ACCC warns of surge in payment redirection scams as Aussies lose $16.2 million

Australians have been warned to triple check invoices amid a surge in scams which have already cost citizens millions.

Australians have been warned to triple check their invoices amid a surge in payment redirection scams, which have cost citizens more than $16 million over the past 12 months.

The Australian Competition and Consumer Commission’s (ACCC) Scamwatch service says the problem is only getting worse Down Under. One of the worst hit victims was a couple who lost an astonishing $800,000 to a sophisticated scam.

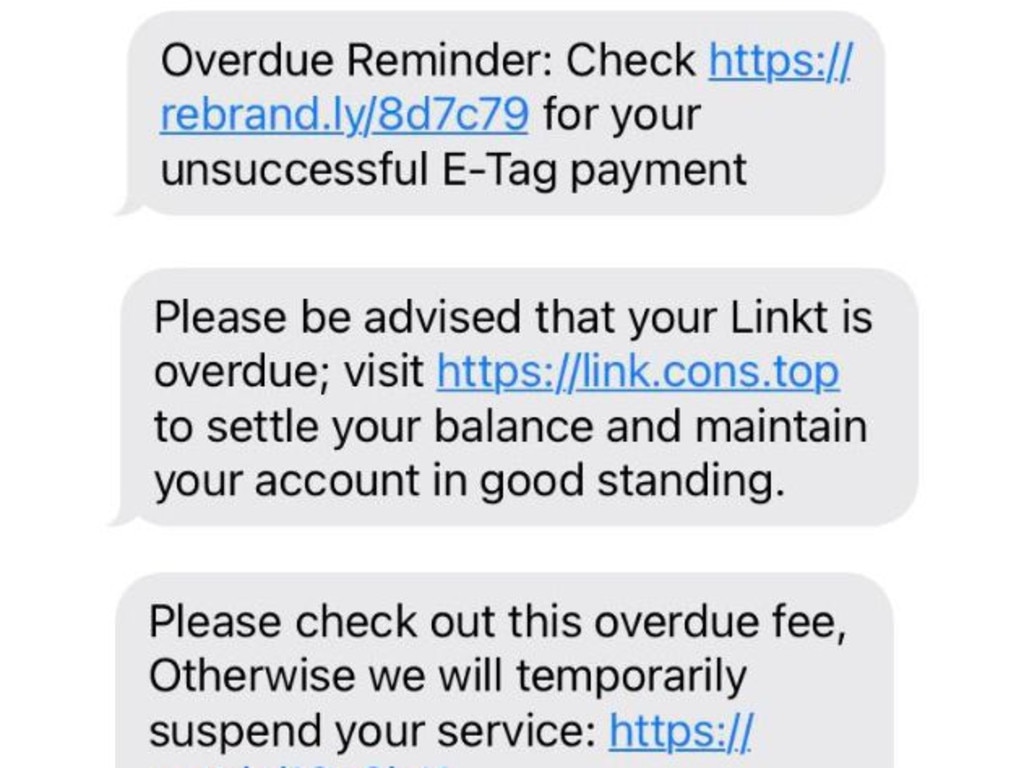

Scammers impersonate real businesses that the victim has previously interacted with and send through a bill for a service. They work in volume, hoping a tiny percentage of recipients are complacent enough to trust the unidentified number or email addresses asking them to foot a bill.

The fraudulent invoices are sometimes sent via compromised email accounts of the business or through a fake email that closely resembles the legitimate business’s email.

Victims often only realise they have been scammed when the actual business follows up on the unpaid invoice.

High-value industries such as real estate and construction are frequently targeted due to the large sums typically invoiced. Travel companies and car dealerships have also been recent targets.

But scammers also play in small numbers, regularly posing as roads services asking for recipients to pay overdue tolls.

“Scammers are sophisticated criminals and are becoming more targeted in how they exploit Australian consumers and businesses,” ACCC Deputy Chair Catriona Lowe said.

“These criminals are posing as genuine businesses that a consumer has recently dealt with, sending fake invoices with altered payment details so that the money ends up with the scammer.”

The couple that lost over $800,000 had paid the sum to a fraudulent bank account provided by a scammer impersonating their solicitor as they attempted to secure a property.

Another individual lost $35,000 to scammers who compromised the email of a car dealership, misleading him with a fake invoice after he had already made a secure deposit.

The ACCC advises you verify who you are dealing with before making large payments. If you are suspicious or have mistakenly transferred money, immediately contact your bank and Scamwatch.

“After paying the deposit securely through the dealership’s official website, he received an email with an invoice for the remaining amount owed which he paid thinking it was genuine,” the ACCC said.

“When he went to pick up his new car, he found out that the invoice was a scam and the dealership had only received his deposit.”

Older Australians are more at risk of falling victim as scammers take domain in the online sphere.

Recent data from ScamWatch revealed Australians had lost some $95 million to social media scams in 2023, a 249 per cent increase from 2020.

People aged 65 and over experienced the highest losses of any group, accounting for almost a third of all social media scam losses during October-December 2023.

That stark figure represented a whopping 57 per cent increase from the previous quarter, with older Australians also at risk from investment and romance scams.

“Over 16,000 people who reported losing money (in 2023) said it started on a social media platform or an online forum with an ad, a post, or a message,” Scamwatch said.

“Many people reported placing an order, usually after seeing an ad, but never received their goods. Some described advertisements that impersonated real, online retailers.”

In total, Australians lost $477 million to scams in 2023, despite losses falling between October-December in a range of areas, including crypto and bank scams.

During those three months, Australians lost some $82 million to scams, down 26 per cent from the previous quarter and 43 per cent from the same time last year.

Compared with the same period in 2022, losses to cryptocurrency scams fell by 74 per cent in 2023, while bank transfer and investment scam losses fell by about a third.

The average reported loss to scams during October-December 2023 was $1224, more than half of which came from high-cost investment scams.

Phishing scams, a type of online scam usually involving emails, meanwhile represented the largest share of reported scams which topped 67,000 in the late-2023.