New share-trade drama ignites for Peter Dutton over BHP shares sell-off

It can be revealed Peter Dutton sold BHP shares just two days before the mining company made a drastic move, but the opposition leader denies he has “questions to answer”.

Peter Dutton has revealed another astute share trading move confirming he dumped his BHP shares in 2008 two days before the mining giant slashed 3,300 jobs.

But he’s denied any inside knowledge on the decision that sparked an 8.5 per cent slump in the share price, rejecting fresh Labor claims that he has “questions to answer”.

At the time, the Liberal leader was in opposition and Kevin Rudd was Prime Minister.

Mr Dutton had recently held the shadow finance portfolio and had just moved to health when he disclosed to Parliament he had bought the shares on October 17, 2008.

The day before, BHP shares fell 13 per cent amid reports the Chinese economy could no longer support the Australian mining boom.

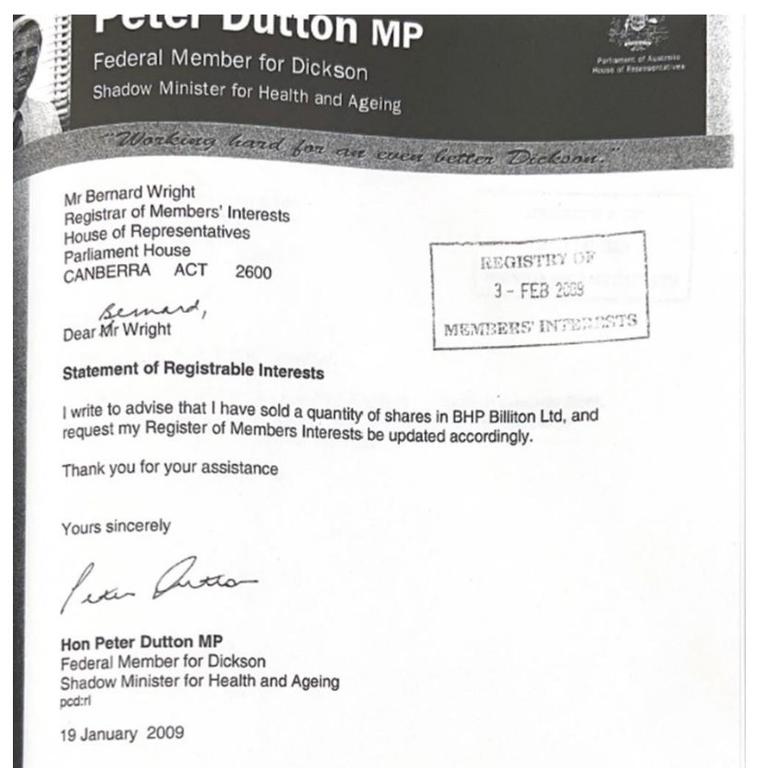

Just a few months later, Mr Dutton sold a quality of shares in January 2009. He disclosed the sell-off on January 19.

Two days later on 21 January, BHP announced it would slash 3300 Australian Jobs.

BHP announced it would axe 1450 jobs at its Ravensthorpe nickel mine in Western Australia, 300 jobs at WA’s Mount Keith nickel mine, 1100 New South Wales and Queensland coal industry jobs including 350 jobs at the Yabulu nickel processing plant in Queensland, and 200 jobs from the Olympic Dam extension in South Australia.

Minister for Employment and Workplace Relations Murray Watt claimed that it now appeared at a time when thousands of workers were losing their jobs that “Peter Dutton was more worried about making a quick buck.”

“This is now a serious problem for Peter Dutton and shows just how out of touch he is with working Australians,’’ he said.

“He owes those workers and all Australians an explanation about what he knew of the pending mass sacking and when he knew it.”

Peter Dutton rejects Labor’s allegations

Mr Dutton told news.com.au that he had no foreknowledge of the job losses before selling.

“Mr Dutton provided all the required information and updates to his register of members’ interests in 2008 and 2009,’’ a spokesperson said.

“He was not aware of any internal matters at BHP at the time.”

The value of the shares dropped 8.5 per cent over the course of the week amid the news that Queensland’s Courier Mail newspaper said had “devastated” local communities.

2010 share purchasers

Fifteen years ago, Mr Dutton was publicly accused of buying up BHP shares before the Liberal Party announced it would oppose the mining tax.

At the time, the Australian Workers Union said the purchase of BHP Billiton shares by then Opposition frontbencher Peter Dutton was “almost like insider trading”.

News.com.au does not suggest Mr Dutton has ever engaged in insider trading, a claim Mr Dutton has flatly denied, only that the claim was part of the cut and thrust of political debate at the time.

AWU national secretary Paul Howes questioned Mr Dutton’s purchase of BHP shares.

“One thing Peter Dutton knew that the rest of the community didn’t know, is that at the time of buying the shares the Opposition hadn’t announced its position on the tax,” Mr Howes said in 2010.

“We hadn’t heard the Opposition Leader’s budget reply speech and so [Mr Dutton] clearly knew the Coalition was going to oppose the resources rent tax.”

At the time, Mr Dutton said he bought the shares because the tax announcement was wiping value off good companies.

“I bought a small parcel of shares off the back of Mr Rudd’s decision to attack Australian mining companies,” he said.

“I still thought they were good value long-term and I made an investment decision on that basis.”

Previous share claims

Earlier this year, the Prime Minister demanded Peter Dutton provide voters answers on his trades during the global financial crisis.

News.com.au had revealed that a forensic analysis of Mr Dutton’s financial declarations revealed he notified parliament of a share-buying blitz involving the big banks the day before Labor announced a bailout in 2009.

During campaigning in Sydney, Mr Albanese was asked if the Labor Party was seriously suggesting that the Liberal leader engaged in insider trading.

“That’s a matter for Peter Dutton to explain,” the Prime Minister replied.

But Mr Dutton accused Labor’s “dirt unit” of trawling his financial records to create controversy.

“If the Albanese Government’s dirt unit spent more time being focused on fixing Labor’s cost of living crisis rather than obsessing about Peter Dutton, Australians might be better off,’’ a spokesman said.

“Mr Dutton had no access to any sensitive information on these matters, nor was he privy to government briefing on the GFC.”

After the Prime Minister’s intervention calling for Mr Dutton to explain, his office released the following statement.

“Mr Dutton had no access to any sensitive information on these matters, nor was he privy to government briefing on the GFC.”

Between October 2008 and March 2009, Dutton updated his register of interest 13 times to indicate that he had either bought or sold shares.

News.com.au has confirmed he had not previously bought or sold any shares for the previous three years, according to his parliamentary records.

Blow up in Senate estimates

The controversy blew up in Senate estimates with Liberal Senator Jane Hume hurling insults at Finance Minister Katy Gallagher after she raised the issue under the guise of what would happen if a public servant used sensitive information.

“If a public servant was to know that, hypothetically, that the banks were to be bailed out during the GFC and sought to buy up shares of all those major banks on the eve of that announcement, I imagine there would be very, very serious consequences, that we are now reading about how Mr Dutton behaved,” Senator Gallagher said in a public hearing.

“Do you want to say that outside of parliamentary privilege?,” Liberal Senator Jane Hume interjected.

“Say it outside the room. It’s grubby. You’re so grubby. Say it outside this room.”

Under parliamentary privilege, senators cannot be sued for defamation about what they say in Parliament.

Timelines under the microscope

The Labor Party asserts that some of the bank share-trading buy-ups occurred shortly before the Rudd-Gillard Government announced big bailouts for the banks, spiking share prices.

On January 23, 2009 Dutton declared that he had bought Commonwealth Bank, National Australia Bank and Westpac shares.

On that date, all three companies experienced record-low share prices.

On Saturday, January 24 2009, the Rudd Government announced the Australian Business Investment Partnership, a $4 billion in stimulus package to the commercial property market to be delivered in partnership with Australia’s major banks.

The ABIP never went ahead as it was opposed by the Coalition, but the announcement made waves at the time.

Following this announcement, Commonwealth Bank shares rose from $23.94 at the close of trading on January 23 to a high of $29.11 on the day Dutton declared that he had sold Commonwealth Bank shares – a 21.6 per cent rise in twelve days.

It’s not known if Mr Dutton bought the shares on January 23 or the day or prior but he did update his register multiple times during this period with individual share purchases. Under the rules, he must update the register within 30 days.

Why January 23, 2009 was a big day

While the timeliness of Mr Dutton’s declaration to parliament is not in question, what Labor wants to know is whether or not Mr Dutton was aware when he bought the shares that the government planned to make billion-dollar investments that would increase the value of the shares.

For example, on January 23 2009 Dutton declared that he had bought Commonwealth Bank, National Australia Bank and Westpac shares.

That date was an extraordinary day as all three companies experienced record low share prices.

Then, on Saturday, January 24 2009, the Rudd Government announced the Australian Business Investment Partnership, a $4 billion in stimulus package to the commercial property market, to be delivered in partnership with Australia’s major banks.

Following this announcement, Commonwealth Bank shares rose from $23.94 at the close of trading on January 23 to a high of $29.11 on the day Dutton declared that he had sold Commonwealth Bank shares – a 21.6 per cent rise in twelve days.

Read related topics:Peter Dutton