Why Australia’s superannuation scheme is ‘stacked against you’

One of Australia’s key schemes is “stacked against you”, with our pollies “deliberately” ripping us off. You should be outraged.

It’s one of the cornerstones of the country’s economic system — but it’s also broken, expensive and “deliberately” robbing from the poor to line the pockets of the rich.

That’s according to Richard Denniss, the chief economist and former executive director of influential progressive think tank The Australia Institute, which claims Australia’s superannuation policy is in desperate need of an overhaul.

Dr Denniss told news.com.au “no other area of policy was less fair” in Australia today than our “taxpayer support for retirement” — a system that showers lucrative tax concessions upon the wealthy while thumbing its nose at low-income earners.

“Taxpayers literally give tens of thousands of dollars a year to help high-income earners save for their retirement, while we literally give zero to many low-income earners to save for their retirement,” Dr Denniss said.

“We give you a bigger tax break the more you earn, while taxpayer support for your retirement savings increases as your income increases — it’s the opposite to the rest of our welfare system.”

He said the cost of tax concessions to superannuation continued to rise, and the system “deliberately” favoured men working full-time on high incomes.

“It was invented by high-income men looking after their own. It was created in Australia when most men worked full-time their whole lives and almost nobody worked part-time or casually,” he said.

“Now the labour market has changed completely, but our super system hasn’t — it still works pretty well for people who work full-time their whole life, but it is terrible for those who work part-time or who take time out of the workforce over the course of their lives.

“If you think a system that gives tens of billions of dollars a year to the highest income earners — to help those high-income earners have even more money in retirement — sounds fair, then keep ignoring the boring issue of super. But the whole system is stacked against young people and women.”

He said the inequality was amplified because men tended to earn more and work for longer than women and qualify for bigger tax breaks.

RELATED: ‘Crazy’ rule giving Aussies free money

RELATED: Aussie mum slams $141-a-day ‘robbery’

“You should be enraged by a system that’s unfair and unsustainable,” he said.

“Unless you want your grandson to retire with a lot more money than your granddaughter, you should be outraged by the current system.”

Dr Denniss claimed the “confusion and complexity” surrounding superannuation was “deliberate” and current tax concessions also favoured older people over the young.

“Young people saving for a house are in no position to access these very generous tax breaks (for super contributions) whereas older people who are cashing in on record house prices are in the perfect position to use these tax breaks,” he said.

“But it’s so confusing young people just think they’ll deal with it later.”

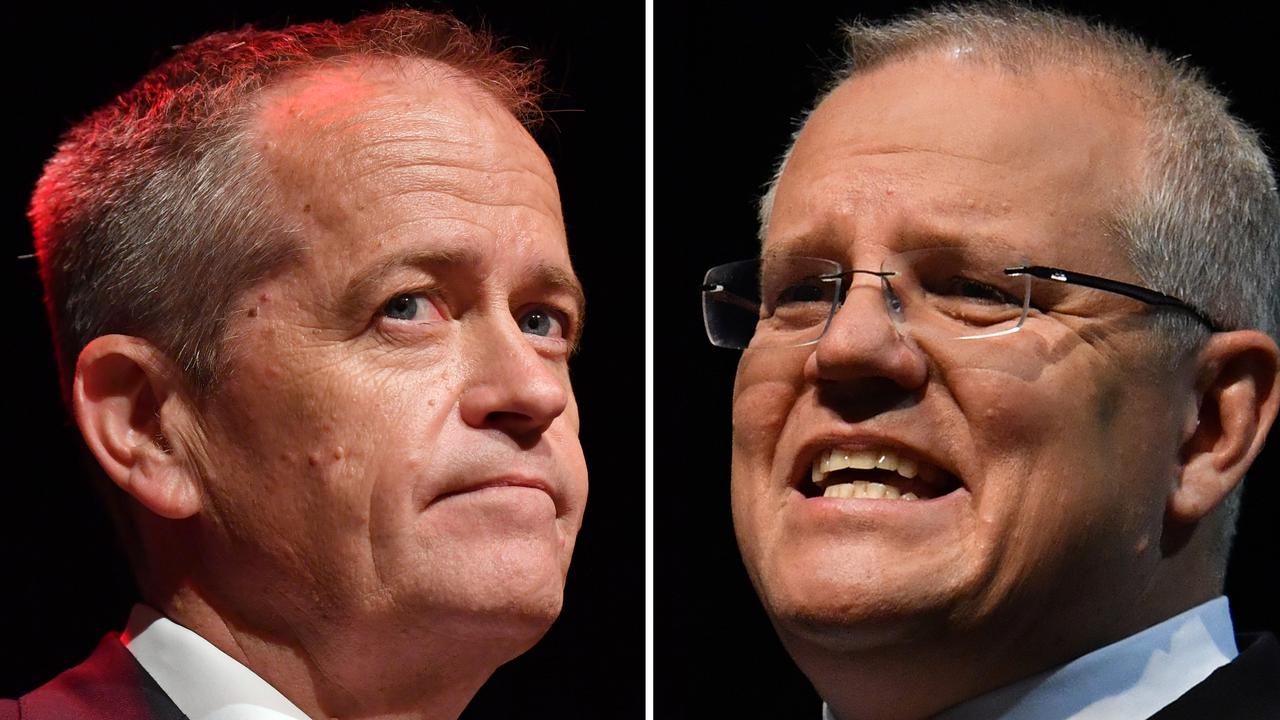

COALITION V LABOR

Both parties have promised to lift the compulsory superannuation contribution from 9.5 per cent to 12 per cent by 2026 — a move public policy think tank The Grattan Institute claims will slow wage growth and strip $20 billion a year out of wages, according to a new report.

Last week, report author Brendan Coates made headlines after warning the cash would be pinched from workers’ wages, not employers’ profits.

“Both sides of politics are committed to wage cuts that workers can’t afford in exchange for extra super that won’t help them much,” Mr Coates said.

“The overwhelming evidence is that higher super contributions are paid for by lower wages for workers.”

Meanwhile, both major parties have revealed a suite of other super policies in the lead-up to the May 18 federal election.

As part of its 2019 Budget announced last month, the Government revealed Aussies aged from 65 to 67 would be allowed to make voluntary superannuation contributions without meeting the work test, which requires people to work at least 40 hours per month to make a voluntary super contribution.

It also raised the age limit for spouse contributions from 69 to 74 and announced Australians aged 65 and 66 would be able to bunch up three years of non-concessional contributions to a total of $300,000 without a work test.

Under a Labor government, the annual non-concessional contributions cap would be lowered to $75,000, and the high income superannuation contribution threshold would be further lowered to $200,000 — meaning people earning above that amount would have to pay 30 per cent tax on their superannuation contributions, instead of 15.

The ALP has also pledged to reverse the introduction of catch-up concessional contributions and changes to tax deductibility for personal superannuation contributions.

THE INSIDER

Combined Pensioners and Superannuants Association (CPSA) policy manager Paul Versteege agreed the system was unequal.

But he told news.com.au while the current favouring of men and older people could come down to the superannuation system being still relatively “immature”, benefits intentionally given to richer Australians were perhaps more of a concern.

“You could argue the system has design features that facilitate (inequality), particularly the ability to essentially make after-tax contributions in combination with the tax-free status of earnings inside super funds and pensions coming out of them — it tends to disproportionably favour richer people,” he said.

Mr Versteege said evaluating the major parties’ policies depended on what they were trying to achieve and whether they wanted the superannuation system to “supplant” the pension or just supplement it.

But he said the CPSA represented lower-income retirees, and he personally wanted to see a superannuation system that maximised benefits for those people.

“Things like the Coalition’s $1.6m transfer balance cap (placed on the total amount of accumulated superannuation an individual can transfer into the tax-free retirement phase) is nice if you’re rich and can get that, but I’d like (the Government) to look into what happens to people who have multiple jobs or casual jobs or part-time jobs — what happens to their super?”

He said he hoped whoever won the election would implement measures suggested by the Productivity Commission’s review into our super system, such as reducing Australia’s high superannuation fees and fees for superannuation advice.

He said he expected women’s average super balances to increase as more and more women entered the workforce for longer periods, and the underlying issue with women’s lower superannuation balances was pay inequality.

Continue the conversation @carey_alexis | alexis.carey@news.com.au