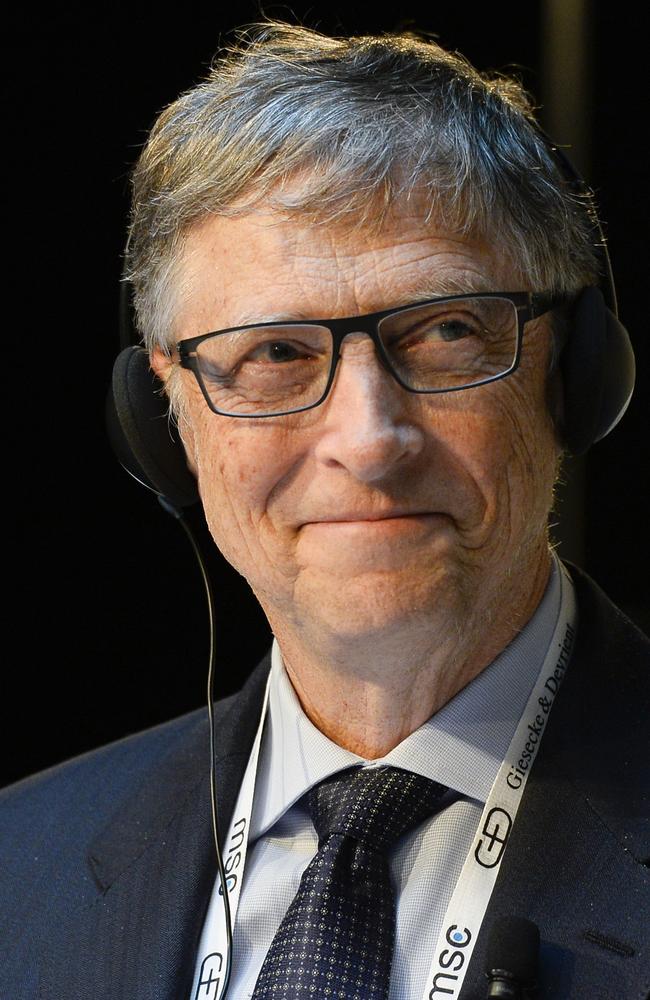

Bill Gates says that robots who steal human jobs should pay taxes

MICROSOFT founder Bill Gates believes that robots who steal human jobs should pay their fair share of taxes, too.

BILL Gates, the co-founder of Microsoft and world’s richest man, has said in an interview that robots that steal human jobs should pay their fair share of taxes.

“Right now, the human worker who does, say, $50,000 worth of work in a factory, that income is taxed and you get income tax, Social Security tax, all those things,” he said. “If a robot comes in to do the same thing, you’d think that we’d tax the robot at a similar level.”

According to the New York Post, Mr Gates made the remark during an interview with Quartz. He said robot taxes could help fund projects like caring for the elderly or working with children in school. Quartz reported that European Union politicians considered a proposal to tax robots in the past. The law was rejected.

Recode, citing a McKinsey report, said that 50 per cent of jobs performed by humans are vulnerable to robots, which could result in the loss of about $USD2.7 trillion ($3.5 trillion) in the US alone.

“Exactly how you’d do it, measure it, you know, it’s interesting for people to start talking about now,” Gates said. “Some of it can come on the profits that are generated by the labour-saving efficiency there. Some of it can come directly in some type of robot tax. I don’t think the robot companies are going to be outraged that there might be a tax. It’s OK.”

Last month, Gates told FOX Business Network’s Maria Bartiromo that he is excited to work with President Trump and his administration, especially when it comes to the US government’s support of the Bill & Melinda Gates Foundation and Global Alliance for Vaccines and Immunisation he said.

“How we continue that type of outreach and how it helps our security that we are helping those countries to be healthy and be stable,” he said. “There will be some great conversations and be some ideas about new investments that can be made.”

This story originally appeared in the New York Post