Australians are getting a raw deal on money exchanges: report

DODGY exchange rates and high fees are slugging Australians billions a year. Most have no idea how much they’re being dudded.

DODGY exchange rates and high overseas card fees are ripping off Australians to the tune of about $3.1 billion a year, new research reveals.

And most Australians have no idea how much they’re being dudded.

The research by Capital Economics, out today, found Australian holiday-makers, business travellers and businesses paid $3.9 billion on foreign currency fees in 2016.

Of that, a whopping $3.1 billion was hidden in mark-ups on exchange rates, as well as card spending charges by banks and currency brokers to international transactions, said TransferWise, which sponsored the research.

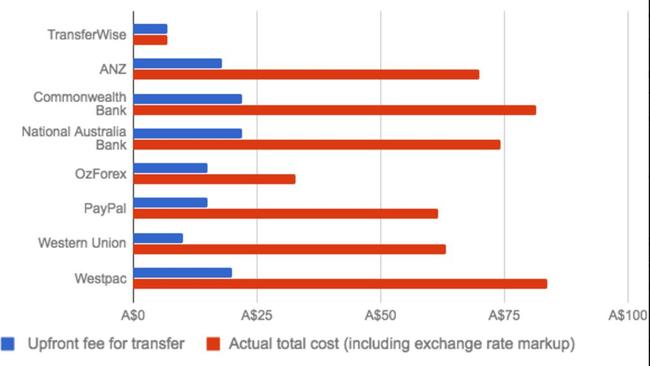

Banks often advertise a small upfront fee for international money transfers but incorporated a “significant margin” in the exchange rate mark-up, TransferWise said.

And most consumers don’t understand the fees charged by banks on these transfers, and many think there is no cost at all.

Commonwealth Bank and Westpac were identified as two of the worst offenders for exchange rate mark-ups.

“Most banks tell their customers that they only pay a small upfront fee for international payments. But in reality customers pay much more,” TransferWise co-founder and chairman Taavet Hinrikus said.

“Huge hidden charges are taken in the form of the terrible exchange rates, often without the customer realising.”

Mr Hinrikus said by hiding their charges in “fake” exchange rates, banks were able to claim they offered “low fees” or “no commission”.

“These practices aren’t transparent and hide important decision-making information from customers,” he said.

And it’s not just travellers being stung — the research found Australian small businesses spent $146 million on poor exchange rates on their international exports.

People who transferred money to friends and family overseas were also being slugged.

SO HOW DO YOU GET A BETTER DEAL?

A recent report by Choice compared the money transfer options available and found banks were generally the worst way to go because they offered a poorer exchange deal.

Choice warned customers could be tripped up on the conversion rate calculators on bank websites because it wasn’t always clear whether customers are looking at the interbank rate — which banks used to trade with each other — or the customer exchange rate.

The interbank rate showed a better deal, but that wasn’t the one that would be applied to customers’ transactions.

Choice recommended customers looked beyond the big banks for their international money transfers.

It found OFX, World First, CurrencyFair and TransferWise had the best deals on exchange rates and fees, but noted most non-bank services had a minimum send amount and required customers to open accounts.

But they always disclosed the exchange rate and fees before customers finalised their transaction, which meant there was no disappearing money on the other end.

TravelWise said customers could also consider transferring the money to a domestic account in the country they were travelling to in advance, as those firms offered better rates and no extra fees.

It also recommended prepaid travel money cards, but warned it was wise to shop around as many came with extra fees and false exchange rates.