Ban on Chinese car tech exposes Australian vulnerability

Australia’s reliance on Chinese cars could be put under the spotlight by bold action in the US.

America’s proposed ban on connected vehicle technology by Chinese car companies would have a much greater impact in Australia than the U.S.

While Chinese cars have a minor presence in North America, China is now Australia’s third-largest source of new vehicles, and the largest source of electric vehicles by a wide margin.

The Biden Administration has tabled a ban on connected car tech from China, citing cybersecurity and privacy concerns.

A spokesperson for the Department of Home Affairs said “the Government is closely monitoring the developments in the US on this matter, and the Department of Home Affairs has been proactively engaging with the US Government to understand the implications of any proposed regulation.”

U.S. authorities are understood to have briefed Australian counterparts before going public with their concerns.

It supplies about 15 per cent of Australia’s new car market, and that share continue to grow as new electric vehicles enter the market, many equipped with connected services.

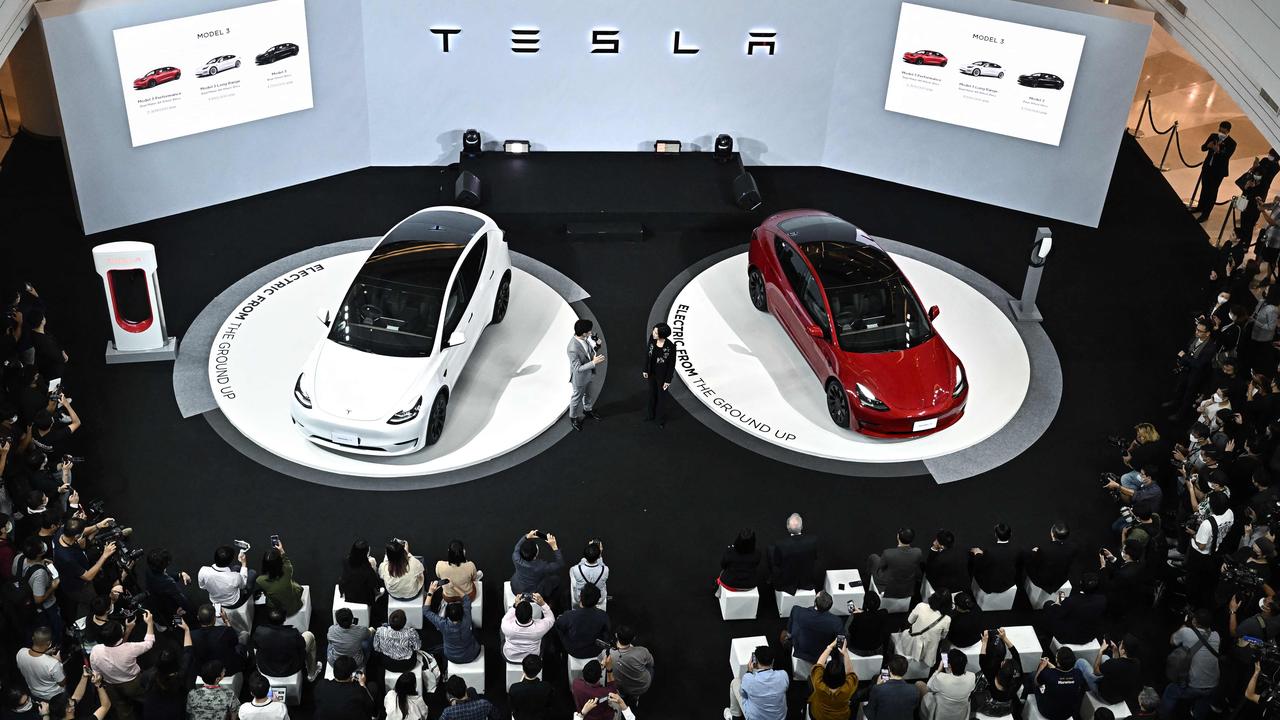

Chinese manufacturers such as BYD, MG and GWM represent some of the fastest-growing brands on Australian roads. They will be joined in coming months by new names such as Zeekr, XPeng and Leapmotor, in addition to established manufacturers such as Tesla, Volvo and BMW that source some models from China.

The Albanese Government said it is monitoring developments in the US.

But Shadow Home Affairs and Cyber Security Minister James Patterson said it must do more, citing concerns about perceived “inaction” from the government.

“Given the serious national and cyber security concerns held by our closest ally about connected vehicles, the Albanese government must urgently explain their own inaction,” he said.

“If they don’t believe these vehicles pose a threat, they should explain why.

“If they agree with the Biden Administration about the risk, they should front up and say why they’ve done nothing about it. This is a problem which only gets harder to fix the longer they delay as more and more of these cars are imported.”

The U.S. decision is driven by the fear that connected vehicles transmit real-time data including location, activities of drivers and privacy data, and that data collected by China-made vehicles could be used for espionage or surveillance.

Lauren Indiveri, a spokeswoman for General Motors in Australia said connectivity risks surrounding cars from China have “been discussed” within the American auto giant.

“I don’t think it’s a new fear,” she said.

“I’ve been in meetings where they’ve mentioned that they’re studying it, they’re looking at it.

“I know we’re aware of it, but beyond that I couldn’t say anything further.”

University of New South Wales associate professor Katharine Kemp said there is already a precedent for Australia banning Chinese technology, Huawei, from the country’s 5G network over security concerns.

“It’s not possible to say how the government would assess the risks of Chinese-made software and hardware in connected cars, or the measures it would take in response to those risks,” she said.

Kemp also explained the dangers of connected vehicles, stating they are effectively “surveillance devices”.

“This data can be transmitted via mobile networks to manufacturers and others overseas continuously as someone drives their car in their daily routine,” she said.

According to Kemp, Australia’s Privacy Act is “outdated” and ill-equipped to deal with the complex nature of connected car technology.

“For example, Australian ‘consent’ standards for data uses are well behind those in jurisdictions such as the EU, and companies rely on quite fictional ‘consents’ by consumers.

“We also need an updated definition of ‘personal information’ to make sure companies aren’t trying to get out of their privacy obligations for new kinds of data that can single us out as individuals,” she said.

Cox Automotive Australia corporate affairs manager Mike Costello said a U.S. ban on Chinese software and hardware would mean that Australia would become an even more important market for the Chinese.

“With the US and Europe placing restrictions on Chinese cars, these brands (both State-owned and private) will look for additional export opportunities, and markets like Australia are very attractive,” he said.

Costello also explained that any move by the Australian government to restrict Chinese software and hardware would be difficult and costly.

“Politically, it would be a challenge to restrict access to well-priced and high-tech vehicles, particularly given the government’s desire to stimulate EV uptake and China’s strength in this area,” he said.

“The difference here is that Chinese brands are much more established and entrenched than they are in the U.S.”

According to Costello, the result of such a ban in Australia would result in higher car prices for consumers, reduced competition and a slowdown in EV adoption.

“If Chinese software and hardware were banned here in a hypothetical future, it would cost consumers and therefore would be a challenging policy to sell to voters,” he said.

But the issue does not just concern connected consumer vehicles, government fleets are also a potential target.

The Home Affairs Department has been contacted for comment.

– with David McCowen