How Australia could avoid recession

Australia has weathered its fair share of economic slowdowns in the past without going into recession – but will it be able to pull off a miracle again?

Australia has weathered its fair share of economic slowdowns in the past without going into recession – but will it be able to pull off a miracle again?

Things are looking more and more challenging for the Australia economy, with five key factors putting the nation under pressure.

Fuel prices are under control – at the moment. But three key factors are about to combine and the impact on Aussie households could be devastating.

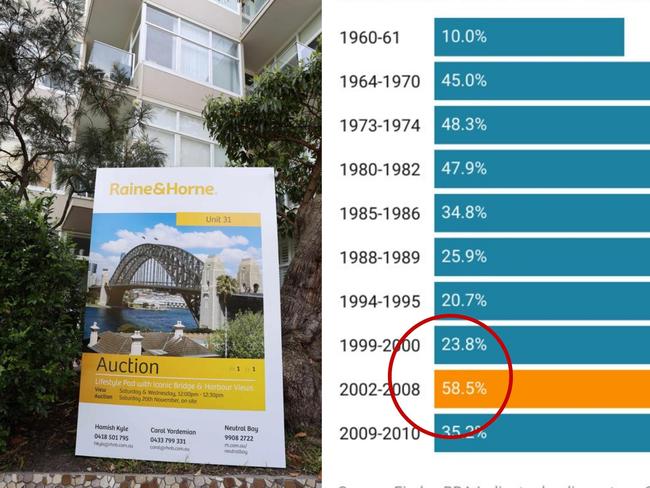

The generation wars always seems to come down to this one topic – and it turns out Boomers might just be right.

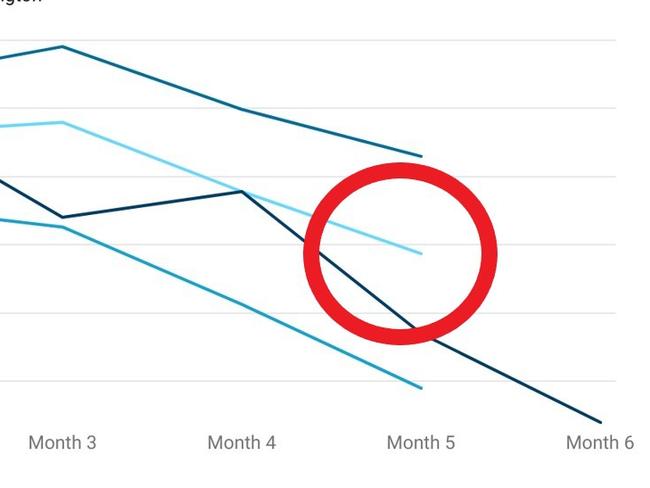

Rising interest rates in two similar countries to Australia have seen their house prices drop by worrying amounts.

Interest rates are scheduled to keep going up but there’s a worrying sign it won’t be enough to save the Aussie economy.

The RBA has made a worrying forecast about how long it will take for wages to catch up with inflation – and it’s no wonder we all feel so poor.

Bring up today’s cash rate and Boomers will often retort with the 17 per cent rate of the 1980s. But it turns out their argument simply doesn’t stack up.

China’s harsh lockdown in response to its Omicron outbreak is coming at a cost to the rest of the world. And that includes Australia.

A combination of factors have aligned to leave Australia in a very vulnerable position – and there’s one reason it could be about to get a lot worse

Original URL: https://www.news.com.au/the-team/tarric-brooker/page/17