Staggering insurance costs of Qld, NSW floods revealed as tens of thousands lodge claims

The staggering cost of flood insurance claims across NSW and Queensland has been revealed as devastating rains continue to batter the east coast.

Tens of thousands of insurance claims have been lodged by flood-affected Queenslanders and New South Welshmen, with experts estimating the costs at $900m.

The staggering sum could rise as heavy rains continue to batter Australia’s east coast and residents in South East Queensland face the prospect of more flash flooding, hail and intense rainfall.

The Insurance Council of Australia (ICA) on Thursday announced 60,163 claims were received over the ongoing flooding across Queensland and NSW.

The ICA said eighty-three per cent of the insurance claims relate to property, while the remainder concerns vehicles.

An ICA spokeswoman said the $900m figure – based on previous flood events – was likely to change.

“This figure is subject to detailed assessment of claims as loss adjusters move in over the coming weeks and will increase as further claims are made,” the spokeswoman said.

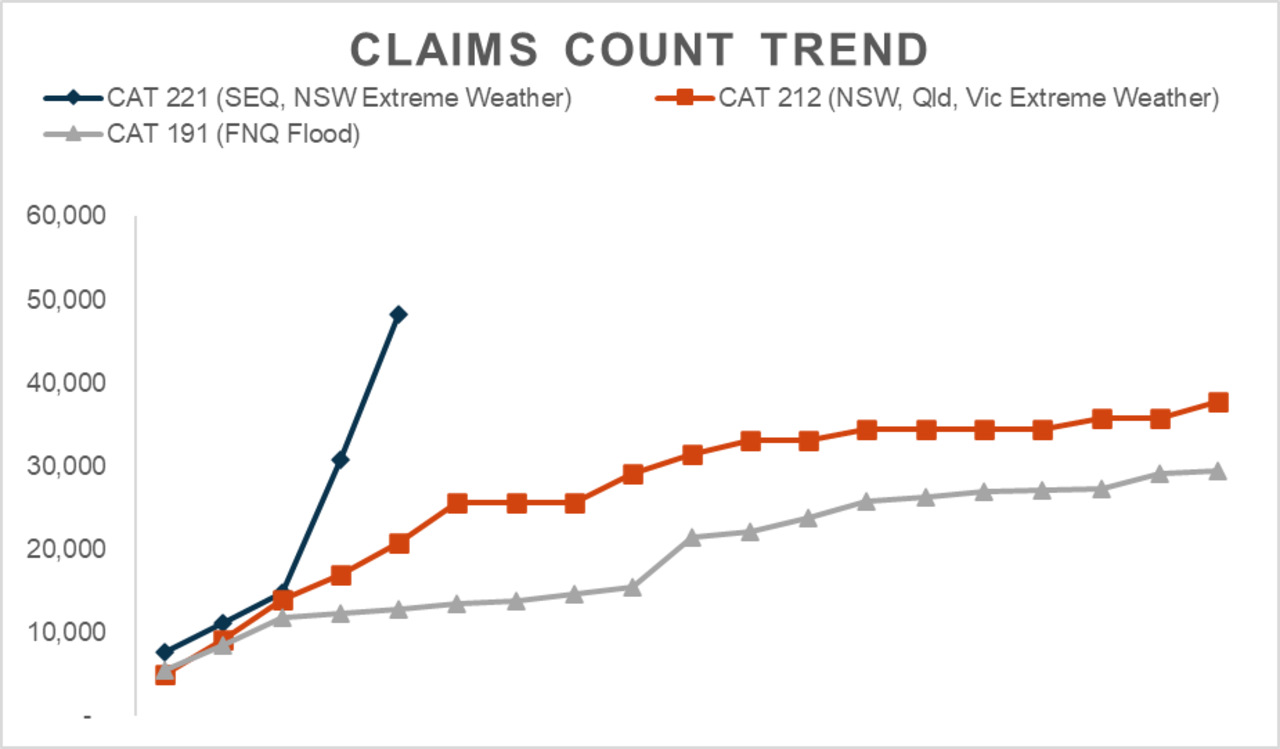

The number of insurance claims have risen remarkably in the past few days alone.

The ICA on Tuesday announced 31,000 claims across Queensland and NSW had been received by insurers – a 107 per cent increase on the day prior.

That figure increased by another 53 per cent on Wednesday when 48,220 more claims were received.

In Queensland, RACQ has so far received 8835 claims, including 7058 for homes and 1777 for vehicles.

ICA chief executive Andrew Hall said insurance policies now had a standard flood definition after Brisbane’s disastrous flooding in 2011.

He said the ICA was calling on Australian governments to do more to protect homes and businesses from the impacts of extreme weather.

“This is an ongoing and severe weather event, so it is still too early to predict where it will end,” Mr Hall said.

“These severe weather systems have been impacting the east coast now for more than a week and are still very active across all regions.”

While rainfall died down in Brisbane earlier this week, the city was hit by another freak bout of dangerous storms on Thursday.

Towns and cities across the southeast were smashed by damaging winds of up to 93km/h and 6cm hail.

Another 48mm of rain was dumped in the Brisbane CBD in half an hour – just as residents were beginning to clean up.

Nine people have so far died in Queensland floodwaters.

However, the Bureau of Meteorology has announced there is a reduced risk of thunderstorms in the southeast due to the morning activity.

⛈ï¸Some good news: a reduced risk of thunderstorms (and severe thunderstorms) in #SEQLD for the rest of the day due to the morning activity. Showers and thunderstorms increasing tomorrow. Current warnings: https://t.co/FBmpsInT9opic.twitter.com/F09CQZubqB

— Bureau of Meteorology, Queensland (@BOM_Qld) March 3, 2022

In NSW, multiple evacuation orders were issued as the destructive weather system that ravaged Queensland moved south.

At least four people have died.