Melbourne first-home buyers share tips on how they’re getting ahead on the mortgage and saving for a wedding

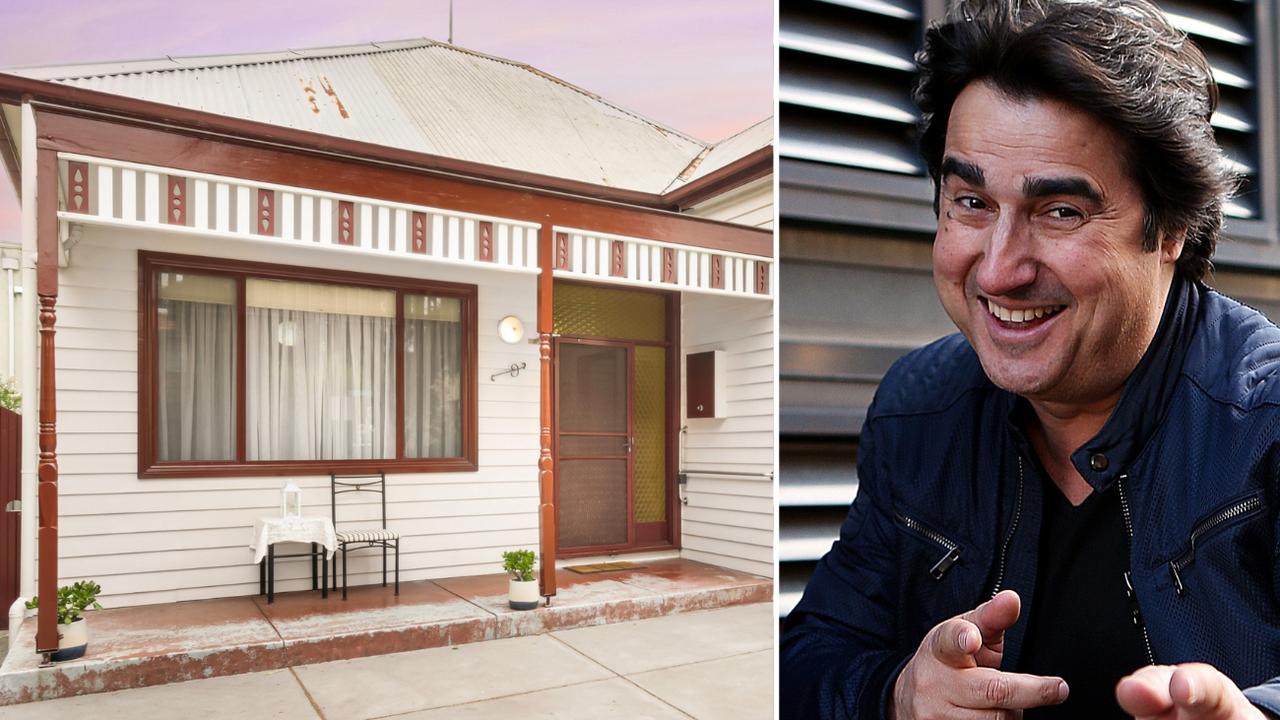

Melbourne first-home buyers Jesse and Tiana purchased their first home last year. This year, they’re saving for a wedding while paying a mortgage and still booking flights. Find out how.

Melbourne couple Tiana and Jesse are hoping to one day purchase multiple homes for their future child, or children, to live in.

But first, they’ve set their sights on getting married.

Last year the pair bought their first home in Melbourne, and are now planning their nuptuals for next year.

RELATED: Melbourne first-home buyers’ plan to pay off their house within six years

Coburg unit snapped up by first-home buyers a week before scheduled

How one decision saved me at least $50k on my mortgage

They’re part of a wider trend of Australian first-home buyers choosing to buy a residence before saying “I do”.

New research revealed the number of home loans taken out by de facto couples across Australia has jumped 80 per cent since 2015.

Aussie Home Loans analysis shows the average $47,200 wedding cost in Victoria equates to a significant chunk of a median-priced house deposit.

The $47,200 figure would cover more than a quarter of an average-priced $890,300 Victorian house’s 20 per cent deposit ($178,060) – or 53 per cent for a 10 per cent deposit ($89,030).

Online wedding directory Australian Bridal Industry Academy calculated the average wedding cost after surveying 10,000 Australian married couples, in 2024.

Tiana said that having a residence where their wider family could visit and stay over was important to both her and Jesse, plus she’s wanted to own a home ever since she can remember.

She added that it made financial sense to invest in a home rather than spend all their savings on a big wedding or honeymoon.

“We thought, ‘We’ll be together forever so there’s no point in rushing into a wedding’,” she said.

Jesse and Tiana said that when they first started dating, they discussed their future plans.

This included the aim of owning properties where any children they might have could live.

While they have no intention to acquire another residence just yet, they’ve agreed to do so when they’re able.

“For me, it’s security for our future child,” Tiana said.

Their respective families have all been incredibly supportive of their plans, she added.

In addition to making extra mortgage repayments, they have implemented small lifestyle changes to boost their savings as they prepare to grapple with the cost of a mortgage and a wedding.

This included deleting the Uber Eats app from their phone, only buying petrol when prices dip and purchasing furniture on sale, from thrift shops or online marketplaces.

Using points earned from shopping and bank cards to help pay for flights when travelling is another of their tips, as is buying plane tickets during sales events like Black Friday.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

RELATED: Interest rate cut sparks Melbourne bidding wars as auction prices soar

Housing affordability: young solo buyers reveal buying and rent challenges they’re facing

WAG and former TV host Bec Judd puts Mornington Peninsula holiday home up for sale

Originally published as Melbourne first-home buyers share tips on how they’re getting ahead on the mortgage and saving for a wedding