ATO’s tax rebate fails to stimulate economy as Aussie use it to pay off debt, report says

The Federal Government’s tax rebate was meant to boost the economy, but what cash-strapped Aussies are really spending the money on has been revealed.

The tax rebate of about $1000 hoped to be an economic stimulus isn’t travelling far or doing much stimulating.

It is being used by debt-laden households to take advantage of low interest rates and pay off IOUs and reduce home mortgages, a bank’s survey has found.

And some households are still unable to survive on wages and investments every month without going further into debt.

The ME Bank’s Household Financial Comfort Report released today found families are more worried than six months ago about job security, income, and meeting living expenses.

It found 35 per cent of those surveyed wanted more work than they could currently get, and around a quarter of those in jobs felt insecure.

RELATED: Tax refund: How to get your $1080 offset

RELATED: ATO’s hit list revealed as it clamps down on dodgy tax returns

More households want to increase cash savings as a precaution against a financial emergency, but that is beyond the reach of some 10 per cent of families who already spend more than their income each month.

The survey of 1500 adds to warnings from the Reserve Bank that the nation’s economy is not reaching goals on GDP growth, employment and wage increases.

And it adds to pressure on Prime Minister Scott Morrison to spend more tax revenue to stimulate economic activity even if that put the promise of a budget surplus at risk.

However, the report indicated some households might have been more financially uncomfortable had Labor won the May 18 election.

The 16th bi-Q annual survey reported households were gloomy about their present financial situation and their future.

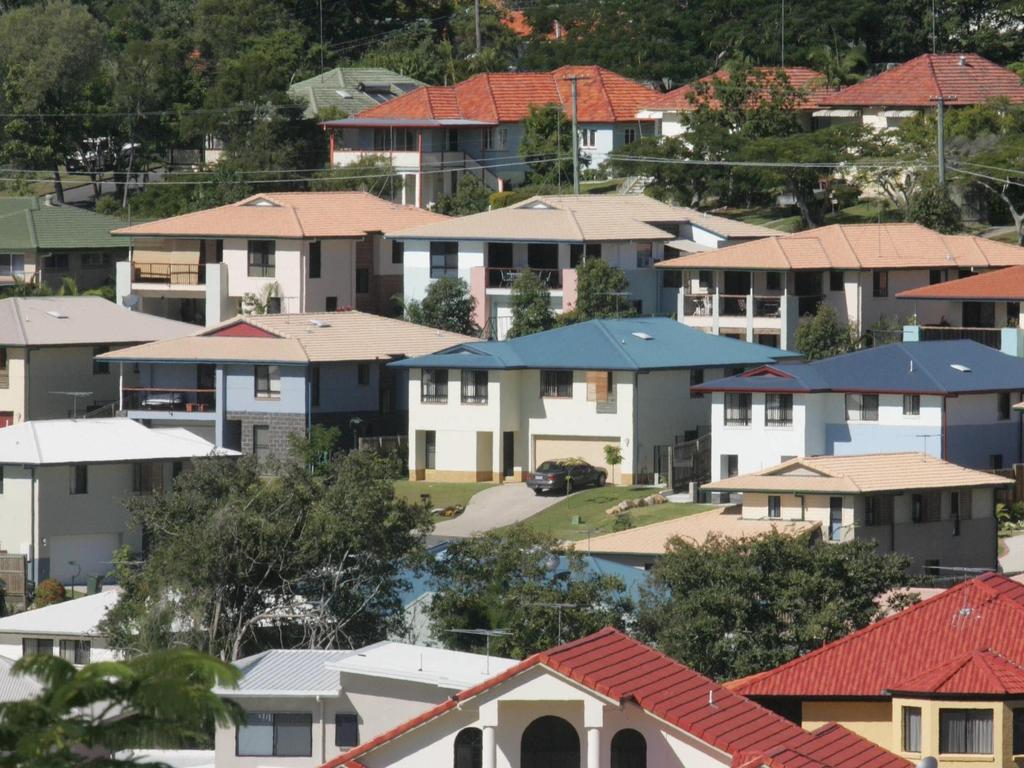

“Despite lower mortgage loan rates, expected cuts in personal income tax and higher local and global equity prices, this is largely a consequence of continued decreases in the value of residential property in many parts of Australia,” said Consulting Economist for ME Bank Jeff Oughton,

“Comfort with wealth would have fallen much more if it wasn’t for record bond prices and rebounding share markets as well as the Government’s retention of negative gearing on investment properties and cash refunds for franking credits that saw household comfort with

investments increase.”

The ME Household Financial Comfort Report is based on a survey of 1500 households with project assistance from DBM Consultants and Economics & Beyond.

Originally published as ATO’s tax rebate fails to stimulate economy as Aussie use it to pay off debt, report says