Young people most likely to fall victim to scams

Australians are more likely to fall victim to a scam than ever before, and new details about who is most likely to be scammed might surprise you.

Young people are the most likely to have fallen victim to a scam, challenging perceptions over who is the most vulnerable to fraudsters.

People aged between 18 and 29 are the least concerned about becoming a victim but more likely to experience a scam or cyber attack, according to research from NAB.

Only 16 per cent of men and 18 per cent of women in that age bracket said they were concerned about being scammed.

However, twice as many men (34 per cent) and women (38 per cent) in that age group had become a victim of a cyber attack or scam.

NAB investigations and fraud manager Chris Sheehan said it was a common misconception that scams were an “older person’s problem”.

While older Australians are more likely to fall victim to investment scams, young people are more likely to fall victim to other types of fraud.

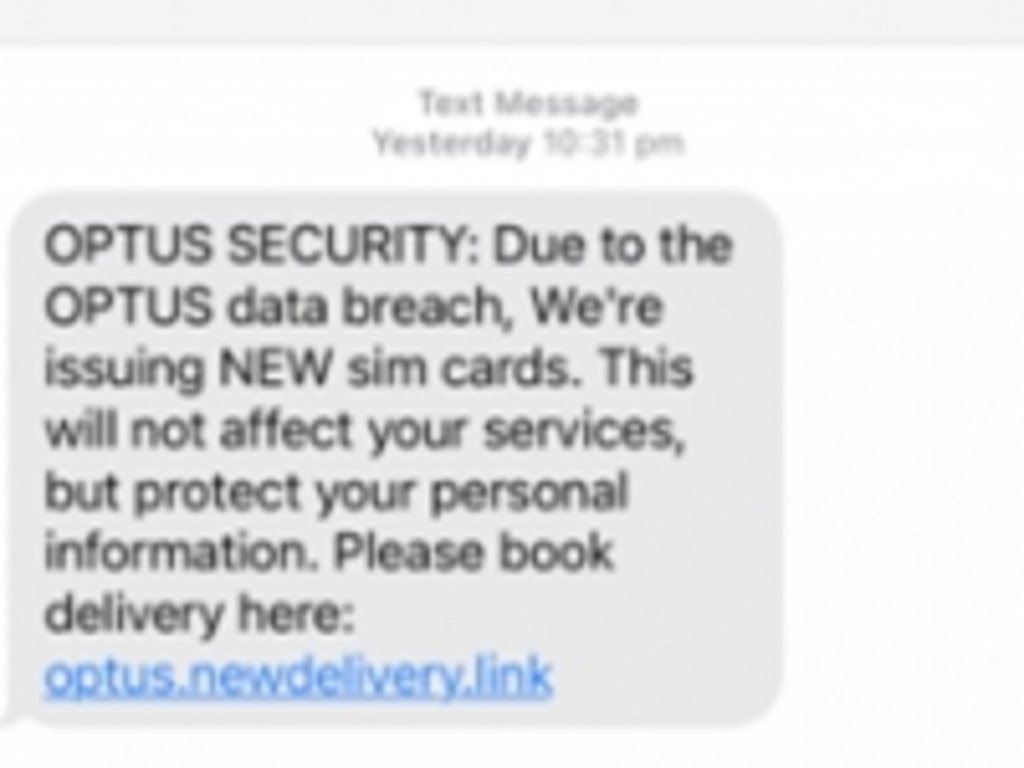

“We’ve seen a real growth in phishing scams where the criminals are spoofing legitimate text messages and phone numbers belonging to organisations like ours, young people fall victim to those in equal numbers to older people.” he said.

“Scams targeting online shopping, for example, young people fall victim to those at a probably slightly higher rate than older people.”

The rates of young people who have experienced a scam come despite young people saying they felt they could protect themselves.

Half of the young men questioned said they had good or very good knowledge of cyber security and a third of young women had the same answer.

“There‘s a level of confidence in their own ability to function safely in the cyber space, but young people are not across the types of risks and threats that exist out there to the extent that they should be with that level of confidence,” Mr Sheehan said.

He said he didn’t believe the community “has got our heads around the nature of the threat that we’re facing”.

“We are only in the early stages of understanding the sophistication of the criminal groups that are doing this and their persistence,” he said.

“We see people who are scammed and then they will get a follow-up scam attempt from the same crooks who present themselves as a legitimate company that helps recover scam losses for people.”

That type of scam is so prevalent, NAB warns scam victims to watch out for companies who appear to want to help them but in reality will steal more money.

Some types of scams that occur in Australia and throughout the world are often misunderstood according to Mr Sheehan, with some fraudsters choosing to not take out funds themselves or lying in wait before stealing money.

“What these crooks will do is just aggregate thousands of people’s credit card details and then sell those onto other people on the dark web to facilitate other types of scams,” he said.

That means the scam may not be caught out for months, leaving victims in the dark about how their details were taken.

Mr Sheehan said the likelihood individuals would fall victim to scams was “really, really high” as more Australian organisations fall victim to cyber attacks and customers details are leaked.

“These crooks just spend their whole time cooking up new schemes to scam money out of people,” he said.

“It’s a huge issue that’s impacting a very, very large section of our community.

“Everybody has had an attempt made against them.”