Major factor that led to Aussie airline’s collapse

A massive Aussie company had been making money but one decision is being blamed for its downfall – and it’s clear as day on its own website.

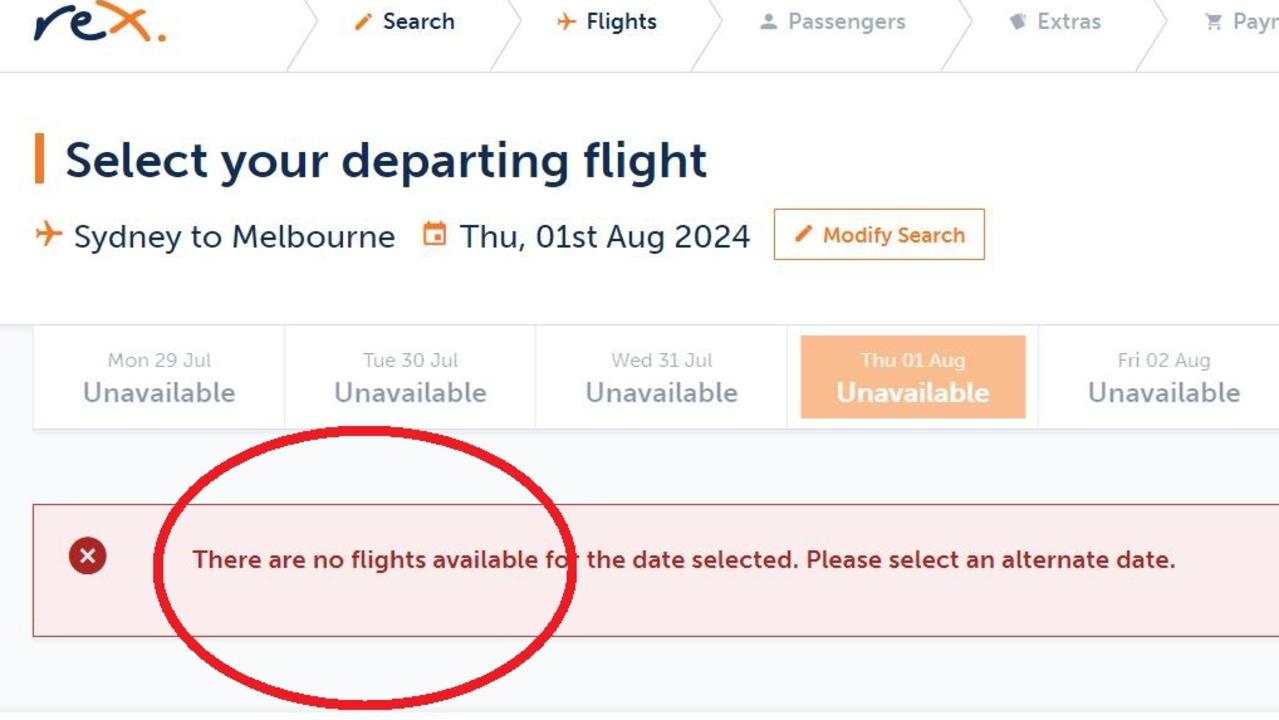

A clue to one of the main reasons why airline Rex is now on its knees stares you in the face on its own website.

Despite Australia’s third largest airline going into administration late on Tuesday, right now you can still book a flight from, say, Sydney to Dubbo or Adelaide to Broken Hill.

The kind of flights Rex has long been known for.

On its website you can also search for a fare from Sydney to Melbourne or Adelaide to Perth, for instance. But do that now and you’ll come across a warning all in red.

“There are no flights available” the urgent text states.

It’s telling that the first routes to go as Rex desperately tries to bounce bank from the brink are the capital city pairs it launched in a blaze of glory deep in the pandemic.

Rex’s slogan is “our heart is in the country”. But a swerve to serve Australia’s major cities with big jets, rather than country communities with tiny turboprops, appears to have drained Rex’s coffers to the point of collapse.

Self inflicted

There are now real questions for the connectivity of regional Australia as well as hundreds of jobs.

But the other question is how Rex let itself get into the position where it went from profitability to insolvency in such a short period.

Taking aim at Qantas by flying interstate could be the self-inflicted wound that led to its downfall.

However, Qantas is also in the spotlight, accused of pushing the vulnerable Rex even closer to the edge.

Rex’s wild swerve into big city flying

On Tuesday, Ernst & Young was appointed as the administrators of Regional Express, to give the carrier its full name.

It comes just months after start up low cost airline Bonza stopped flying and never restarted.

Rex’s traditional core of services, its regional routes operated by 33 seat Saab 340 turboprops continue to operate. But its almost certainly bye to the Boeings buzzing between the capitals.

Virgin has come to the rescue stating it will allow Rex customers with tickets on 737 flights to transfer them to its services.

Risky move had huge upside

There have long been murmurs that Rex, a small airline, was overstretched competing head on with Qantas and Virgin.

Yet for Rex the risky move promised rich rewards – if it could pull it off.

And for a hot second, it looked like it would.

In June 2020, when the world was consumed by Covid-19 and a cash strapped Virgin Australia had gone bust just weeks before, Rex announced it would use leased 737s to begin services on capital city trunk routes.

The ex-Virgin jets had a new paint job outside but inside they still sported Virgin colours.

Rex was bolshie about its big new plans.

“Travellers will finally have a high quality, reliable and affordable airline to fly between Australia’s major capital cities,” it said ahead of the first 737 flights in early 2021.

Rex undoubtedly would have recalled how the then Virgin Blue was in the right place at the right time when Ansett ceased operating in 2001.

Filling the vacuum, Virgin suddenly went from scrappy challenger to Australia’s second largest airline.

With a foothold on Australia’s busiest routes, Rex was well placed to repeat that feat 20 years later should a weakened Virgin diminish in size or cease operating altogether.

But Virgin did not vanish.

Under new owners Bain Capital it rebounded and in 2023 made a profit of $129 million.

It once again took its place as Qantas’ largest domestic competitor. Qantas has also been swimming in post pandemic profits.

In an uncomfortable irony for Rex, Virgin will now take on the leases of three Rex 737s which Rex had taken from Virgin.

Rex’s woes

Rex was making money before the pandemic. It also made a profit in the last full year, of $14.4 million, when it was flying 737s.

But there were worrying signs in the small print. Its entire profit was due to a fair value contribution from a stake it had bought in another airline. Strip that out and Rex sank to a pre-tax loss of $31.7m in 2023.

Airlines are expensive businesses: leasing planes, maintaining them, paying wages, buying fuel and competing with rivals.

Rex kept its head above water on regional routes where costs were lower and competitors fewer. But between major cities, it was far more difficult.

Added to that, Rex’s lower frequencies between the big cities meant it found it harder to prise passengers away from the big two.

The 737 division was also taking management’s eye of its bread and butter regional routes. For instance, how to eventually replace its Saab 340 planes, some of which have been flying for three decades.

It likely all became too much of a challenge financially and on Rex’s staff.

“You’ve got one major airline, one challenger airline that is strong and well-funded and it’s just hard for a third player to compete directly when there’s a limited number of people who want to fly between places,” associate professor at Sydney University Rob Nicholls told SBS News.

Speaking to news.com.au earlier this month, Qantas CEO Vanessa Hudson cast doubt on there being enough room in Australia’s domestic market for three major airlines.

“If you think of why three airlines really struggle … it’s our (smaller) population (and) the economics of being a viable airline is capital intensive,” Ms Hudson said.

“The next biggest challenge we have is decarbonisation, that is significant.

“(And) I don’t think there is sufficient volume to sustainably support a significant growth in the number of players.”

Qantas in the spotlight

But Qantas has itself come in for criticism for Rex’s woes.

Shadow transport minister Bridget McKenzie told ABC7.30 that it would be “absolutely catastrophic for regional and rural Australians,” if Rex didn’t keep flying.

“As soon as Rex announced that they were going to take it up to Qantas and seek to provide more competition on the … capital city routes, Qantas decided to fly and make a loss into those markets and put Rex under more financial pressure,” Ms McKenzie claimed.

Qantas has been contacted for comment.

Air connectivity is simply too vital to regional Australia. It’s almost certain a slimmed down Rex, in some form, will emerge from the ashes.

Already the government has stepped in with temporary funding to keep Rex’s regional route airborne, reported the AFR.

Although transport minister Catherine King told ABC Radio on Wednesday that Canberra was “reluctant to just throw money at the problem”.

Virgin has been mooted as a possible buyer. But it doesn’t have money to burn itself. It has talked of a future partnership with Rex to funnel passengers from the country on to its planes in the major cities – one ticket from Broken Hill to Perth via Adelaide for instance.

On Tuesday, Prime Minister Anthony Albanese was just the latest person to cite the expansion to capital city markets as a key factor in Rex’s downfall.

“One of the things that I expressed concern about was that Rex moved away from their traditional role of being a regional airline into flights from Sydney to Melbourne”.

Rex, its management, staff and passengers, may now regret its bold move to take on Qantas on the flag carrier’s own turf.

– with Vanessa Brown.