Authorities issue fresh warning as scammers rort Australians $41 million a month

Australians are already $336 million out of pocket due to scams this year, so what is it that makes the nation such an easy target for swindlers?

Alarming figures from Australia’s consumer watchdog have revealed the nation’s lost more money to scams in the last six months compared to the entirety of last year.

According to the Australian Competition and Consumer Commission’s (ACCC) Scamwatch database, Australians have lost more than $336 million to scams so far this year, which is just over $12 million more than what was stolen in all of 2021.

In the first half of 2022, fraudsters have swindled an average of $41 million per month from Australians who have fallen victim to their web of deceit, doubling the average amount of money stolen by scammers between January and June last year.

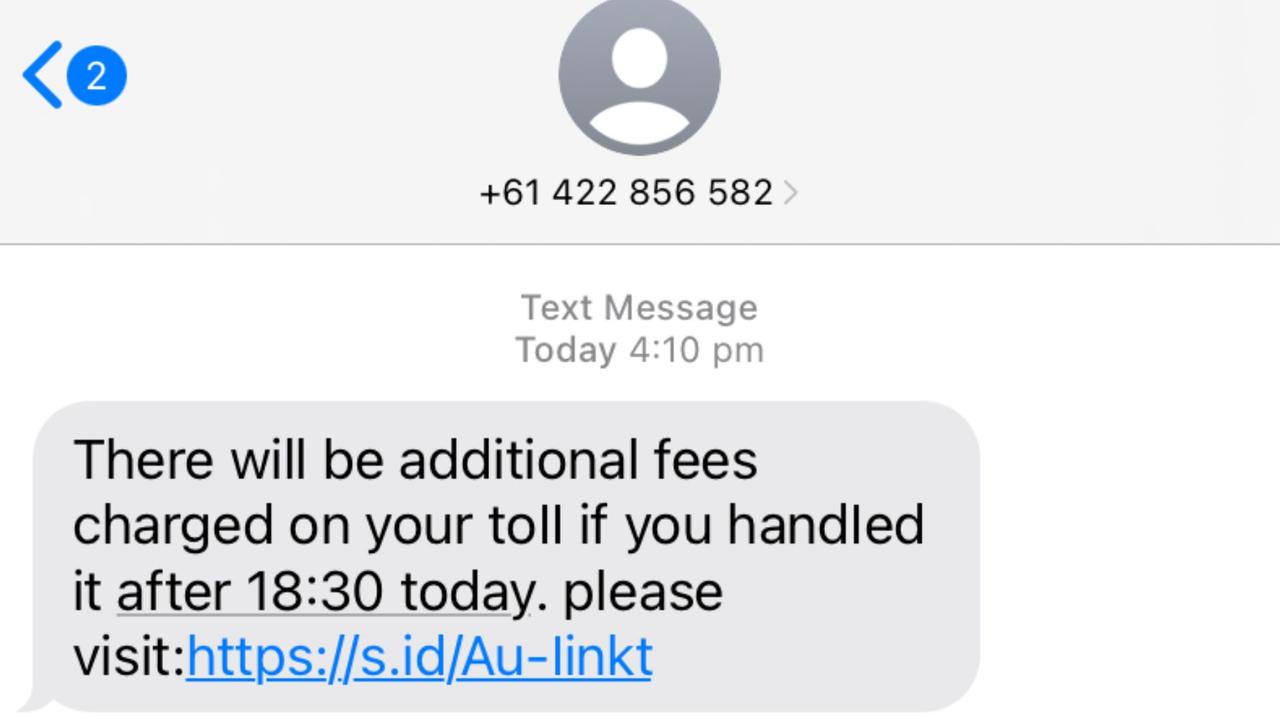

It comes as a number of new scams emerge, including the ‘Hi Mum’ texting scam and toll scams telling road users to pay up even if they didn’t use a toll road.

But while the ACCC, Australian Taxation Office and Crimestoppers are among a number of organisations issuing warnings about the presence of scams, some Australians are continuing to fall victim to the heartless crime.

So it begs the question: why are Australians so vulnerable in the eyes of scammers?

Peter Price, NSW CEO of Crime Stoppers, told news.com.au that scammers use the empathetic nature of Australians to their advantage in order to trap their victims.

“When it comes to charity, for good causes, whether it’s bushfires or things like that, we give,” Mr Price said.

“So they have learned that with Australians you need to create empathy … and the more empathy they create, then the more they’re reeling you in.”

The number of fraudsters and avenues they use to scam are also on the rise, particularly through technology.

Phishing has remained the top scam for over three years in a row, with more than 38,000 reports made to Scamwatch already this year.

Over $100 million was also lost to phone scams in 2021, followed by more than $55 million lost via social media and almost $52 million via internet scams.

“What we see is that (the number of scams are) growing and growing, but that’s not because we’re becoming more and more vulnerable, it’s just because scam activity is growing because people are perpetrating these crimes from abroad.”

Mr Price describes scammers as members of an organised crime network, where thousands of people are recruited to “sit on the phones”.

Most scammers are known to come from third world countries, with data website Analytics Insight listing Nigeria, India and China as the top three countries to be wary of.

“If you look at these perpetrators strictly not as criminals but as actually running an enterprise, they are doing what any normal enterprise does,” Mr Price said.

“They come up with an idea to make money. They test the market and hopefully they get a good result and then they scale it up. It’s basically just business (but) it’s all criminal.”

The stolen money that is made from these networks is then used to fund other criminal activity, such as purchasing weapons and drugs.

Australians over the age of 65 have lost the most money to scams this year, with con artists stealing more than $61 million from the country’s senior citizens.

Men have also lost more money to scams this year compared to their female counterparts, while NSW has recorded the biggest loss to scams in the country.

One target of a phone scam was a friend of Mr Price’s – a holocaust survivor in his 90s who was contacted by a person pretending to work for Telstra in an attempt to access his computer and bank details.

“From a perpetrators perspective, because there’s no personal confrontation, it’s actually just easy and it’s not threatening,” Mr Price said.

“They don’t have to pluck up the courage to basically send an email or to put something online, whereas if you’re going to assault someone and steal their handbag, there’s anxiety and it takes courage to do that.”

As scam activity grows across Australia, the ACCC, ATO and NSW Crime Stoppers have come together to launch a new campaign in order to raise awareness about scams and to help prevent them where possible.

Unlike previous campaigns where the call to action was to just “hang up” on or delete messages from scammers, Mr Price said this campaign is focusing on the consequences.

Messaging for the campaign features the phrases ‘say bye bye or kiss your cash goodbye’ and ‘think before you click’, in an attempt to help Australians become more vigilant against scammers.

“When we were young kids, we got taught that if you do something naughty there’s consequences, so the same principle applies,” Mr Price said.

“For example, if you knowingly and diligently hand over money to a third party because you haven’t used common sense or you’ve been too trusting, (that money is) gone.”

If you believe you have fallen victim to a scam, the ACCC urges you to file a report via Scamwatch and to contact your banking institution immediately.

Meanwhile, if you receive a message and are unsure if its legitimate, the ACCC recommends you contact the organisation that allegedly sent the message or called you, to confirm it was them.

Alternatively, it’s recommended that you don’t give any personal information including passwords over the phone or via text, or click on any suspicious links.

Australians can find more information on how to deal with scams via the ACCC, ATO and Crime Stoppers NSW websites.