‘The deposit hurdle is too high’: Coalition’s huge $50k housing move

In a huge move for those looking to get into the housing market, the Coalition is promising a major change to first home deposits.

Peter Dutton’s big plan to allow first homebuyers to raid their super for up to $50,000 in one go to buy a first home will be under scrutiny today as political leaders face off over the housing crisis.

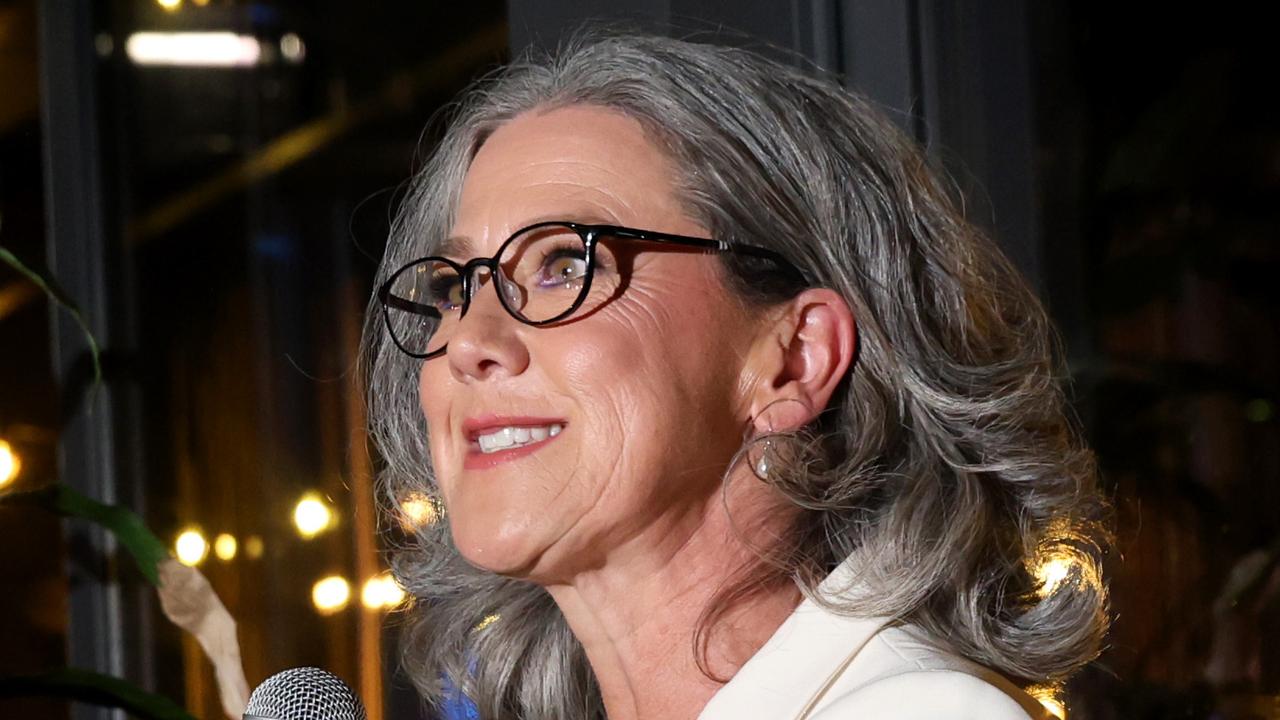

Liberal frontbencher Michael Sukkar will outline the Coalition’s housing policy today in an address at the national press club as he prepares to debate the Greens housing spokesman Max Chandler-Mather.

Mr Sukkar told news.com.au that if there was “one message I want Australians to take away from my remarks today, it’s that the Coalition will not accept a generation of Australians not having the same opportunities that previous generations have enjoyed for home ownership.”

“This Labor Government is failing Australians,’’ he said.

MORE: Dutton hits back at super-for-housing fears

“The deposit hurdle is too high, with Labor trenchantly standing in the way of first home buyers accessing part of their superannuation savings for a first home deposit.”

Big difference between major parties on super and housing

The Coalition’s big idea to tackle that deposit hurdle remains controversial – allowing first home buyers to take money out of their super.

But there’s a big difference between the Coalition’s plan and the existing first home super saver (FHSS) scheme which allows you to make personal voluntary contributions into your super fund to help you save for your first home.

Under the existing plan if you make extra contributions you can withdraw up to $15,000 of your voluntary contributions from any one financial year.

MORE: How high house prices could jump if homebuyers dip into super

Under the Liberals plan you can withdraw up to $50,000 but when you sell your house down the track you need to put the money back into your super.

Concessional contributions are taxed at only 15 per cent, which is usually less than your marginal income tax rate.

Under the Coalition’s alternative Home Guarantee Scheme first home buyers and separated women can use up to $50,000 of their superannuation savings for a home deposit.

“Ultimately, we stand for choice and giving Australians options on their own money is hardly radical,’’ Mr Sukkar said.

“We are the only party fighting for the Dream because home ownership has always been a Liberal value and something Labor has never signed up to.

“Australians deserve action, not spin, and housing – without a doubt – will be a defining issue at the next election.”

Economists concerned over super for housing push

Economist Saul Eslake has warned using super to buy a house would make homes more expensive and reduce retirement incomes.

“If super for housing was introduced, it would be one of the worst public policy decisions in the last six decades,” Mr Eslake said.

Some experts have also cautioned against the super for housing plan and warned such demand-side policies drove home prices higher.

Mr Sukkar also warned that construction is at record lows and construction costs have been exacerbated by the “unholy alliance between the Labor Party, the CFMEU, and now the Greens.”

He warned that first homebuyer loans had plummeted from 171,218 in 2020–21 under the Coalition to just 108,599 in 2022–23.

Home completions dropped to 177,185 last year — 40,000 fewer than the 216,707 under the Coalition in 2016–17.

Approvals for new homes have also crashed, falling to 167,287 over the past year, compared to 233,247 when the Coalition was in government.

Meanwhile, national median rents have skyrocketed by 23 per cent, reaching $632 per week from $512 in May 2022.

“Coming from a migrant family, I experienced first-hand why millions of people have come to Australia, and home ownership has been a big part of that better life,’’ Mr Sukkar said.

More Coverage

“Migration needs to be planned and controlled, which is why the Coalition proposes several measures to potentially free up nearly 40,000 homes in the first year and over 100,000 homes in the next five years.”

The Liberal Party is proposing a two-year ban on foreign investors and temporary residents buying existing homes.

They have also pledged to deliver a significant reduction in the permanent migration program, and to net overseas migration.