Sophisticated new phone and internet scams robbing Australians of thousands of dollars

THINK you're immune to phone and internet scams? Well, think again, because smart new scams are robbing us blind.

THEY say the best lies are based in truth and a new breed of scammers have taken that adage to extremes with a sophisticated set up that impersonates real people and has robbed two victims of hundreds of thousands of dollars.

Just as people are wising up to more obvious scams, such as the exiled Nigerian prince searching for a bank account to stash his millions, authorities are warning that criminals are jumping ahead with an array of swindles which are almost impossible to spot and have “suckered” people in leaving them massively out of pocket.

The Australian Competition and Consumer Commission (ACCC) reported Australians had lost $82 million in 2014 to scams, but the true amount was likely to be closer $1 billion annually.

One notable scam, which hit two residents of the inner Sydney suburb of Surry Hills in just one month last year, was notable for its both its brazenness and the length it went to gain the victim’s trust.

IMPERSONATING POLICE OFFICERS

“These scams have developed into this half-truth scenario where people are now using real people’s names,” Chief Inspector Craig Middleton, the crime manager at Surry Hills Police Station told news.com.au.

“It’s a complex scam that takes place over a couple of weeks and allegedly involves the NSW Police ringing them and convincing them they are part of an undercover operation.

“The person is told to follow a number of steps and, as the story is quiet elaborate, they can get suckered in very easily.”

The victim is initially called by someone claiming to be from their bank and stating that their credit card has been used and their account is at risk. Following this, they receive a series of phone calls from people purporting to be from the bank as well as a man claiming to be a senior police officer investigating the matter. In some cases, the real names of serving police officers are used meaning if the victim were to check the person’s details online they could well find them.

“They received a number of phone calls from people saying they were high ranking police officers over a number of weeks and that tended to make them feel it was real,” said Insp Middleton.

The victim is given a series of codes to “authenticate” they are involved in a genuine investigation. Finally, when their trust has been built, the fake police officer asks for the victim’s own cash as bait to nab the so-called fraudsters.

“There are certain guarantees given about refunding the money but, of course, once they transfer that money out of their own bank account it’s never heard of again,” he said.

HUNDREDS OF THOUSANDS

One victim lost $180,000 and the other $220,000. “They’ve lost large amounts of money, which as yet have not been recovered and they’re distraught and feeling somewhat taken advantage of,” Insp Middleton said of the victims.

“It’s cruel. They are particularly picking on vulnerable members of the community.”

Insp Middleton said police would never ask the public to move money between bank accounts and even if real officers’ names were used, people should confirm that person’s identity by ringing the police station on the number found in the White Pages rather than any email or number given by the person on the phone.

Deputy chair of the ACCC, Delia Rickard, said they estimated only 10 per cent of scam cases were reported each year with many people simply too ashamed to admit they were a victim.

In the first six months of 2015, Australians lost $46 million to scams, of which $10 million were dating based, $9 million dodgy investments schemes and $2.3 million of the Nigerian variety. While many were purely online, scams where people talk directly to the fraudster on the phone, accounted for almost half of the cons.

TRAFFIC VIOLATION CON

“When we look at the statistics around scams, it’s fairly evenly spread across all age groups. But it’s clear the older you get the more vulnerable you are [to phone scams] but that could be partly due to older people being at home during the day,” Ms Rickard said.

New swindles were even fooling people who thought they were wise to scams, said Ms Rickard who advised regular checking of the scamwatch.gov.au website to keep up to date on the latest schemes.

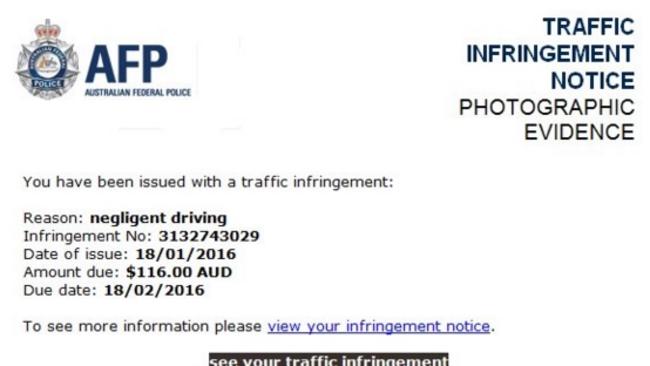

“One we’re seeing a lot of at the moment involves people getting an email to say they have a traffic violation for which there is photographic proof,” she said.

“People then click on a link to look at the photograph and unwittingly download an executable file which locks the computer. A pop up comes up demanding a ransom for it to be unlocked.”

INVESTMENT SCHEME

Some investment scams build trust by creating professional websites, posting out glossy documents and providing familiar looking phone numbers for victims to get in touch on.

“It’s very convincing and it helps to build legitimacy. But while the telephone numbers look Australian, the caller could be anywhere in the world,” Ms Rickard said.

Last October, Gold Coast local Shirley Wood received a call from a person purporting to be from the Australian Taxation Office. The voicemail message said a lawsuit had been filed against her for tax and urged her to call a NSW phone number to resolve the issue.

Ms Wood, who has an unlisted number, said she had just completed a genuine tax return and had not heard back from the ATO, so was worried by the voicemail.

“I said to my daughter, ‘Jenny, listen to this’,” she said.

“She phoned back and he abused her. They knew my name — how did they know my name?,” the Gold Coast Bulletin reported.

Suspicious, she called police who said they were powerless to act because no money had been taken and the calls were most likely from overseas.

Despite the sophistication of a scam, the simple rule is, if people you have never heard of want your cash or your personal details, always be wary.

“The story will change but they always want personal information and your money,” said Ms Rickard. “If you don’t know them don’t send money, don’t give credit card details, hang up and call the institution.”