$1000 travel mistake you could be making

UNSUSPECTING Australian travellers are being hit with fees that could cost more than their trip if they choose this option when heading overseas.

AUSTRALIAN travellers are being hit with unexpected fees if they choose the wrong type of card when heading overseas that could cost more than the trip itself.

That’s the warning from financial comparison website Mozo.com.au whose research has revealed that Australians could be shelling out more than $1000 in bank fees depending on which travel money card they select.

The company’s banking experts analysed 314 travel money products from 89 providers and found that prepaid travel cards often offer the best value for money compared to credit and debit cards.

Mozo’s director Kirsty Lamont cautioned travellers to be particularly wary of annual fees that may be charged on the cards.

“A travel credit card can be very appealing when planning a trip overseas, especially when you’re able to nab complimentary travel insurance and rack up a few frequent flyer points,” Ms Lamont told news.com.au.

“That said, don’t succumb to slick marketing — some travel credit cards have annual fees that could cover a return trip to tropical Fiji.”

Foreign exchange conversion costs can also quickly add up, along with overseas transaction and ATM fees.

“Travellers should always look out for the annual fee as this is where you can get really slugged, and it pays to always keep an eye on the foreign exchange margin on overseas transactions, which can range from 0 per cent to 5 per cent on a debit card and 0 per cent to 3.65 per cent on a credit card,” Ms Lamont said.

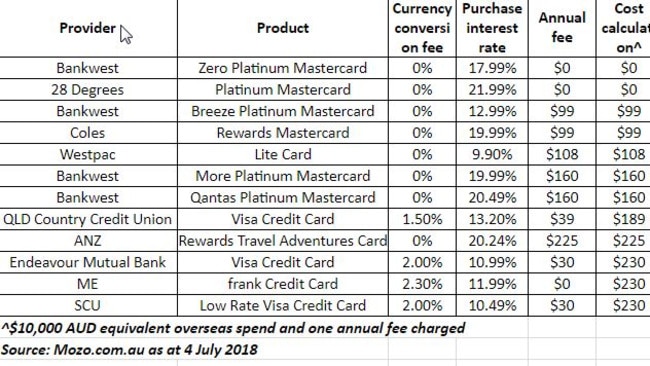

“Overseas transaction fees and ATM fees can also leave a major dent in your pocket. If you’re booking everything from flights to accommodation to evening meals on your travel credit card, those charges can really add up. A travel credit card with a spend of $10,000 can incur charges ranging from $0 to $1089 which is quite the margin.”

Exacerbating the problem is the fact that some companies make the costs involved in using such cards rather, well, complicated so even savvy travellers end up confused.

Last year Twitter user James Cridland shared his complaint about his experience of using a travel card. He attached a letter detailing how the card ended up costing him $87 more in fees than if he’d just used his debit card. He demanded a refund, which he says he received.

Got a @CommBank Travel Money Card? It’s a complete ripoff. This complaint letter explains why; and got me a refund of over $100. pic.twitter.com/WNIo0ogXVw

— James Cridland (@JamesCridland) August 30, 2017

Another consumer tweeted their confusion over the exchange fee variations: “St George Bank I check the $ exchange rate to pound sterling on the internet & its .56 I go to the bank and they use .58 why? Then they charge me a $10.50 fee to cash my cheque all smells of a money scam.”

@StGeorgeBank I check the $ exchange rate to pound sterling on the internet & its .56 I go to the bank & they use .58 why? Then they charge me a $10.50 fee to cash my cheque all smells of a money scam @abcnews @CommBank

— Charles Wright (@charleshawa) July 10, 2018

I took out a travel money card before going overseas and they put a hold on it when I was in Disneyland. I had to call Australia, and they were like “did you spend x amount at a spa yesterday? and x amount at [shop inside disney]?†Yes I did, I’m on holiday!

— NJ☽☠(@noellejosephine) June 1, 2018

I had to pay for Apple Music on my travel card so I put money into the Australia currency yet Apple goes and takes it from the uk currency anyway and charges me fees 🙃

— Danielle. (@ForeverWithJoeJ) December 31, 2017

THE PROS AND CONS FOR DIFFERENT TYPES OF CARDS

• Credit cards. According to Mozo’s research, they are great for those wanting to make large purchases overseas, rack up rewards points or take advantage of free travel insurance, they also have downsides. That includes cash advance fees when using ATMS to withdraw money, potentially huge annual fees and also being exposed to negative exchange rate fluctuations.

• Prepaid travel cards. These cards allow you to lock in your exchange rate before you go — this involves some research but it can really pay off. However, the downside of these cards is that currencies of smaller countries may not be supported and any leftover funds loaded into that currency need to be covered back to AUD upon your return.

• Debit cards. Some debit cards have small or no ATM withdrawal or currency conversions fees, with funds converted only into the local currency when you use it. However, the cons of such cards include negative fluctuations in the exchange rates and hotel security deposits which can take days to be processed back into your card once refunded by the hotel. This means you often need to load more money on to the card than needed.

So, at the end of the day which companies offer the best deals? Mozo selected HSBC as the Travel Money Bank of the Year, while Bankwest scored the titles of Travel credit card provider of the year for the second year in a row.

For a comprehensive comparison of cards, visit Mozo.com.au.