Urgent tax scam warning as fraudsters prepare to make the most of the EOFY

Australians are being warned to be vigilant over the next few months as the end of the financial year increases the risk of being scammed.

Australians are at a heightened risk of being targeted by crooks over the coming months as cyber criminals try to con people out of their money through end of financial year or tax-related scams.

One in four Australians (24 per cent) have experienced a scam related to EOFY or tax matters according to new research from Commonwealth Bank (CBA).

However, the bank’s fraud experts are warning that scammers don’t necessarily wait until June 30, when people begin to file their tax returns, to find their targets.

Only five per cent of people experienced EOFY/tax related scams at tax time, meaning that people are being targeted in the lead up with fake ads and schemes designed to strip them of their cash.

The Australian Competition and Consumer Commission’s Scamwatch organisation warns consumers against rebate scams where cyber criminals convince individuals they are entitled to a reimbursement from the Australian Taxation Office (ATO), often through overpaid or unclaimed taxes.

These scammers ask their victims to pay a small initial payment to cover “administration fees” in order to access the amount “owed” to them.

Victims will often lose more money in the scam than they are believed to be owed by the organisation.

Scammers are making more money off this type of fraud than ever before, with Australians losing $1,488,331 in March 2023 from 563 scam cases.

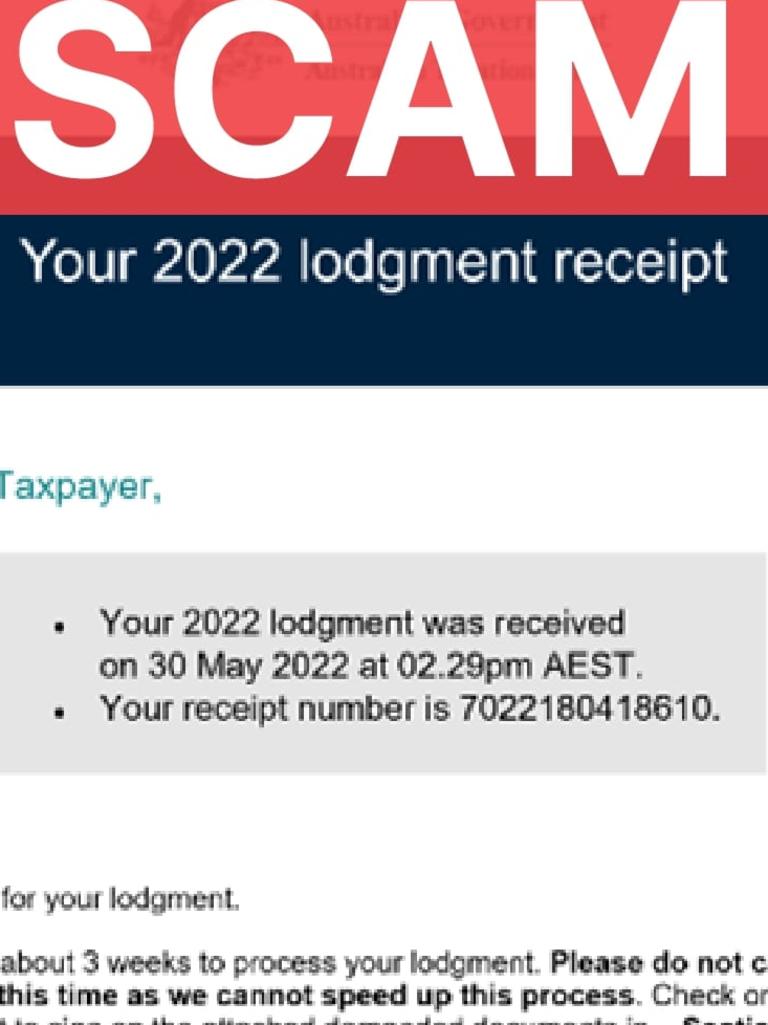

The ATO sent out warnings during the 2022 tax season about multiple scams being sent via email and text message.

These scams often include links to fake web pages designed to look like the ATO website and would often steal their login details in order to strip the victim of their money.

“The real ATO will never send you an SMS with a link to log in to our online services,” an ATO spokesperson said.

“We’ll also never ask for your credit card details.”

There are no limits on who scammers pretend to be according to Ratecity.com.au research director Sally Tindall.

“Scammers are continually evolving to be ahead of their next victim rather than behind,” she said.

“People need to stay ever vigilant when it comes to scams.

“Scammers spend a lot of time thinking about what their next trick might be and who their next victim might be.”

Australians also need to be aware of other types of scams as many retailers will be offering sales and discounts to customers ahead of tax time.

Online shopping scams have affected 25 per cent of the Australian population, with CBA warning that people need to ensure that the merchant they are purchasing from are really who they say they are.

The bank also urges customers to google retailers and read reviews and comments before purchasing and to be wary of extremely low prices and limited payment options.