Travel money cards review: Don’t get stung by hidden fees and exchange rates

THEY’RE supposed to make overseas transactions easier but this traveller found she was getting completely fleeced by a little-known fee.

IT WAS my own fault, really.

When I decided to load my holiday money onto a travel card I was so focused on avoiding some international fees and locking in a good exchange rate that I completely missed the potential downsides.

Though it must have been on the brochure somewhere I don’t remember seeing anything about an inactivity fee and so when I didn’t spend all of my euros and American dollars on my trip I figured I’d spend the leftovers the next time I went to Europe and the States.

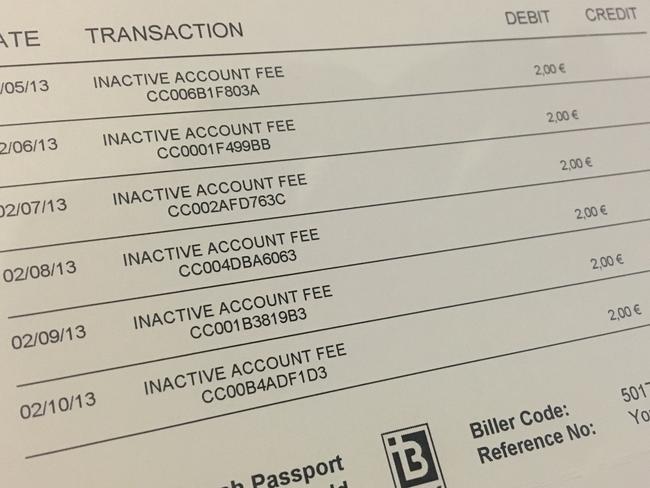

Then I took my eye off the ball. Time went by, the cards stayed in a bottom drawer and in the end I lost more than €36 from one and US$24 from the other in inactivity fees.

WHY I REGRETTED GETTING AN UPGRADE

14 TRAVEL MISTAKES THAT ARE COSTING YOU

ONE THING YOU SHOULD DO TODAY TO TRAVEL CHEAP

That was back in 2013 when I was using Travelex Cash Passports and the monthly fees were €2 and US$2 after a year of inactivity. Today Travelex has Travel Cards instead, and their inactivity fee is $4 a month after 12 months of no usage. They also have a 2.95 per cent domestic withdrawal fee if you try to get your money out in Australia and a $10 fee to move any money you have left to your own bank account when you close your account.

Needless to say after being burnt the first time I haven’t gone down that route again. Ever since I’ve simply taken money out of ATMs around the world and used my credit card for other purchases on my travels and have been very happy with my decision.

That said not every travel card has an inactivity fee, and depending on your bank some may indeed be better value when you travel.

But you really do need to pay attention to what you’re agreeing to, and do the maths on any card purchase fees, loading fees, reloading fees, transaction fees, ATM fees (remembering ‘free ATM’ doesn’t cover what the local ATM operators charge), negative balance fees and closure fees before making any decisions.

You should also look at the rate you’re being offered.

Having swung from being clueless to hyper vigilant after my 2013 lesson I stopped my mother in her tracks when she was about to get a travel money card.

Her bank manager had told her it was ‘fee free’ and would be wonderful to travel with, but a quick check of what the bank was offering compared to the official exchange rate showed she’d be losing about $30 in exchange rates if she put $500 on the card.

As we were travelling together and I have always been happy with the way my bank, ING, treats travelling customers, I told her to transfer any money she wanted in Singapore dollars into my account and I’d get it out of the ATM for her when we got there.

It worked a treat, and she’s since opened her own ING account and has been telling friends to watch out for their banks’ travel card traps too.

So before you travel next time do a little research into your own bank’s fees and compare them to the travel cards out there. Crunch those numbers on the various fees and the exchange rates they offer, and see if a change in your money spending tactics could leave you with more money to spend. Which is always a nice thing on a holiday.

For more travel news and inspiration sign up to Escape’s newsletter.