Peter Dutton announced share sale on day Kevin Rudd warned of a ‘national economic emergency’

Peter Dutton announced a shares sale on the day the country was warned of a “national economic emergency”, it can be revealed.

Peter Dutton disclosed to Parliament that he had dumped his Commonwealth Bank shares on the same day that Kevin Rudd announced a $42 billion stimulus package, warning that Australia was “facing an unfolding national and international economic emergency.”

Last week, News.com.au exclusively revealed the Liberal leader declared he had bought shares in the big three banks on January 23 2009 - the day before the Rudd Government announced a $4 billion Ruddbank plan. Those shares went on to surge by 20 per cent.

Mr Dutton’s register of interests has now confirmed the day he told Parliament he had sold the Commonwealth Bank shares, ten days after the initial declaration, was also noteworthy.

It was a busy day of parliamentary sittings when he updated his share register on February 9, 2009, but it was all doom and gloom on the economic front as the Prime Minister warned of the impact of a global recession.

“The world is now caught in the worst economic crisis since the Second World War,’’ Mr Rudd warned as he justified the $42 billion spend-a-thon.

“The government cannot reverse the impacts of a global recession, but this government will move heaven and earth to reduce the impact of that global recession on Australia.”

The same day Mr Dutton told Parliament he had sold a parcel of Commonwealth Bank shares.

Mr Dutton has categorically denied any forewarning of any major announcements regarding his share trading which he has described as “astute” and a simple reflection of when it was a good time to buy and sell.

Asked about the February 9 trades, Mr Dutton declined on Monday to reveal the date or time of the transaction but said regardless, there was no advance information about government announcements.

“Mr Dutton disclosed all share transactions in 2009 in accordance with the disclosure rules,’’ a spokesman said.

“This has been on the public record since 2009. Any suggestion he had insider information or knew in advance of Rudd Government announcements that influenced any share transactions is totally and utterly false. Mr Dutton has acted with integrity at all times.”

What we know so far: Ruddbank and Peter Dutton buys shares

The discussion of Mr Dutton’s share market activity kicked off last week, when it emerged that on January 23, 2009 Dutton declared that he had bought Commonwealth Bank, National Australia Bank and Westpac shares.

On Saturday, January 24 2009, the Rudd Government announced the Australian Business Investment Partnership, a $4 billion plan to support the commercial property market to be delivered in partnership with Australia’s major banks.

“These are extraordinary measures for extraordinary times,’’ Mr Rudd said when he announced the proposal.

This became known as Ruddbank. It was set up between the Government and the major banks and was aimed at providing finance to the commercial property sector if foreign lenders pulled out of the market.

The ABIP never went ahead as it was opposed by the Coalition, but the announcement made waves at the time.

Following this announcement, Commonwealth Bank shares rose from $23.94 at the close of trading on January 23 to a high of $29.11 on the day Dutton declared that he had sold Commonwealth Bank shares – a 21.6 per cent rise in twelve days.

It’s not known if Mr Dutton bought the shares on January 23 or the day prior.

But what we do know is that Mr Dutton updated his share register four days earlier, on January 19, when he sold BHP shares.

That may suggest the share purchase was made in the intervening four days.

$42 billion stimulus announced ten days later and Mr Dutton sells CBA shares

The issue that hasn’t been canvassed until now is what was happening around ten days later when Mr Dutton announced he had sold the Commonwealth Bank shares just ten days later.

Mr Dutton’s disclosures show that he bought Commonwealth Bank shares on November 11, 2008, on December 11, 2008 and of course on January 23, 2009.

Prior to that blast of share-buying between October, 2008 and March 2009 as the GFC hit, he had not bought or sold a share in four years according to his parliamentary records.

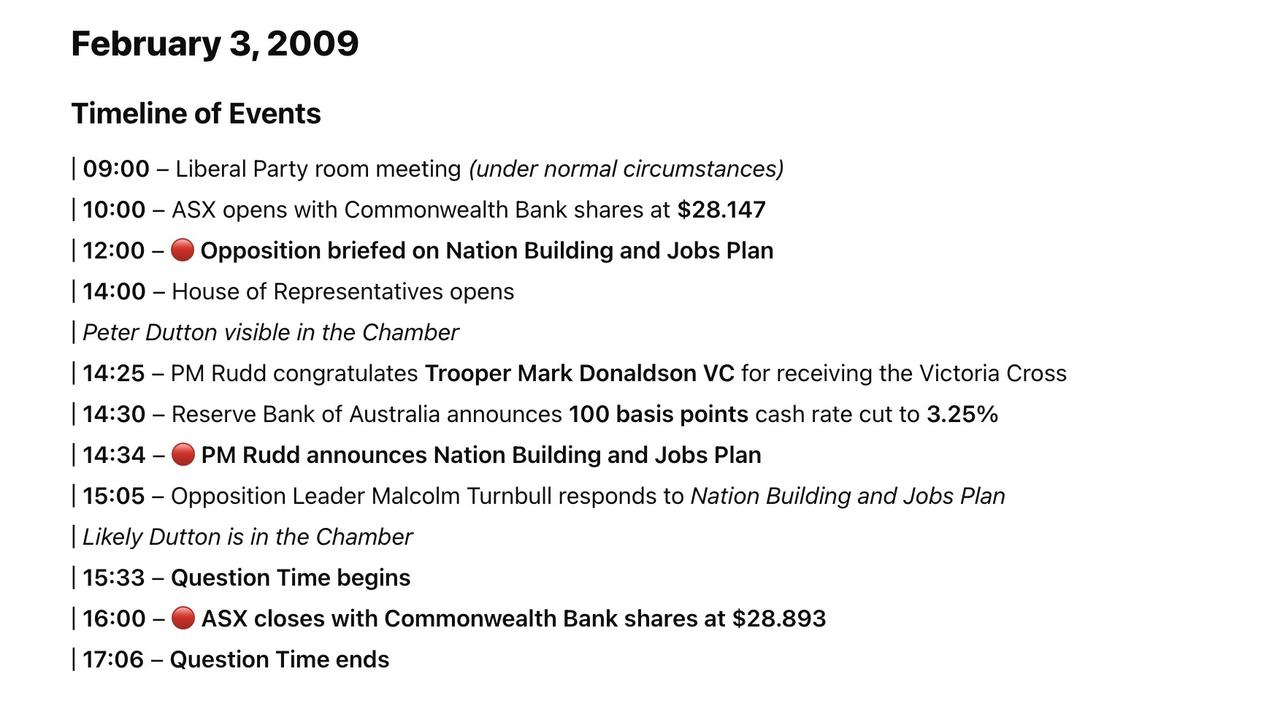

On February 3, 2009, he updated the register to reveal he had sold a quantity of Commonwealth Bank shares. Once again, it’s not known how many he bought and how many he sold.

What’s interesting about that date is that it is the same day as the public announcement of the Rudd Government’s $42 billion Nation Building and Jobs plan.

That plan included the disastrous pink batts ceiling insulation plan and the building upgrades for every one of Australia’s 9,540 schools.

“Because Australia is facing an unfolding national and international economic emergency, the Government of Australia is today launching an unprecedented $42 billion Nation Building and Jobs Plan to support jobs and to invest in Australia’s long term economic future.’’ Mr Rudd said.

“Australia faces a very stark choice. That is whether the government acts, seeks to intervene to reduce the impact of this unfolding global economic recession, or the alternative which is for the government simply to fold its arms and to allow the free market to let rip.”

Liberal leader won’t say exactly when he bought and sold

The Liberal leader has explained his share market activity as a sign of his “astute” investments and “honest and transparent” conduct. He has declined to reveal any information about the volume of shares he bought or exactly when he bought them.

Under parliamentary guidelines he’s not required to disclose the exact date. The only stipulation is that you update Parliament of a share trade within 30 days.

That means while the period he bought the shares is broadly known, the exact day he bought them and the volume or value of shares he bought is unknown.

That’s important because it goes to whether or not his buy ups and sell offs coincided with major announcements or were potentially made days earlier.

Even if they did, Mr Dutton maintains he has never had access to “sensitive information” when he was buying up or when he was offloading the shares and as such any suggestion he bought the shares with political insider information is way off base.

Peter Dutton’s fiery interview on Channel Nine

During a fiery interview with Channel Nine’s Sarah Abo on Friday, Mr Dutton made clear he had no plans to provide more information about his share portfolio and indeed he’s not required to under parliamentary disclosure guidelines.

“Let’s tap into that transparency. Now, when did you buy those shares?,’’ Abo asked.

But in response, Mr Dutton said “that’s been declared in the register” when the actual date of purchase is not disclosed.

“And I think a lot of Australians were buying bank shares at the time because the Australian banks were strong,’’ Mr Dutton said.

“So there was an opportunity to invest. I just disclosed it, declared it, as the rules require.”

Mr Dutton’s office has not sent out a transcript of the Today show interview or published it on the opposition leader’s website since Friday.

Malcolm Turnbull was briefed

On February 3, 2009, Mr Turnbull told Parliament that the Liberal opposition had been briefed on the stimulus plan at 12 pm on February 3.

But he complained he wasn’t provided with much detail. Nevertheless things clearly moved quickly because by 2 pm that day he was in question time debating the proposals.

“This program of so much spending, of such great scale, moment and importance was presented to us at 12 o’clock with a briefing where basic questions could not be answered by some of the officials present,’’ Mr Turnbull said.

“Those officials said, ‘We will get back to you’—and that is good; I have no doubt that they will.”

There’s no evidence to suggest Mr Dutton was briefed at the same time or indeed if he sold the shares before or after the briefing as he is not required by Parliament to disclose this detail unless he voluntarily chooses to do so.

Dutton denies any access to sensitive information

Mr Dutton’s office was contacted on Sunday and Monday to ask when he sold the Commonwealth bank shares but has not responded.

He has previously said in a statement he “had no access to any sensitive information on these matters, nor was he privy to government briefing on the global financial crisis”.

More Coverage

“Just to be very clear, there’s no information I’ve been privy to that influenced any share that I’ve bought,” he said last week.

“I’ve not received any information that has influenced any share transaction by the selling or buying that I’ve made, or the purchase of any property or other asset or other asset class or type where I’ve been privy to any information other than what is publicly available. It’s not something that I would ever do, and that’s something I’m proud of.

“The Prime Minister’s office is shopping around dirt sheets at the moment – transactions that go back to when I was 20 years of age, I’ve conducted myself with integrity at every moment of my life, including as a police officer and since I’ve been in politics.”