Aussies feel they could escape mortgage prison in 2025, as Trump’s trade war could trigger rate cuts in Australia

Australian experts have lifted the lid on when people can expect a string of interest rate cuts - and it’s sooner than most think.

Aussie mortgage holders are feeling a growing sense of optimism that they could escape ‘mortgage prison’ and their financial stress could ease before the end of 2025.

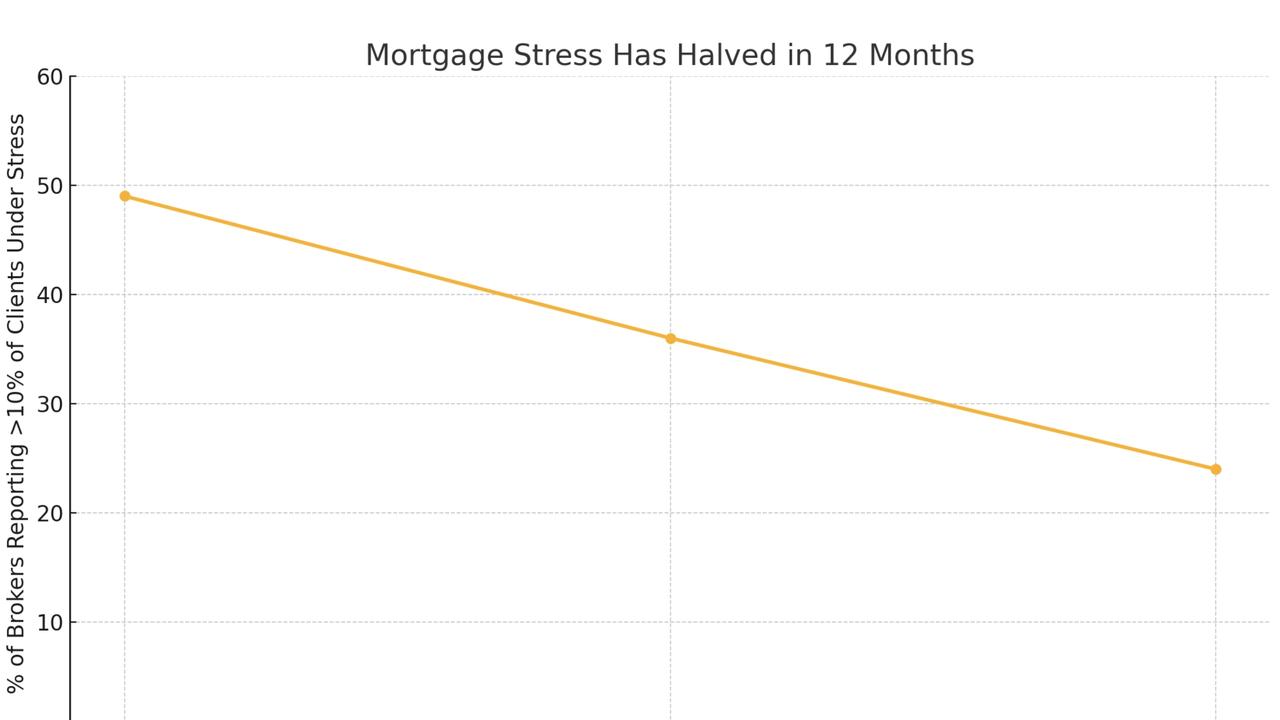

New data from the Mortgage & Finance Association of Australia revealed the number of brokers reporting more than 10 per cent of their clients are under mortgage stress has halved — from 49 per cent to 24 per cent in just 12 months.

MFAA chief executive Anja Pannek said the Reserve Bank’s February rate cut had already “sparked a wave of renewed interest”, with more borrowers actively reviewing their loans, exploring refinancing, or renegotiating with lenders.

“Mortgage stress is easing slightly, and serviceability is improving,” Ms Pannek said.

“That means more borrowers are in a position to work with their broker to reduce their financial burden.”

Their report showed that more than 80 per cent of borrowers now say they feel either positive or neutral about their financial outlook — a marked improvement on sentiment at the start of 2024.

Ms Panek said some have even managed to escape what brokers call “mortgage prison”, using new rules allowing a reduced 1 per cent serviceability buffer for simple refinances.

“For those who qualify, that change has made a real difference,” she said.

Melbourne buyers’ advocate and M R Advocacy director Madeleine Roberts said the shift was flowing through to the housing market, with more clients upgrading, tapping equity or purchasing a second property.

“After sitting tight for so long, clients are now telling me, ‘I can finally do something,’” Ms Roberts said.

It comes as Donald Trump’s trade war threats could do more to rescue mortgage belt voters — and sway the federal election — than anything Anthony Albanese or Peter Dutton have promised so far.

AMP chief economist Shane Oliver said growing fears of a global economic slowdown, triggered by the former US president’s renewed tariff agenda, could force the Reserve Bank of Australia into up to four more rate cuts this year — with a 50 per cent chance the next one will be a double cut.

“Right now, I’d say there’s about a 50/50 chance of a 0.5 percentage point cut at the next meeting,” Dr Oliver said.

“If this trade tension continues to ramp up, we could be looking at four, possibly even five cuts.

“Markets are now pricing in around four and a half by year’s end.”

Dr Oliver said while Australia’s direct exposure to the US was limited, the bigger risk lay in a global demand crunch — which would weigh heavily on local exports and force the RBA to act.

“Australia isn’t on the front line — only about 5 per cent of our exports go to the US,” he said.

“But if the US tips into recession and drags other major economies down, that’s where the real threat lies.”

The AMP chief economist said the RBA was in a far better position to act than the US Federal Reserve, with more “wiggle room” in the 4.1 per cent cash rate and a falling dollar helping to buffer the economy.

“The Australian dollar is already doing some of the heavy lifting,” Mr Oliver said.

“It makes our exports more competitive and supports growth.”

“If you’ve got a home loan and your rate drops from 6 per cent to 4.5 per cent, that’s about a 25 per cent reduction in repayments. That can make a huge difference for households under pressure.”

Ms Roberts said locally that the rate cut had already brought a wave of first-home buyers back into the market, and investor interest in Melbourne was surging — particularly from interstate buyers chasing relative affordability.

“There’s a lot of momentum returning. People are ready to move again,” she said.

Dr Oliver said the scale of the sentiment shift had even caught him off guard.

“It shows how even small movements in interest rates or income can have a big effect when households are stretched,” he said.

With a federal election just weeks away, both Ms Pannek and Ms Roberts say mortgage belt voters are watching closely.

“Mortgages are the biggest expense for most households,” Ms Pannek said. “Interest rates, housing supply and affordability are absolutely vote-deciding issues.”

Ms Roberts said policy reform was overdue — and voters were ready.

“There’s a real hope that this time, something actually changes,” she said.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Yarra Ranges house has secret passageway behind bookshelf

Secret Zuckerberg’s $36m vanishes on Google

‘Like it’s hovering’: Rare Peninsula home design lovers are circling

david.bonaddio@news.com.au

Originally published as Aussies feel they could escape mortgage prison in 2025, as Trump’s trade war could trigger rate cuts in Australia