to give the Group more of a “buffer” to cope with high cost of fuel, adding that the move was “temporary”.

“Maintaining performance means we have to trim domestic capacity across the Group. We will add some of this back if we believe operations can sustain it,” Mr Joyce said.