Growing number of Aussies falling behind on their mortgage set to hurt tenants — Moody’s, SuburbTrends

A rising number of Australians are falling behind on their mortgage, and analysts fear the trend could spell disaster for tenants across Victoria as the state’s rental pain grows.

The number of Aussie homeowners falling behind on their mortgage is growing, with more than $1.53bn in loans now in arrears.

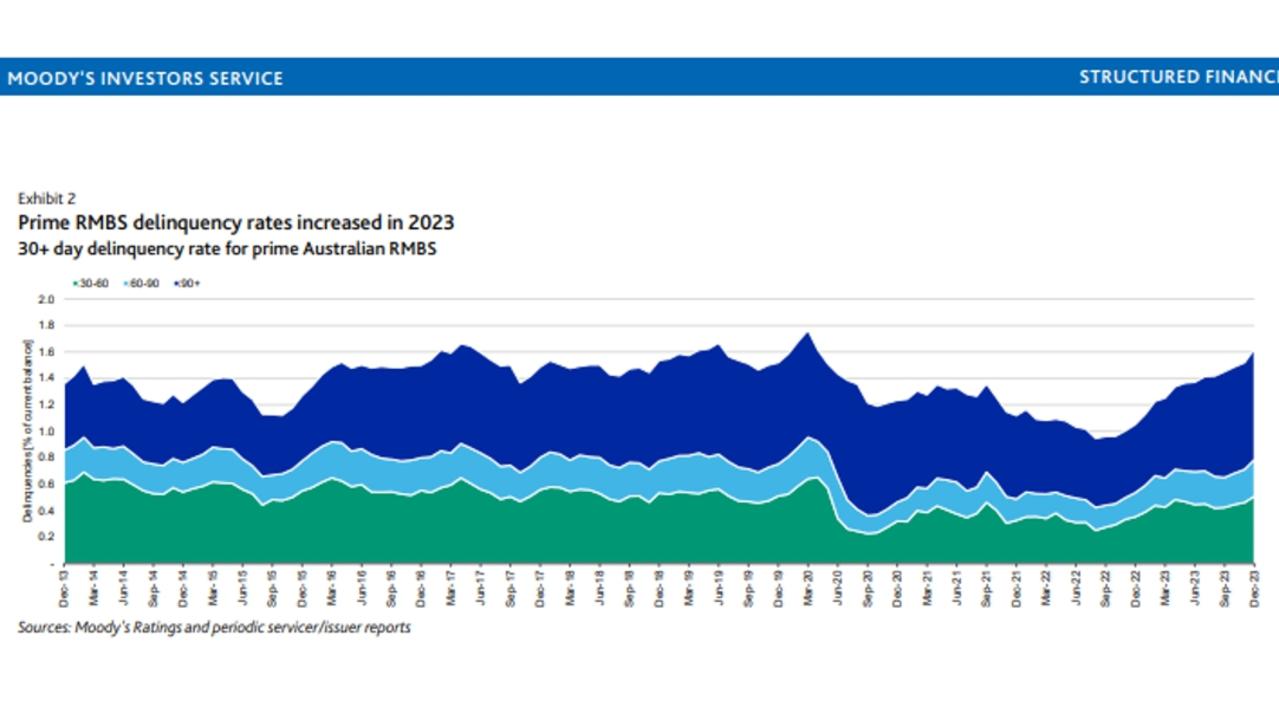

New data from respected analysts Moody’s shows 1.62 per cent of $94.188bn worth of prime home loans assessed are at least 30 days in arrears at the end of last year, up from 1.45 per cent in September.

Moody’s senior ratings associate Philip Au said they were not expecting the trend to taper, though it was difficult to say if it would reach the 1.76 per cent peak level recorded during the Covid-19 pandemic.

RELATED: Melbourne homeowners hold on ‘by their finger nails’ as mortgage stress rises

Stamp duty cut a solution to Australia’s new home building crisis: Charter Keck Cramer

Rental Crisis: Victorian tenants could face weekly rents surging up to 43 per cent

But the increase in mortgage arrears is an alarm bell for tenants, with AI data analysis specialist Kent Lardner noting national trends indicated up to a third of owners struggling with their mortgage could be investors.

With the prospect they would sell rental homes rather than risk losing their own residence, Mr Lardner said the arrears could compound an already grim situation for Victorian tenants.

“Landlords falling into arrears and exiting rental ownership, there’s nothing good about that,” he said.

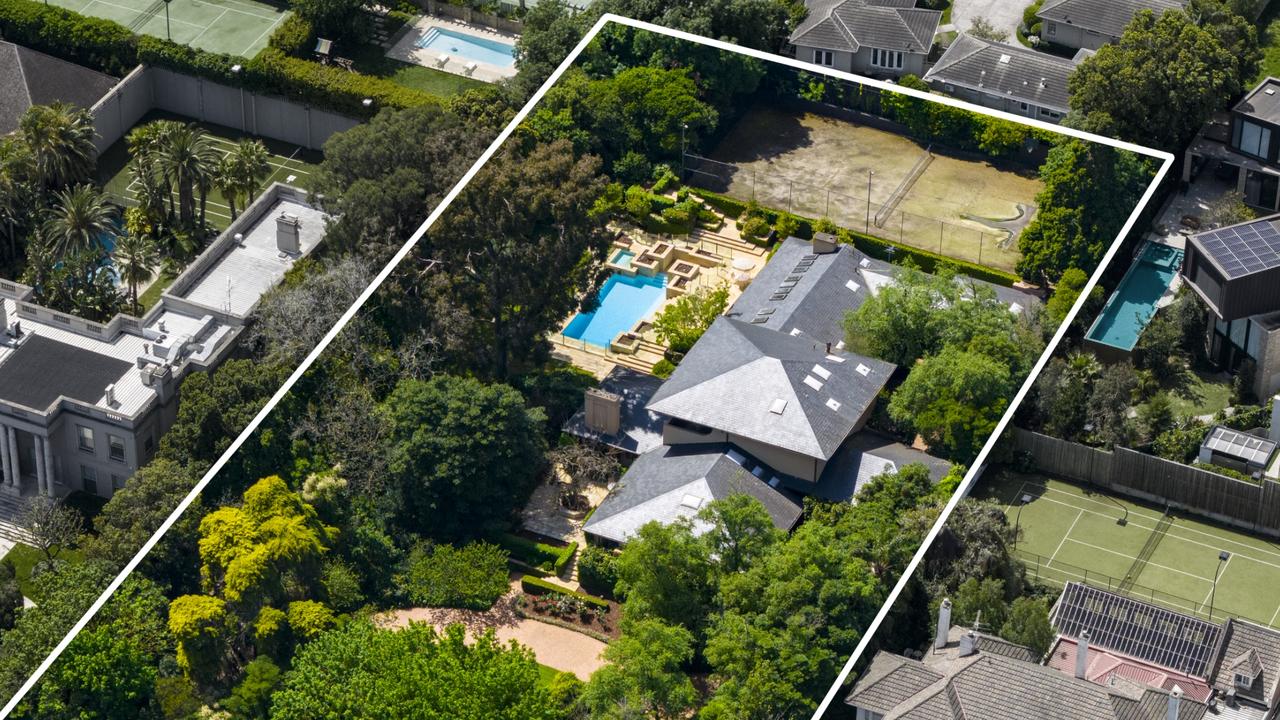

“They are not all fat cats and rich people, most are ma and pa owners.”

The operator of SuburbTrends just released a Rental Pain Index, which for the first time included three Victorian towns or suburbs scoring the worst possible result, 100.

It shows tenants are in the worst position in Balwyn to Melbourne’s east as well as Cobram in Victoria’s north, and regional Rochester, which is still recovering from severe floods in 2022 and in 2023.

“Victoria is certainly creeping up there,” Mr Lardner said.

He noted that a rapid rise in rents across a lot of Victoria, as well as a growing share of markets where more than 30 per cent of homes are for sale were core to the worsening situation.

“And there will absolutely be more pain ahead as the supply is just not keeping up with demand,” Mr Lardner said.

“I see a problem for at least the next 12 months.

“We’re observing a distressing pattern that may lead to a significant increase in homelessness among the most vulnerable populations. The data demands not just our attention but immediate action to prevent a social disaster.”

There were 25 suburbs across Victoria that scored a 95 or more out of 100, which means that while the state is overall more affordable than others for tenants — it has worse pain points than every state other than NSW and Queensland.

Sign up to the Herald Sun Weekly Real Estate Update. Click here to get the latest Victorian property market news delivered direct to your inbox.

MORE: Prize homeowner’s amazing win changes her life

First-home buyer scheme most likely to get you into a home

10 best suburbs in Victoria to buy a unit ranked: PRD Real Estate

Originally published as Growing number of Aussies falling behind on their mortgage set to hurt tenants — Moody’s, SuburbTrends