Covid cancellation clause catching Australian travellers out

Australians looking to travel over the upcoming holiday period have been warned they risk losing thousands of dollars due to a little-known rule.

As the holiday season fast approaches, an unfortunate surge in Covid cases particularly in states such as New South Wales and Queensland has again highlighted the importance of travel insurance for those planning on heading away.

However, a relatively unknown but important travel insurance clause could see many risk losing thousands in holiday costs.

Prior to Covid, pandemics and disease outbreaks were excluded from most travel insurance policies as they were deemed too difficult to price due to their unpredictable nature, or simply thought to be too high risk.

However, since Covid, most insurers now offer medical coverage for travellers who contract Covid, and some offer cancellation cover in certain circumstances too.

However, there’s a little-known clause that could affect some Australian travellers who take out policies with insurance companies such as Cover-more and Easy Travel insurance, and then end up needing to cancel their holiday due to Covid; and it involves those who purchase coverage less than 21 days from the start of their trip.

Natalie Ball, director of Comparetravelinsurance.com.au, explained: “Several insurers offer cancellation cover for your prepaid deposits and costs should you catch Covid before or during your trip.

“However, there is a caveat that some brands have applied to policies purchased within 21 days of your departure date. In this instance you may only be able to recover costs incurred after your policy purchase date.”

So, if you booked your December flights in October, but waited until two weeks before leaving until you took out your insurance and then got Covid and had to cancel, you may not be covered for the cost of the flights.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

However, Ms Ball says customers that had purchased a policy prior to those 21 days would be covered up to the full cancellation benefit listed on their policy.

“If you purchased your policy ahead of time or prior to the 21-day period, you would be eligible to claim on all your prepaid and non-refundable travel expenses, regardless of when they were made.

“Buying cover too late is where travellers are getting stung.”

She said the key to avoid getting caught out is to buy travel insurance at the same time as purchasing your trip.

“The way this clause works is to deter you from buying travel insurance too late.”

On the flip side, any bookings made after buying travel insurance early would be claimable.

“If you were to pay for your accommodation after purchasing travel insurance, you would be eligible to claim back those costs. So be mindful that if you book your holiday ahead of time, it really does pay to buy travel insurance early.

“A basic policy starts at about $10-$20 per day. When you compare that to the thousands of dollars spent on a typical overseas trip, travel insurance is a no-brainer.”

Lastly, Ms Ball notes that insurers usually offer Covid cancellation cover as an add-on extra, which is worth considering in certain instances.

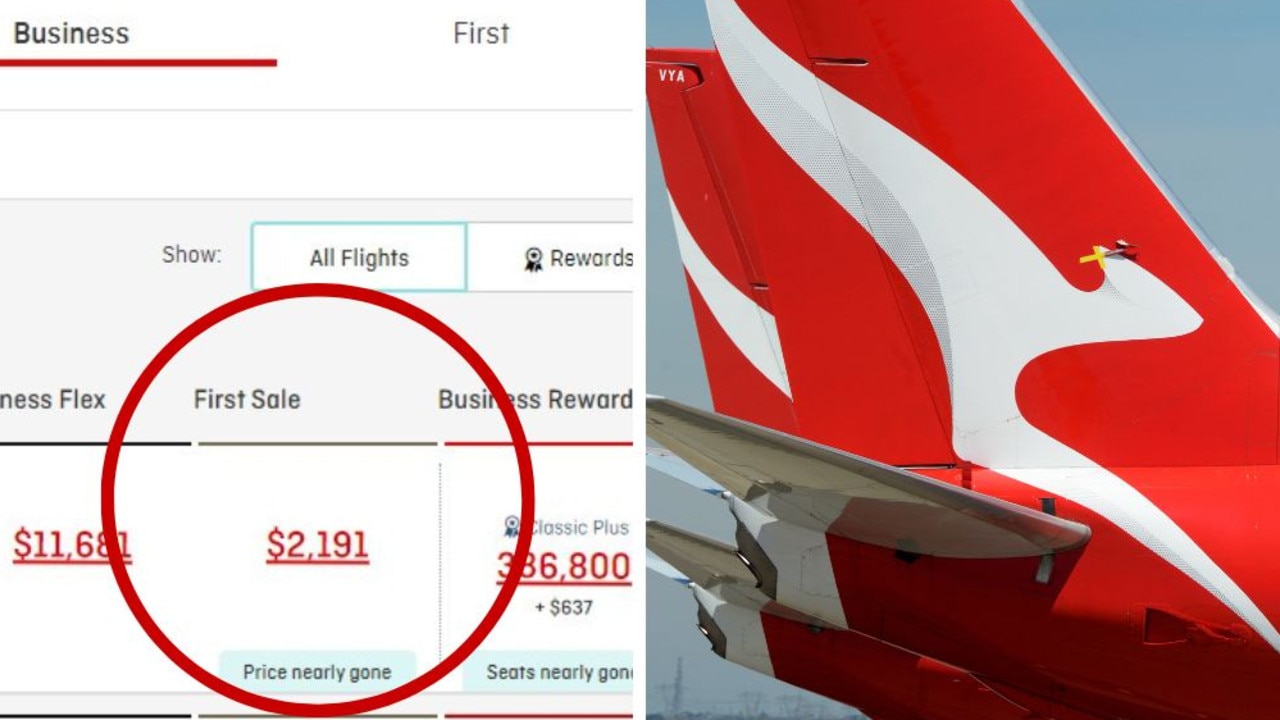

“With rising airfares and travel costs, that cover may be an expense worth taking if your prepaid costs are in the thousands,” she said.

The government’s Smartraveller echoes this advice on its website, advising to buy early.

“There are cooling-off periods for Covid-19 cancellation cover, so it’s best to buy your travel insurance at the same time as you book your trip. Some insurers may only cover cancellation if you test positive to Covid-19 and the policy was purchased more than 21 days before your scheduled departure date.

“The further out from your departure date that you buy travel insurance, the more you’re likely to pay for it, but you’ll be covered from the moment you buy your policy.

“For example, if you buy insurance two months before you fly, you effectively have cheap cover for any events that affect your travel plans in those two months.

“If you pay for your trip in full six months in advance, but you only buy an insurance policy two weeks before you depart, you may not be covered for any cancellation costs if you contract Covid-19.”

However, it warned to read the fine print.

“The list of travel insurance disputes taken to the Australian Financial Complaints Authority (AFCA) reveals a battlefield of unread or misinterpreted terms and conditions. Between 1 July 2020 and 30 June 2021, AFCA received more than 2000 travel insurance complaints related to Covid-19.

“Not all travel insurance policies are the same, and the wrong policy can be almost as bad as none at all.”

Smartraveller found that one-in-four Australian travellers experienced an insurable event on their last overseas trip, including flight or tour cancelled, or received medical treatment.

Australian travellers lodged almost 300,000 insurance claims in 2018–19, the last financial year before Covid-19 travel bans. Almost 90 per cent of those were paid out.