Bitcoin headed towards ‘death cross’ that could wipe $23,000 from its value, analyst warns

The cryptocurrency market is headed towards a catastrophic event for investors – and it could be just days away, an analyst has warned.

The world’s biggest cryptocurrency bitcoin is plunging towards a “death cross” – a technical pattern that could lead to another major sell-off of the coin – a prominent crypto trader has warned.

Cryptocurrency trader and analyst, Rekt Capital, which is followed by more than 150,000 people on Twitter, said the potentially catastrophic event for big-time crypto investors could happen by the middle of this month if bitcoin doesn’t increase its price soon.

Once the “death cross” hits, they said the digital coin could tumble by as much as $US18,000 ($A23,500). The coin is currently worth US$38,879 ($A50,749) – meaning its value could be more than halved.

According to Rekt, a death cross is when the short-term moving average moves down and crosses under the long-term moving average. The opposite pattern is known as a “golden cross”.

The analyst said there have been similar “death cross” patterns in the market in previous years which have seen cryptos drop by eye-watering amounts.

1.

— Rekt Capital (@rektcapital) June 1, 2021

A bullish Golden Cross occurs when the 50 EMA (blue) crosses OVER the 200 EMA (black)

Golden Crosses precede lots of upside in #BTC's price (green)

A bearish Death Cross occurs when the 50 EMA crosses UNDER the 200 EMA (red)

Death Crosses precede lots of downside for $BTCpic.twitter.com/NTsJN3aRiE

In 2013, bitcoin dropped 73 per cent pre-death cross and an extra 70 per cent post-death cross.

In 2017, they said it dropped 70 per cent pre-death cross and an extra 65 per cent post-death cross.

While in 2019 they said it dropped 53 per cent pre-death cross and an extra 55 per cent post-death cross.

Since then, bitcoin has dropped 54 per cent since its approximately $US65,000 ($A85,000) highs and Rekt believes it could lose a further 55 per cent in the event of another death cross.

However, they said this wasn’t inevitable.

“It hasn’t occurred and doesn’t have to occur if BTC recovers,” they said.

How did the market fare overnight?

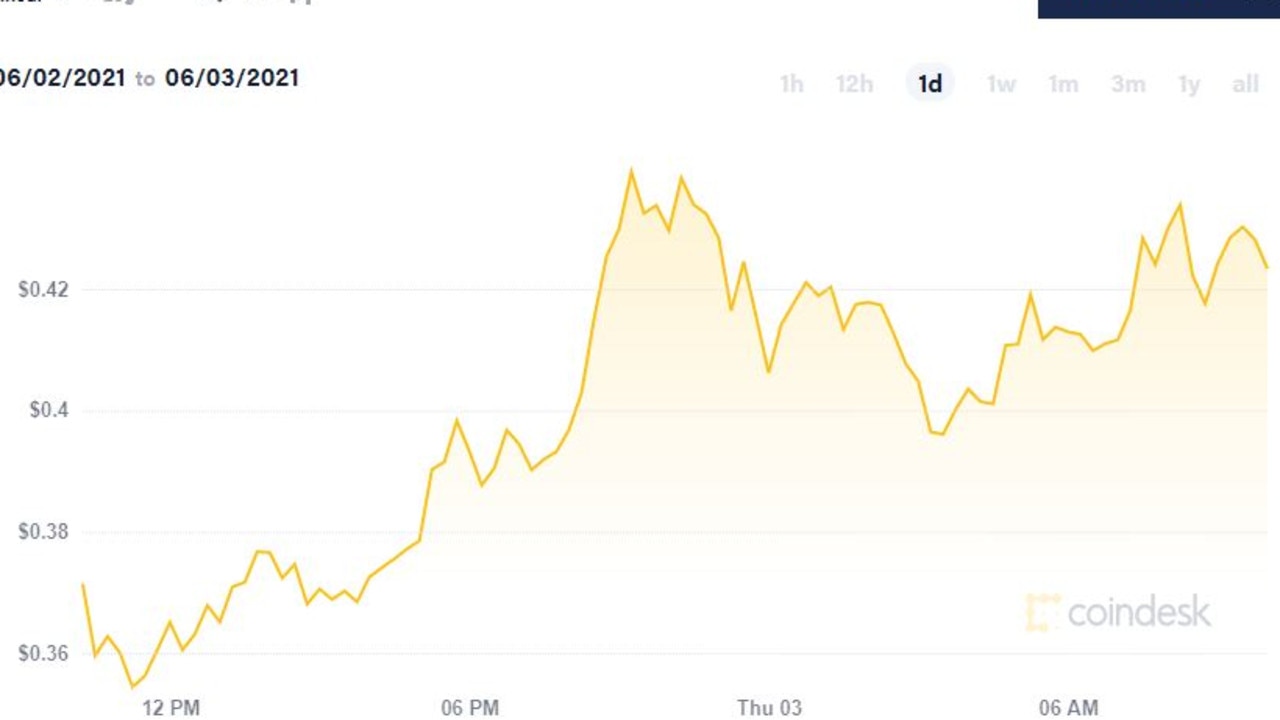

The value of the big players like bitcoin and ethereum continued to bounce back from last month’s slump overnight.

According to CoinDesk, bitcoin jumped by 3.67 per cent in the past 24 hours, while ethereum rose by 5.35 per cent.

There was a lot of attention on dogecoin yesterday, after the meme coin shot up by 21 per cent – its highest in about two weeks, according to CoinDesk.

The rise came after it was added to Coinbase Global – a platform that is geared towards more experienced investors.

It means the digital coin, which was originally designed to serve no real purpose, now has a market value of about $US53 billion ($A63 billion). Still, it has lost almost half its value from its May peak.

And according to CoinDesk, it has slumped 4.12 per cent in the past 24 hours.

The debut on Coinbase Pro means users of the hugely popular cryptocurrency exchange can now trade dogecoin for the first time by signing up for its free professional platform.

Dogecoin was also likely given a boost by Tesla CEO Elon Musk, who has amassed huge influence on the crypto market.

After Coinbase said it would support dogecoin trading, Mr Musk reshared a July 2020 meme showing the cryptocurrency subsuming the global financial system, with the comment, “It’s inevitable.”

RELATED: Musk tweet sees company’s value rocket

— Elon Musk (@elonmusk) June 1, 2021

He also suggested that he planned to adopt a shiba inu – the Japanese dog breed that inspired the doge meme and dogecoin – later this year.

Cryptocurrencies such as bitcoin and dogecoin previously saw sharp moves in their prices following comments by the tech billionaire. His tweets have previously also been linked to moves in the stock market in so-called meme stocks such as GameStop.

Last month, while hosting Saturday Night Live, Musk said dogecoin a “hustle”, causing its value to slump again.

The price of bitcoin climbed 14 per cent to a record high of $US43,500 ($A56,700) earlier this year after Musk praised it on Twitter. He subsequently bought $US1.5 billion ($A1.96 billion) of the digital currency and said Tesla would allow customers to pay with it.

But then a turnaround last month saw bitcoin fall back 17 per cent after the electric car company suspended bitcoin payments. Musk said he had concerns about the fossil fuel intensity of bitcoin “mining”.