‘Never seen it before’: Used vehicle prices tipped to remain sky-high for foreseeable future

Aussies are paying staggering amounts for used cars but there’s one model that’s selling for an eye-watering price.

It’s a short and simple ad, and really only comes with one warning.

“Please make sure you can access the money, and the wife, girlfriend or your mother has said it is okay before you ring, text or email.”

At first that might seem a bit full-on – particularly because it’s a used car site – and especially because the vehicle you’re looking at is a three-year-old Landcruiser, not a Lamborghini.

But considering the state of Australia’s used car market – and a $260,000 asking price – it’s easy to understand why the seller is keen to shore up the financing.

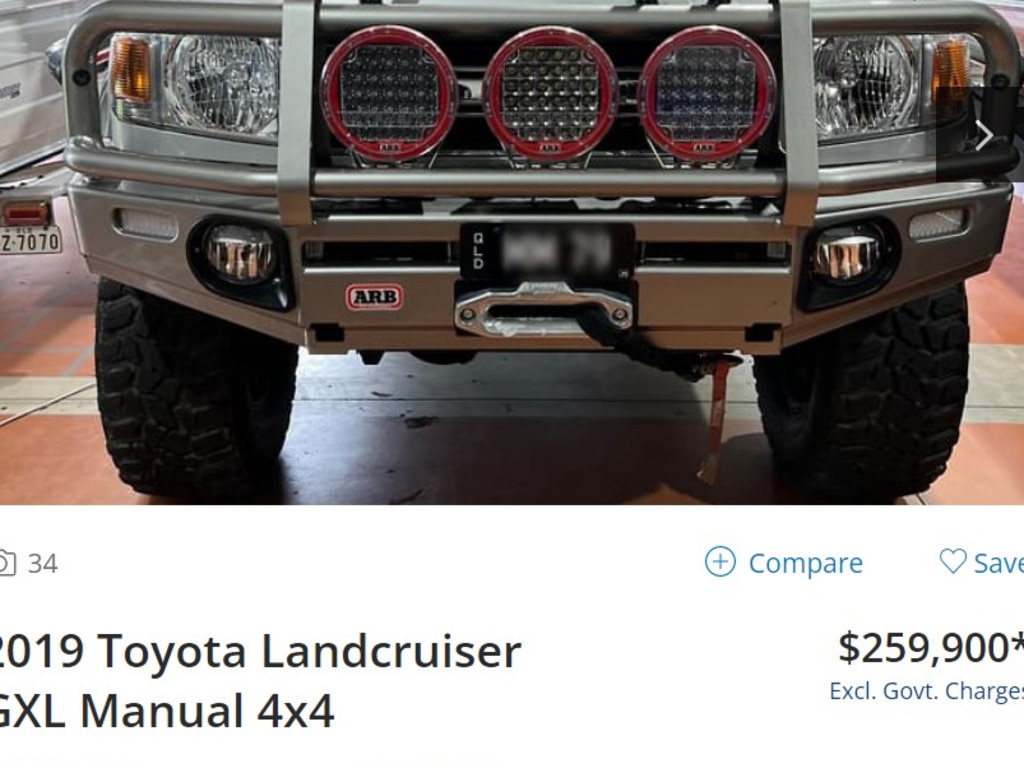

The near-mint condition 2019 Landcruiser 79 series GXL Manual 4x4 up on carsales.com.au on Thursday afternoon has a fridge and coffee machine and is pretty much kitted out to live in.

While not even the most expensive Landcruiser on the site at the time (that one was for $370,000), it would still be irresponsible to treat it as representative of the wider trend of surging used car prices.

However, local auction houses and motor industry experts alike maintain that the humble Landcruiser remains vehicle gold in an already inflated market.

Brisbane’s City Motor Auction general manager, Matt Stubberfield, says Landcruisers are easily among the most hefty price-wise – as are a number of popular Toyota models – confirming widespread reports the Japanese manufacturer is struggling to meet demand.

But he also acknowledges the issue is widespread across the used car market.

Supply chain disruptions, a global semiconductor shortage and production snarls continue to smash Australia’s new car market, leaving many buyers facing a years-long wait for their vehicle.

The flow-on effect has been a surge in used car prices and booming crowds at vehicle auctions as competition for vehicles heats up.

Data from Moody’s Analytics in June showed used cars prices have risen a staggering 65 per cent on pre-Covid levels and 18 per cent on what they were at the end of 2021.

The rate of growth may have eased in May but Mr Stubberfield can’t see any meaningful cooling so long as new vehicle backlogs continue to frustrate buyers.

“We thought it’d be a year of Coronavirus … and then other outbreaks came and now it’s two years … three years and we’re talking up to two years for certain models like Landcruisers and Hiluxes,” Mr Stubberfield told NCA Newswire.

“I can’t see any fix in the next 12 to 18 months.”

He also says the market seems well aware of the value of their assets and are empowered to seek more from buyers.

“Vendors are now being told they‘ll get more for their car, and you notice the increase that people have put on (carsales.com.au) – the cars that they had and what they were asking for and what they’re asking now – because obviously they’ve been told they will get more,” Mr Stubberfield said.

“So the market is going up not just in our sector, but privately as well. Certain models that were bought two years ago … people are now selling for the same price they paid for them. An extra 40,000 kilometres and people are getting their money back.”

“Depending on the model, some are even selling for more. A few dealers are actually offering the customer money on the new car to leave it there with them so they can sell it again.”

PriceMyCar.com.au founder David Lye backs this up.

In a message to NCA Newswire, he says some used car buyers are now paying more for a 12-month-old model that what the equivalent brand new car would cost.

Mr Lye said a boom in local tourism due to Covid restrictions on overseas travel had helped push up the cost of 4WDs such as Landcrusiers in particular, while large utes were also seeing huge waiting lists due in part to the tradie boom in response to home improvements.

“It’s an extraordinary situation … the old saying that you lose 20 per cent when buying a new car as soon as you drive out of the showroom has been turned on its head,” Mr Lye says.

“Now people gain 20 per cent just by virtue of having the car at hand rather than on a 12 or 18-month waiting list.

“In fact some people hearing these stories are actually starting to speculate. Aussies are ordering brand new cars with little or no desire to hold them long term, believing that, in time, once they arrive they can potentially flip them on Carsales for a tidy profit.

“Or at least drive around for six to 12 months and get their money back at the end.”

However, Mr Lye says this is also risky business.

As production ramps up, and signs of demand starting to weaken, there looms a potential for a crash in used car prices.

“Used car prices appear to have peaked already in many countries in Europe and PriceMyCar expects we’ll see a peak towards the end of 2022, although how quickly values drop is hard to guess,” Mr Lye says.

“You will be paying more than you paid 12 months ago”

Interestingly, Editor in chief of the Carsales.com newsroom, Mike Sinclair, also mentioned the Landcruiser as being a vehicle particularly in demand in the current market.

Mr Sinclair said on top of huge wait times, the impending end of the V8 diesel Landcruiser production had perhaps jacked up the price of certain models.

“But in other cases, there’s been a perfect storm of issues that have affected new car supply and that in turn affects used car supply,” Mr Sinclair said.

“There’s a significant part of the marketplace buying a new car and leasing a new car every three to four years. And if those cars are not available, then that stock is not coming through the system.”

He said another reason supply had dried up was because Australians appeared to be holding onto their vehicles.

“Particularly during the early parts of the global pandemic … people might be adding a third calibre to the household rather than sticking with two because of concerns with using public transport and the elevation of the importance of individual mobility,” Mr Sinclair said.

“They maybe don’t necessarily want to sell their car early because they realise they’re going to be waiting a lot longer for their new car.

“So the only advice we’re giving to people is if you do need to buy a car, there are cars out there to buy and there are cars which are priced well compared to the market, but you will be paying more than you paid 12 months ago.”

As for price surges, Mr Sinclair said those on the east coast appeared to be copping a harder hit than those in Perth, but it was hard to pin down and predict how prices will continue to change.

“It’s a little bit all over the place for different reasons. Particular SUV models are popular with consumers; maybe things like the (Toyota) Rav4 hybrid where they’ve got extreme waiting lists because it is such a popular vehicle and you’re going to be waiting to get one.

“Equally, there’s a limited number of good quality Commodore V8s out there and HSVs and those sorts of things.

“The more limited in the production of those models, the more likely they are to attract significant dollars compared to where they were two or three years ago.”

Mr Stubberfield said despite the state of flux, he’s ultimately thankful that his business has been “one of the lucky ones” during the pandemic.

That said, the current state of the used car market is something he hasn’t seen before in his 33 years in the industry.

“I don’t expect anyone will disagree. It’s a one-off. Unheard of,” he says.