Tesla shares plummet, Elon Musk on verge of tears

Former EV darling Tesla is being smashed by a series of massive problems as backlash against Elon Musk’s political behaviour continues to snowball.

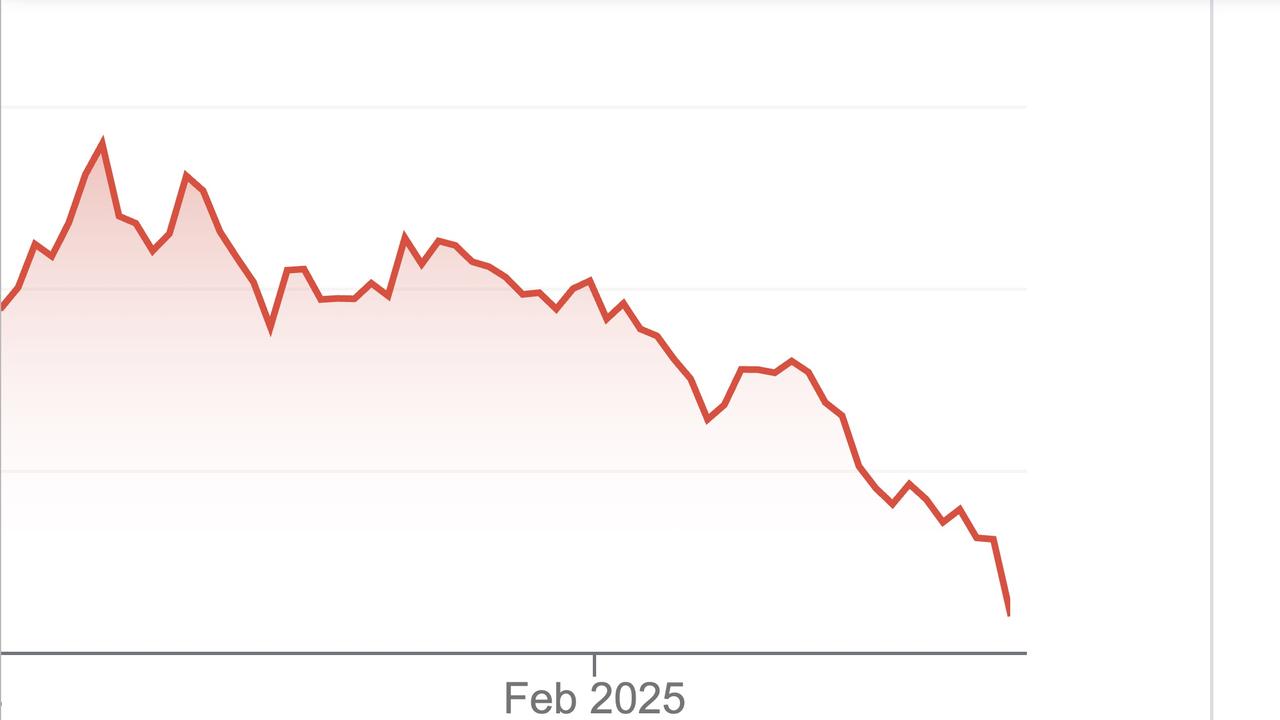

Tesla shares have plummeted today, dropping 15 per cent to its lowest price since October.

The stock is now down approximately 45 per cent since its all-time high of $1.5 trillion in December.

Several factors have contributed to the drop, which has been attributed to slowing sales, increasing EV competition and Elon Musk’s controversial involvement in US politics.

The difficulties have also started taking a visble toll on Musk himself.

The billionaire looked on the verge of tears during an interview in which he was asked how he was managing his other businesses as well as his government role within the Trump Administration.

MORE: Tesla’s Australian sales dive by 70 per cent

“With great difficulty... I’m just here, trying to make government more efficient, eliminate waste and fraud and so far we are making good progress.,” Musk said on Fox Business.

At first, the thought of Tesla chief executive Elon Musk being best buddies with President Donald Trump seemed favourable to investors.

But now his growing presence is raising red flags.

His active role in the Trump administration, including leading the Department of Government Efficiency (DOGE), has sparked concern among Tesla customers and investors.

Other speed bumps include a gesture widely interpreted as a Nazi salute at the inauguration of President Trump in January.

The brand, which once had a cult loyal following, is now facing a wave of rebellion.

Dubbed the “Tesla Takedown” movement, scoresof former Tesla enthusiasts have organised demonstrations at dealerships across the United States and Europe, urging others to sell their stock and vehicles.

Viral social media videos show customers smashing their Teslas with sledgehammers or setting them on fire.

MORE: How EVs saved Cyclone Alfred victims

Over the weekend a protest in Lisbon, Portugal turned violent as demonstrators stormed a Tesla showroom, smashing windows and setting banners alight.

The protests were fuelled by Musk’s support for far-right political figures in Europe.

The fallout from the “Tesla Takedown” has investors worried.

The Automaker’s market value has dropped nearly $US800 billion ($1275bn).

MORE: Building Australia’s millionaire playground

Beyond the drop in shares, Musk’s behaviour and political input, Tesla is facing disappointing sales figures.

Australian sales for the brand are well behind the same point last year.

In China, sales plummeted by 49 per cent, with Chinese rival Build Your Dreams (BYD) surging past Tesla with record-breaking sales.

Several analysts are forecasting flat or declining vehicle deliveries in 2025.

The highly-anticipated Cybertruck has failed to deliver the expected profits and competition in the electric vehicle (EV) market is rising at a rapid rate.

As Tesla’s stock dwindles, Musk’s personal fortune is also shrinking at an alarming rate.

His net worth has dropped from $141.50 billion this year, including a staggering $20 billion loss on Monday alone.