Aussies trade more than $600m in Tesla shares this year

Australians are attempting to cash in on the Tesla’s meteoric rise, investing hundreds of millions this year alone, but trouble could be brewing.

Aussies are cashing in on Tesla’s success, but there are storm clouds on the horizon.

Data from digital share trading platform, Stake, showed that more than 17,000 Aussies traded in excess of $600 million in Tesla shares this year.

The ambitious share traders were taking advantage of the electric car maker’s meteoric share price, which has rallied more than 670 per cent to about $US650 a share this year according to a recent report by Reuters. The same report stated that the median analyst price target was about $US400.

And despite several controversies and setbacks Tesla’s share price has shrugged off the haters and continued to power up.

Stake chief, Matt Leibowitz, said: “Stake traders have been investing this year like never before, particularly in EVs and other stocks they truly believe will move the needle in the future.”

Tesla’s total value has risen to more than $US600b ($A810b) this week, which has also made its enigmatic boss Elon Musk the second richest person in the world with a fortune valued at $US155b ($209b).

Musk’s ballooning personal wealth might even be a contributing factor to his recent announcement that he is moving to Texas, which does not collect personal income tax, while California has one of the highest rates of personal income tax out of any state in the US.

But Musk told the Wall Street Journal his main reason for moving to Texas was to focus on his two biggest projects.

“The two biggest things that I got going on right now are the Starship development in South Texas … and then the big new US factory for Tesla,” said Musk. “It wasn’t necessarily a great use of my time here (in California)”.

Tesla has essentially had the electric car world all to itself the past decade, with the few rivals generally city-focused runabouts compared to the luxurious and rabidly fast Teslas.

But the world’s conventional car makers are waking from their electric car slumber.

Audi, Mercedes-Benz and Jaguar have released their first zero-emissions vehicles this year, with many more to follow over the next few years.

Volkswagen, too, is ramping up development of its planned affordable electric cars, with the first one due to arrive in the coming years.

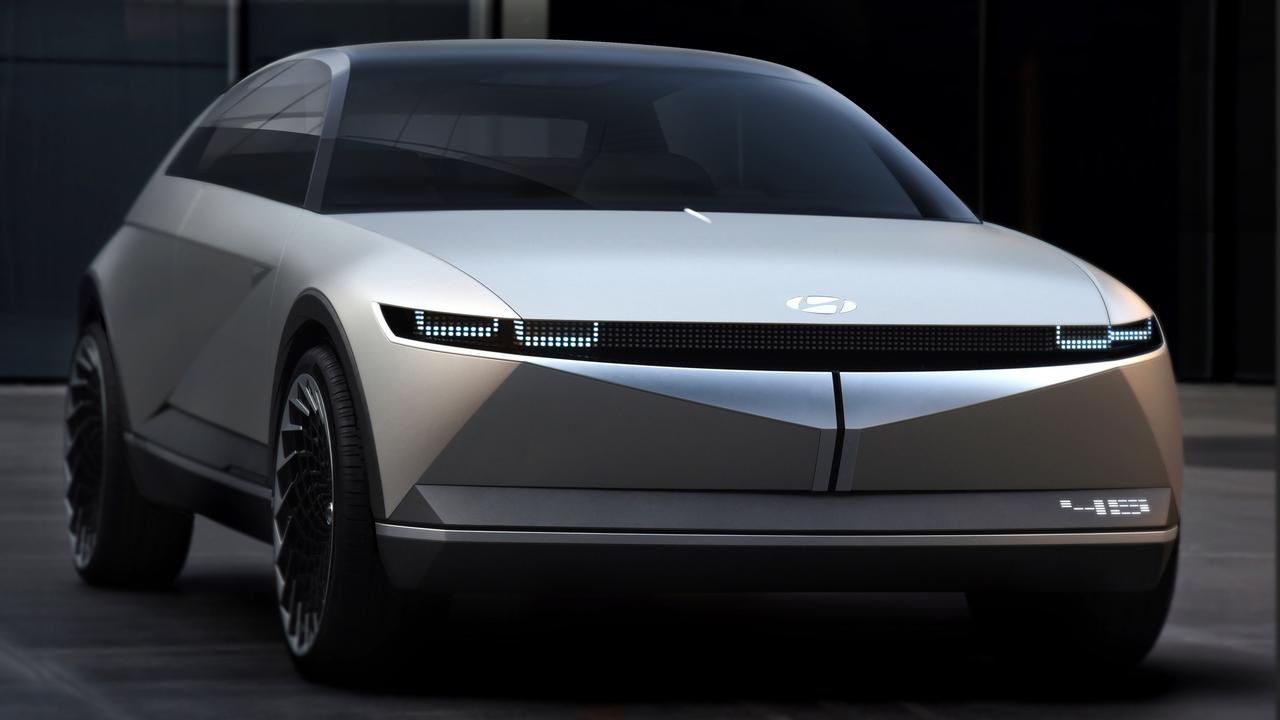

Hyundai Motor Group, which already sells two relatively affordable EVs in Australia, earlier this month announced its new dedicated range of electric cars, which will launch 23 vehicles by 2025.

The global giant, which incorporates subsidiaries Kia and Genesis, has detailed its new electric car platform, E-GMP, which will form the base of the majority of its future electric cars.

These new electric cars will greatly reduce charging times, one of the biggest issues holding back battery-powered vehicles. The maker says new vehicles based on the platform will be able to add 500km of range in less than 20 minutes or 100km in five minutes.

But one of the biggest threats to Tesla could be in its own backyard. Ford is in advanced stages of developing an electric version of the F-150 pick-up truck — one of the world’s most popular vehicles.

The zero-emissions ute would compete against Tesla’s coming Cybertruck, which is to be built in the company’s new Texas factory.

Rivian spokesman Chris Wollen confirmed the ute would be developed in right-hand drive for overseas markets.

“We know that there’s markets that will be into these vehicles and the adventure positioning and Australia fits that perfectly. We know we’re nicely suited for Australia so it’s an important market for us,” he said.