Travel insurer exposes fraud over $7000 claim using dodgy police report

A fraudster tried to pull off a $7000 travel insurance scam — but was exposed by a crucial error in the dodgy evidence he gave his insurer.

A traveller who tried to make an insurance claim worth thousands with a made-up story about being robbed overseas has been exposed as a fraudster by his own sketchy “evidence”.

The customer told his Australian insurer he’d had $7000 worth of belongings stolen, including a laptop, camera, sunglasses and clothes, on a bus ride from Hyderabad to Vijayawada in India.

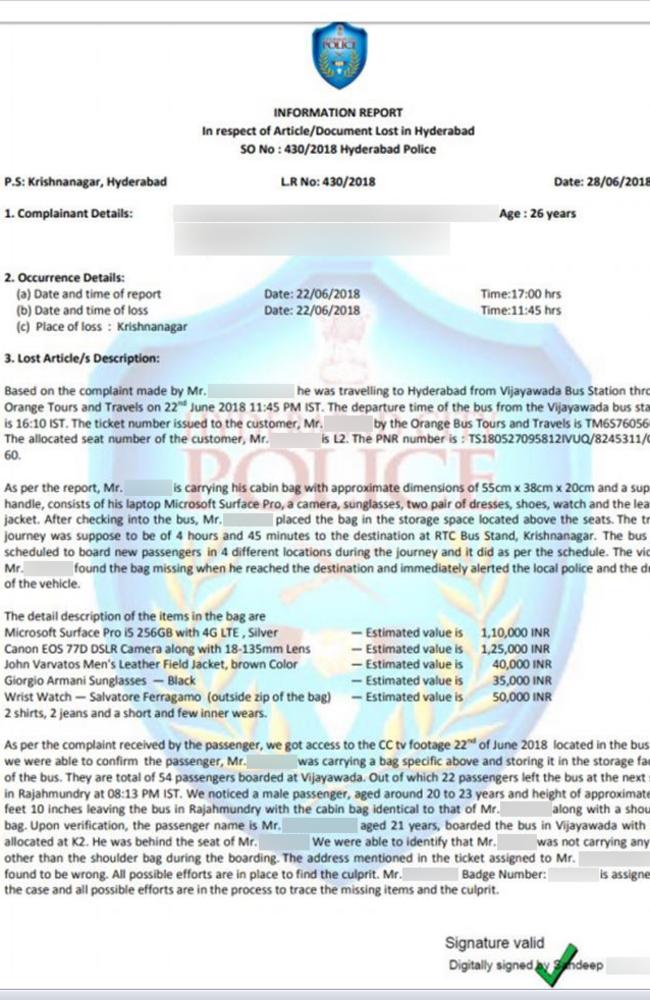

To support the claim, he supplied a detailed, digitally signed report from police in Hyderabad that described the circumstances of the alleged robbery.

The report, supplied to news.com.au, said CCTV captured another passenger — who was identified by name and age in the report — getting off the bus with the customer’s stolen cabin bag.

The report stated the name and badge number of the police officer assigned to the case.

“All possible efforts are in the process to trace the missing items and the culprit,” the report concluded.

But when the insurance company’s travel claims centre received the report with the customer’s claim, it was quickly apparent something was amiss.

“The police report, issued in India, was in English, which triggered our attention,” said the claims centre spokesman, who asked not to be identified.

“The report went so far as to name and accuse the suspect, which is really unusual. Sensing something was fishy, we were then able to establish that the police station did not exist, and that a similar false report had been making the rounds.

“After a bit of probing, the customer quickly caught wind that we were on to him and went quiet. He has yet to respond to our requests.”

In an unrelated case, a customer presented a hospital bill to the same claims team to support a $7000 claim to cover emergency costs for her sick child.

The spokesman said the bill was filled with errors, including the incorrect phone number for the hospital.

When the customer refused to co-operate and the claims team dug deeper, they discovered the patient’s ID number corresponded to someone else entirely.

“These claims have obvious tells,” the spokesman said.

“And we have ways of uncovering the truth. We can validate receipts with stores, source surveillance footage from overseas and send investigators to do in-person field work, just to name a few of the tools at our disposal.”

The spokesman said fraudsters often underestimated how easy it was for fraud-busting investigators to sniff out a phony claim.

“We can validate a lot of information quickly. It doesn’t matter where it happened,” he said.

“We’re currently investing in machine learning and automation. Without giving too much away, document and receipt scanning software along with data extraction systems provide an additional means of detecting falsified information.”

According to the latest figures from the Insurance Fraud Bureau of Australia, one in 10 claims lodged in 2017 were found to be dishonest.

Natalie Ball, from comparetravelinsurance.com.au, said that number was on the rise.

“Travel insurance fraudsters have become increasingly sophisticated,” Ms Ball said.

“We’ve seen everything from professional-looking police reports, store receipts and hospital charges that, at first glance, seem legitimate, however insurers can identify doctored documents and stop scammers in their tracks.”

The bigger problem is insurance fraud isn’t a victimless crime — the Insurance Fraud Bureau estimates fake claims cost insurers $2.2 billion a year.

“Travel insurance fraud is expensive for all of us, as it drives up the cost of policies,” Ms Ball said.

“Regular, honest customers will inevitably pay extra in premiums thanks to those who scam the system. Fraudsters may think they’re committing a victimless crime, but it’s ultimately the general public who pays the price.”

She said not all fake claims were from “mastermind scam artists”.

“There are those who will pad out the cost of an item when lodging a legitimate claim,” she said.

“Or some will choose to leave out some crucial information on their insurance application. “Either way, these are essentially methods of stealing from your insurance company.”

Insurance fraudsters could face tough penalties when caught, including fines and jail time — including a maximum sentence of 10 years in Victoria and NSW and five years in Queensland.

They could also be added to “Do Not Insure” blacklists that meant they couldn’t get legitimate health, car or home insurance in the future.

The travel claims centre spokesman said it was getting harder to get away with dodgy fake claims.

“Fraudsters face tough competition because we are getting better all the time at identifying

disingenuous claims,” he said.

“Every time we discover a doctored receipt or a home-brew police report it is added to our knowledge bank and improves our understanding of how these people conduct themselves.”