New driver tracking app can save you big on car insurance

NEW tech that tracks your driving habits may seem intrusive but it can save you big dollars.

HANDING over your precious data could save you money on insurance.

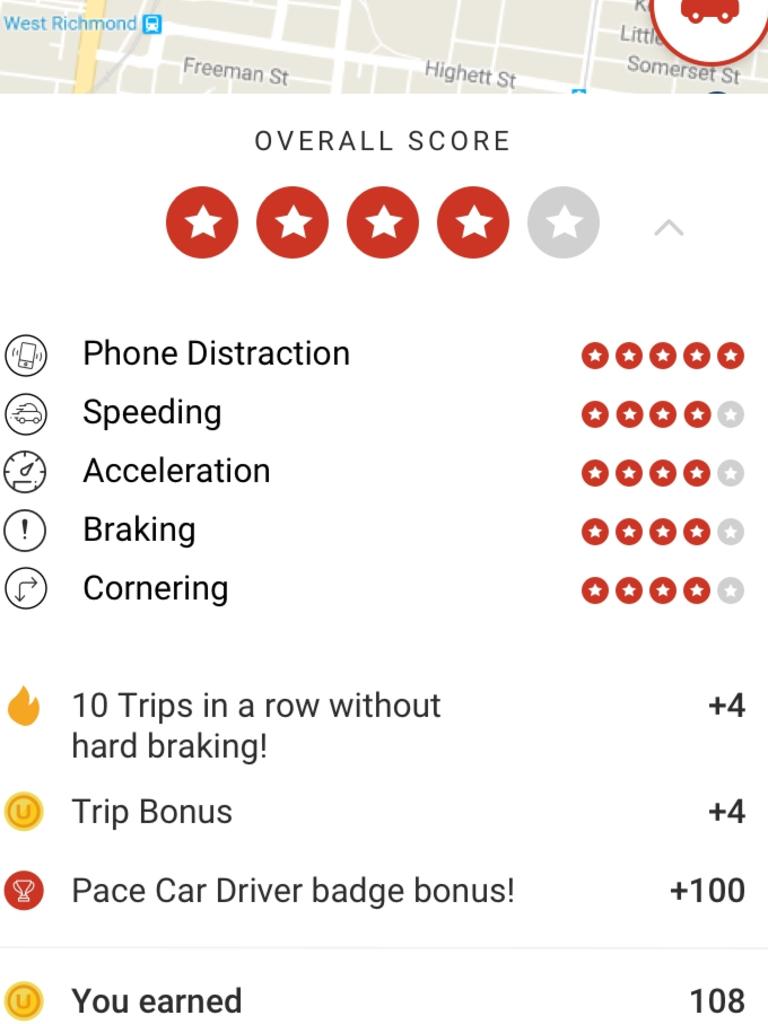

A new app-based monitor from insurer UbiCar uses telematics to track driver behaviour, generating a score for drivers that will have a direct impact on monthly premiums.

The tech measures phone distraction, speeding, cornering, acceleration and braking pressure and quotes your insurance premium accordingly.

The telematics technology provides an incentive to drive more safely, according to UbiCar chief Carolyn Batterton.

“Currently drivers are given a maximum fixed quote that will reduce in cost as their driving improves, saving them money,” she says.

“This is a new approach for the insurer to be actively engaged with drivers and encourage (safer driving).”

The technology is used in many countries including the UK and the US — the overseas data reveals some interesting results.

In the US, telematics tracking has been linked to reducing phone distraction by 35 per cent, hard braking by 20 per cent and speeding by 20 per cent within 30 days of starting to use it.

In the UK, the tracking runs via a “black box”, which is usually stored behind a car’s dashboard and uses GPS to send information about driver behaviour to an insurer.

Batterton says the UbiCar app, downloaded free to a driver’s smartphone, measures phone distraction, speeding, cornering, acceleration and braking on every journey.

“Driving performance is rated as the app runs silently in the background so there’s no interaction with the phone while driving,” says Batterton.

“It’s a win-win for motorists — they pay less on car insurance and our roads will be safer.”

The app is available for Android and Apple devices and generates an insurance quote after five trips. Drivers can rack up achievements, for example receiving badges for completing a specified number of trips without risky behaviours.