‘Insurance catastrophe’ declared as PM backs claims they are ripping off homeowners on premiums

Anthony Albanese says it’s time insurance companies repair their relationships with Australians after posting big profits.

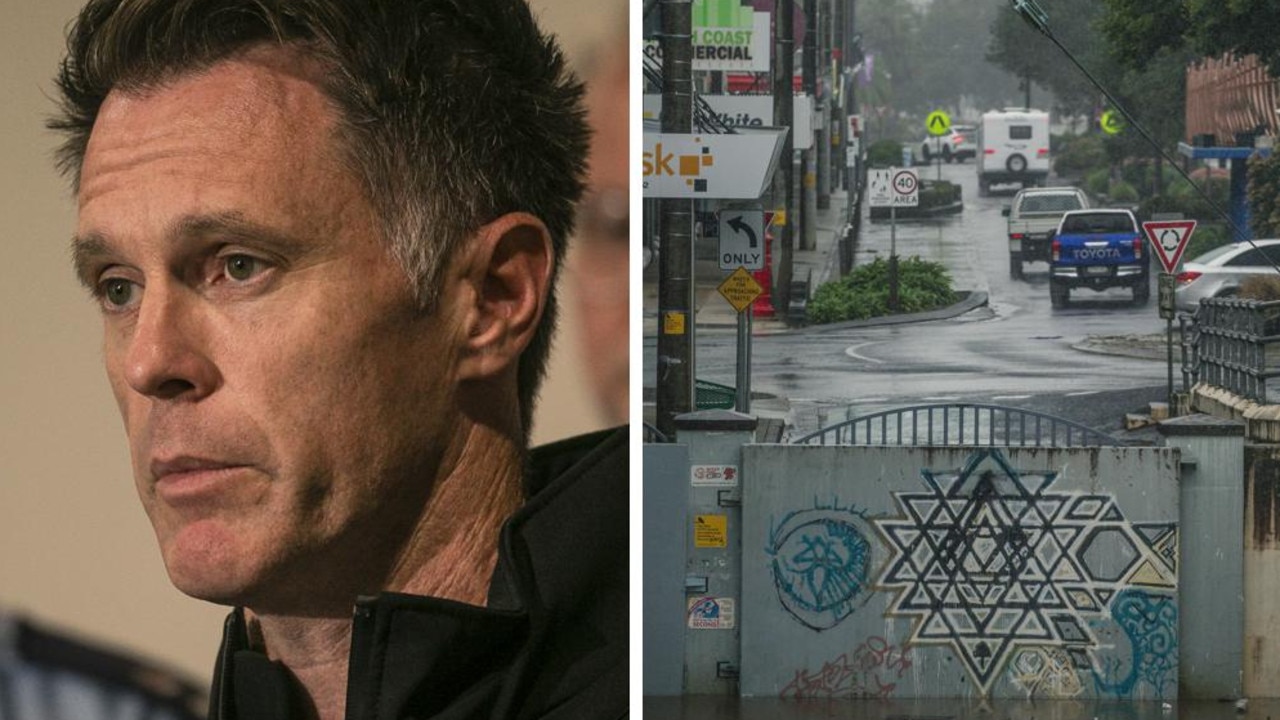

Anthony Albanese has vowed to hold insurers to account backing claims they have been ripping off homeowners who are now dealing with the ex-Tropical Cyclone Alfred aftermath.

As insurance giants brace for billion dollar payouts from the ex-cyclone Alfred storm damage and floods, the Prime Minister has raised concerns about their conduct and recent price hikes.

The Insurance Council of Australia (ICA) has declared an “insurance catastrophe” for the southeast Queensland and northern NSW regions impacted by Alfred and subsequent storms since Friday.

‘Ripping us off’

Insurers have received almost 3000 claims so far with the impact being felt most significantly in the Gold Coast, Brisbane, Hervey Bay, and the Northern Rivers.

“I know in 2022, there were tens of thousands of houses flooded, but people waited years for insurance payouts,’’ Sunrise host Natalie Barr asked the PM on Monday.

“I know you said you’re on to the insurance companies. We’ve just had David Koch say that insurance companies have plenty of money, they are ripping us off, they have put their premiums up, double inflation. What do you say to that?.”

“I say that Kochie’s right, and we will certainly hold the insurance companies to account,’’ Mr Albanese said.

“This is a time where they need to do a bit of repair of their relationships with the Australian public, by doing the right thing and making payments immediately for people who are eligible. That’s what people who are eligible for. That’s what people expect.”

Insurers brace for financial impact

Matt Bowen from ING told Sunrise that billions of dollars are expected in insurance payouts in coming weeks.

“That is the initial forecast we have seen from Standard & Poor’s, the ratings agency there, expecting in excess of $2 billion from damage caused by Alfred,’’ he said.

“To give you a point of comparison the Brisbane floods were around 2.3 billion and in 2022 we saw in excess of $4 billion for claims for the flooding in northern Wales. “

David Koch says check your insurance now

After a federal inquiry into the 2022 floods found that insurance companies failed too many people, Compare the Market director David Koch said there were simple steps affected homeowners need to take.

“The first thing is to check what cover you actually have got. It is amazing how many people haven’t gone through their insurance policies to see exactly what they recovered for,’’ he said.

“Storm damage is a normal part of the house and contents insurance policy. Floods, not automatic in every policy.

“Storm surges. Not all policies have a storm surge. It is pretty rare. That is an important differentiation.”

Why you should take photos of storm damage

“Secondly, take photos,’’ Koch said.

“For example, you should have taken photos around your house in a video before the cyclone hit and all the damage was done. Then take photos of the damage after so the insurance company can see before and after.

“A lot of it is making sure that you get the right information to the insurance company as quickly as possible with all the evidence.

“Now, the insurance company sort of regulates that and the industry body says, ‘OK, if you get it all together, it should only take 10 working days before the insurance company will get back to you’.

“Now, remember, they will be inundated with a lot of inquiries as well.

“Having said that, I reckon they have been ripping Australians off for the last two years and just in the last quarter, September to December, remember the inflation rate is 2 to 3 per cent. Insurance premiums went up 4 per cent.

“Now, all of the excuses were, we had to cope with natural disasters. Yeah, this is the first one for a while. We haven’t had a really damaging storm or cyclone for a long time. Surprise, surprise, because they are all listed companies, their annual profits were through the roof.

“Potentially, they will have to pay out again. Will all of our premiums go up?,’’ Barr asked.

More Coverage

“They will use that as an excuse. Remember, the insurance companies, once they take your insurance policy, they offload it to a whole lot of other insurance companies, so they are derisking themselves,’’ Koch said.

“They have got plenty of money to cover it at the moment I think and they have been storing it up and they have been one of the biggest drivers of inflation over the last two years I think

unnecessarily.”