Traveller’s own blunders exposes him as insurance fraudster

IT’S the cheeky move that many travellers have been tempted by, but it’s contributing to a $2.2 billion problem for all Australians.

AN OPPORTUNISTIC traveller thought he’d make a quick buck with a tale about being robbed on holiday — but his cunning plan came unstuck thanks to some really stupid mistakes in his insurance claim.

And while the attempt at insurance fraud was laughable, it has contributed to a growing problem costing honest Australians more than $2.2 billion each year.

The traveller told his insurer, 1Cover Travel Insurance, he had been targeted by a thief while on holiday in Fiji and robbed of his backpack and brand new camera worth $6300.

According to his dramatic story, he jumped in his car to chase the thief but lost him, so he reported the crime to the local police who launched an investigation — but also had no luck finding the crook or recovering the stolen camera.

The traveller lodged a claim with 1Cover and provided all the necessary documents, including proof of purchase of the stolen Canon DSLR.

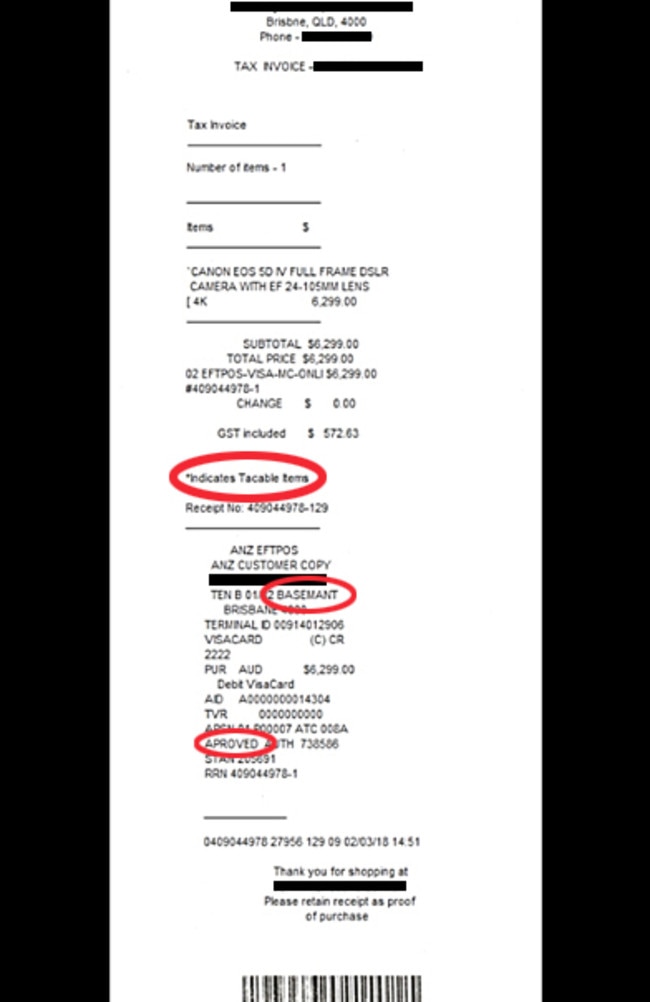

The receipt he provided seemed authentic and included details of the Visa payment and the Brisbane store the camera was bought from, which news.com.au has withheld.

But the fraudster overlooked some glaring errors on the dodgy receipt.

The word “taxable” had been spelt “tacable”, “basement” in the store’s address was spelt “basemant” and “approved” had only one “p”, leading the insurance company to correctly deduce this was a fraudulent receipt and a bogus claim.

Comparetravelinsurance.com.au director Natalie Ball said insurers saw this a lot — despite the fact it had serious consequences.

“This example is just one of the many instances of dishonest people trying to cheat insurers and their more trustworthy customers,” she said.

“The average fraudster isn’t photoshopping receipts for items never purchased for holidays that never happened, though — it’s more often exaggerating the value of stolen luggage, claiming items against both a stand-alone and credit card policy, or misrepresenting misplaced items as stolen.”

‘THIS ISN’T A VICTIMLESS CRIME’

Bending the truth, or outright lying, to an insurance company wasn’t something to give a go with no harm done if it didn’t pan out.

Insurance companies were good at catching cheats, and the law backed them up with heavy penalties.

“While some people like to convince themselves that this is a victimless crime — a big insurer won’t miss $800, right? — it’s important to understand that the insurer reserves the right to go to the police, which can lead to charges,” said Richard Warburton, the chief operating officer of 1Cover Travel Insurance, which received the dodgy camera claim.

“In the digital world that we live in, fraud detection has become more sophisticated and information can be validated regardless of where you’ve been travelling.

“The team at 1Cover are well versed at identifying flawed stories and odd receipts. We also have access to private investigators for more complex claims.”

At worst, insurance fraudsters could face tough penalties, including fines and jail time — including a maximum sentence of 10 years in Victoria and NSW and five years in Queensland.

At best, insurers could add fraudsters to “Do Not Insure” blacklists that meant they couldn’t get legitimate health, car or home insurance in the future.

And the expensive process insurers went through to investigate fake claims, which drained money from the fund pool, forced the rest of us to pay more through higher premiums.

The Insurance Fraud Bureau of Australia said insurance fraud — including travel insurance — cost honest policyholders up to $2.2 billion each year.

“Even when fraudsters are caught, any staff time or resources used to process or investigate fake claims costs travel insurers and their customers money,” Ms Ball said.

Dodgy habits of insurance cheats also had an impact on what customers could get protected under insurance.

Ms Ball said so many fake insurance claims featured mobile phones, insurers were now reluctant to cover them at all.

“Many travellers think that they can take an old iPhone with a broken screen on holidays, claim for it, and then simply upgrade to the latest model,” she said.

“As a result, we are increasingly seeing insurers reduce or remove coverage for cracked screens altogether.”

As travel insurers were careful not to fall for dodgy scams, it often took up to 10 business days for claims to be processed.

Ms Ball said customers failing to provide enough evidence to support their claims was the number one reason they were withdrawn.

But digital receipts and uploaded photos were increasingly being accepted as evidence for claims, which was making the claims process easier for honest customers.

“Waiting a few business days might seem inconvenient for customers but it’s important for insurers to be prudent in catching the fakes to keep travel insurance affordable for everyone,” Ms Ball said.