Why it’s impossible to help first homebuyers without hurting other Aussies

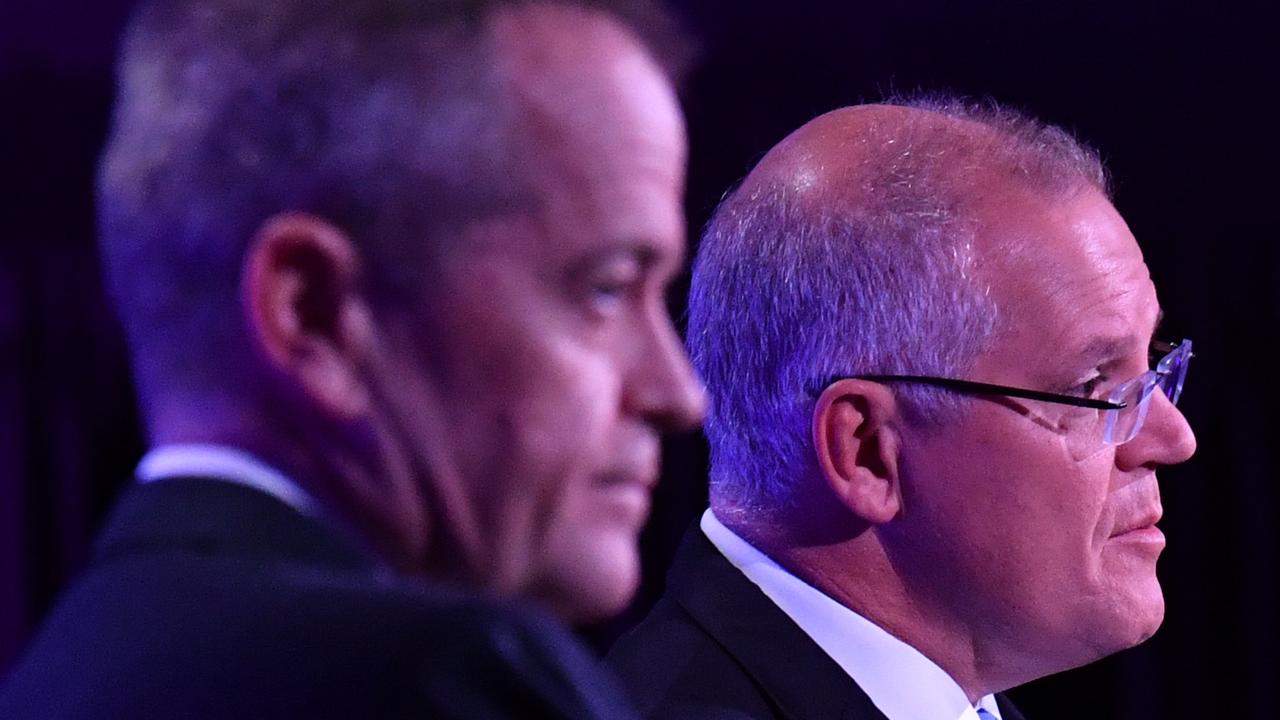

Opposition Leader Bill Shorten and Prime Minister Scott Morrison both promise to help first homebuyers — but at what cost?

Prime Minister Scott Morrison’s surprise pledge to give first homebuyers a leg-up would do little to actually help them — and ignores one of the biggest problems facing the country.

That’s according to several experts from independent think tank the Grattan Institute who claim there’s a “critical flaw” with the newly announced $500 million First Home Loan Deposit Scheme that can no longer be ignored.

THE POLICY

Under the scheme — which was announced by Mr Morrison and quickly matched by the ALP on Sunday — 10,000 eligible first homebuyers would only need a 5 per cent deposit to secure a home, with the Government lending out the remaining 15 per cent from January 1.

There would be a cap placed on the price of the home, and only singles earning up to $125,000 a year or couples on $200,000 would be in the running.

Mr Morrison said the initiative would allow those covered by the scheme to avoid paying at least $10,000 in mortgage insurance, typically charged when a borrower has a deposit below 20 per cent deposit.

THE PROBLEM

But while Mr Morrison has spruiked his scheme as a way to give first homebuyers a much-needed foot in the door, Grattan Institute CEO John Daley and fellow Brendan Coates argue there are several glaring holes in the plan — and it ignores one vital truth.

“Because it costs the budget less, the new scheme is less bad than its predecessors,” the pair wrote in The Conversation.

“But it shares their critical flaw: it pretends we can make housing more affordable without hurting anyone.”

Mr Coates told news.com.au that for the last three decades, governments have “pretended there are costless ways” to fix housing affordability, but that the notion was a myth.

“At the end of the day it ends up being a zero sum gain — first homebuyers are the losers when prices rise,” he said.

“If we want to genuinely help first homebuyers, prices have to fall, and some will be hurt by that.

“It’s a choice we have to make as a society — whether we want younger Australians to be able to live out the Australian dream.”

Mr Coates said the only real solution was increasing supply — an idea usually thwarted by homeowners worried about the effect on their wealth, tough planning and development policies and people who complained about new developments being built in their neighbourhoods.

“There are ways to make housing more affordable, but that involves prices being lower than they otherwise would be, which will affect homeowners today and will involve tackling contentious issues like density in our cities, which means taking on the Nimbys,” he said.

“Until we face up to that challenge, we won’t make any progress.”

Mr Coates and Mr Daley also argued in their article the deposit scheme — which now has bipartisan support — would be ineffective as it currently stands, as it will only help 10,000 borrowers.

On the other hand, if it is expanded, they argue it would push up prices for all Australians — including first homebuyers — and become “counter-productive”.

Instead, they claim Labor’s plan to scrap negative gearing on existing homes and halve the capital gains tax discount could affect new investors but would ultimately help first homebuyers by reducing competition.

THE CRITIC

Realestate.com.au chief economist Nerida Conisbee said the article was “spot on” because “increasing housing supply is the best way to get housing affordability”.

But she said it ignored renters in the negative gearing argument who she believes will ultimately be the big losers.

She argued negative gearing changes would likely cause greater harm than the Coalition’s scheme.

“The negative gearing plan will definitely help first homebuyers if prices drop and investors pull back … but given they provide almost 100 per cent of rental housing, there has to be a fallout in the perspective of raising rents,” she said.

“Ultimately, increasing housing supply is a way to address affordability, but again there are always losers in that.

“No matter what you do there’s going to be losers, but what’s positive (with the new plan) is that the losses will be relatively minor compared to changing negative gearing, which impacts investors and renters, or increasing housing supply, which comes up with so much local opposition.”

However, Mr Coates said it was “fantasy” to expect rents to increase as a result of negative gearing changes.

Continue the conversation @carey_alexis | alexis.carey@news.com.au