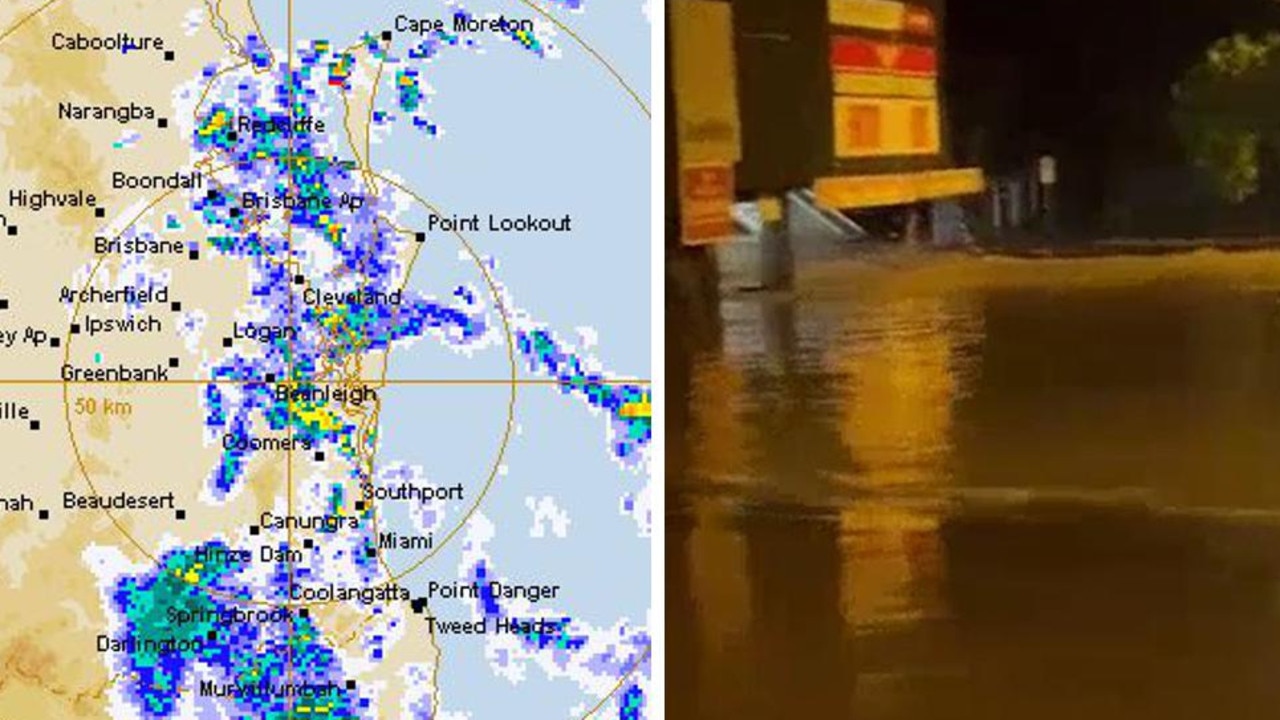

RACQ admits 2022 flood victims were ‘let down’

The boss of a major insurance company has conceded the 2022 flood victims in NSW and Queensland were let down by poor processes and systems.

Many flood victims in NSW and Queensland were “let down” by their insurance company in 2022, with hundreds of claims still open, a parliamentary inquiry has been told.

The standing committee on economics is examining insurers’ responses to four major floods in 2022 that affected Queensland, NSW, Victoria and Tasmania.

RACQ Group managing director and chief executive David Carter told the committee on Friday that he too found himself out of his home following the NSW and South-East Queensland floods in 2022.

“It is a terrible time for those affected,” he said.

“There are times when RACQ’s processes and systems have let our people down and, in turn, have let our members down. We apologise for those cases.”

The floods resulted in 2740 motor claims and 13,306 home claims to RACQ.

While 98 per cent of home claims had been fulfilled, there were still 295 claims open, the committee was told.

While 221 claims were escalated to the Australian Financial Complaints Authority, 79 were negotiated internally.

Mr Carter said the process with AFCA took time so RACQ always tried to resolve matters without going through that process.

Asked whether it was accurate to say 31 out of 221 claims had been upheld by AFCA, Mr Carter said that was “not quite right”.

“Just because we resolve it before AFCA makes a determination, it doesn’t mean we agree that we’ve got it wrong,” he said.

“It’s not that the claim decision itself is necessarily being overturned. It can sometimes include the scope of the claim … a disagreement on the scope.”

Matters referred to AFCA included claims fully or partially declined, service provider complaints such as repair delays and communication, claim delays and handling errors.

Mr Carter accepted RACQ needed to continuously improve its approach to claims handling, complaints and ongoing communication with members at claim time.

Mr Carter also discussed the cyclone reinsurance pool.

“Its current design and implementation is not achieving the policy objective to deliver the actual dollar savings that our members in the community in the north are expecting,” he said.

“We welcome a fast-track review that will bring timely improvements. The top of the list is the removal of the 48-hour rule. It just adds complexity and cost.”

Mr Carter said there should also be some consideration to cover floods but noted it did not have majority industry support.

Allianz Australia chief executive Richard Feledy told the committee 930 claims remained opened from 2022, but 158 were administrative such as needing to close out invoices with suppliers, so there was no further customer impact.

He said that left 787 claims open where customers were impacted, which remained a priority for the Allianz.

While Allianz indicated 36 per cent of AFCA cases ruled in their favour, it was noted their way of measuring it was different to other insurers.

Chief customer and operations officer Brendan Dunne said the figures were related to 107 matters that reached the final stage of the AFCA process.

In total, 735 matters went to AFCA.

The company will provide further clarification about its figures to the committee at a later date.

Both insurance companies admitted communication was an issue for their respective companies and customers had to repeat themselves when speaking to different people.