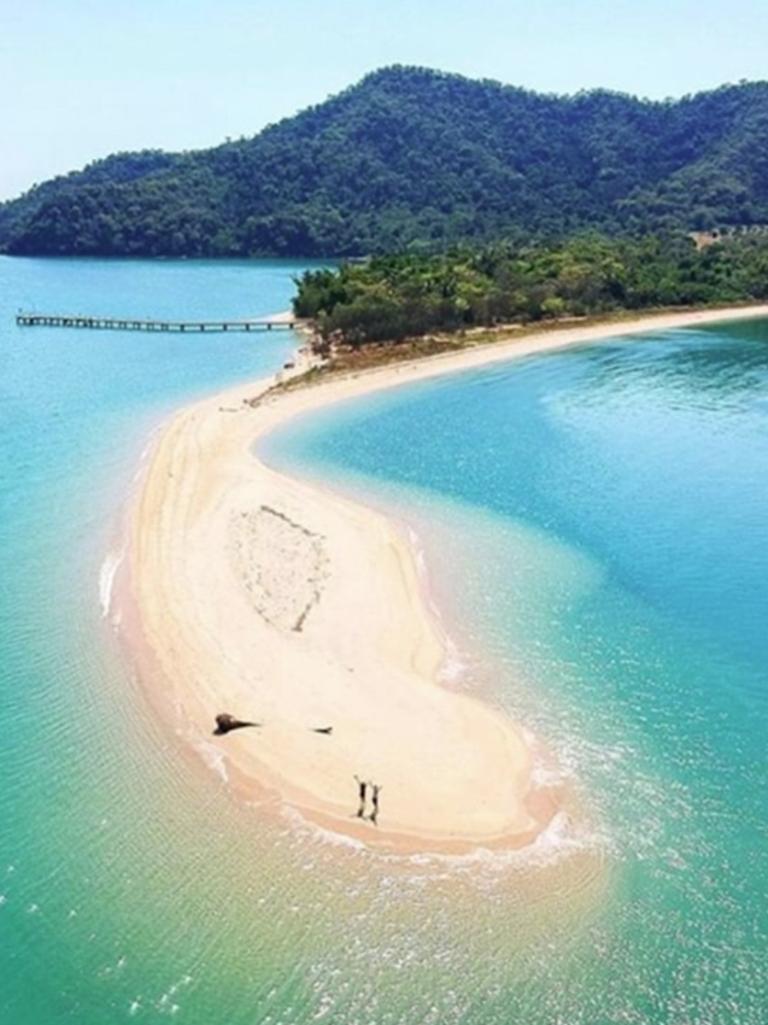

$30 million tropical Dunk Island in North Qld repossessed

The ambitious plan to buy a multimillion-dollar resort in north QLD has been dashed after the long-term owners repossessed the island.

An idyllic north Queensland island, which was sold for around $30 million last year, has been repossessed by the previous owners after the new ones failed to meet their payment obligations.

Investment group Mayfair 101 purchased the island last year off Family Islands Operations, which is owned by the family of Australian businessman Peter Bond. At the time of sale in September 2019, parts of the island were left in tatters after being seriously damaged during both Cyclone Yasi in 2011 and Cyclone Larry in 2006.

RELATED: Five star hotel that could save the economy

It is understood that Family Islands Operations were forced to regain possession from Mayfair, after the group were unable to meet their payment obligations.

The company’s managing director, Adam Bond, said the decision to take back the island from Mayfair was unfortunate.

“Under the circumstances we have been left with no alternative but to foreclose,” Mr Bond told the Cairns Post.

“We have spent several months working with Mayfair in an attempt to engineer a solution. Despite several extensions to payment terms, Mayfair have remained unable to meet their obligations.”

RELATED: Why you need to book a trip to the Great Barrier Reef now

Dunk Island was set to be the jewel in the crown for Mayfair 101, who planned on turning the island – and 200 properties at nearby Mission Beach – into a multi-billion dollar “tourism mecca”.

According to The Australian, Mayfair 1010 had purchased 15 residential properties in Mission Beach worth a total of $20 million. However, it is now understood the group has had to hold off on many settlements citing COVID-19 as the reason.

According to the ABC, Mayfair 101 still has plans for the Mission Beach area, and hoped to refinance by September.

“Mayfair 101 group is well progressed with significant local and overseas institutional financiers who are currently undertaking due diligence on the project,” it said in a statement.

“The group expects to complete the final stages of its refinance next month, enabling it to pay out the finance on Dunk Island provided by the Bond family in the required time frame and refinance its mainland property financier, Napla.”

“We are working with the right credible financiers to deliver this project in full,” managing director James Mawhinney added.

Initial plans for the island included a beachside bar and viewing decks with original plans to be open in October. Mr Mawhinney had forecast the tourism hub would also contain camping sites, family-style resorts and an ultra-luxury beach-club-style resort on the mainland at Mission Beach, which would also create up to 10,000 jobs.