New Facebook Marketplace scam as true cost of scams revealed by alarming data

A new “quick fire” scam is taking on a life of its own, with fraudsters using one dodgy tactic to trap their victims.

A new “quick fire” scam is taking over online marketplaces, with fraudsters targeting everyday users buying and selling their goods online.

Sydney mum Paige Hinson listed garden furniture on Facebook Marketplace after her young family moved to a new house in the western suburbs.

Within minutes of listing an outdoor table and chairs, a buyer landed in her inbox seemingly very keen to take the furniture off her hands.

“They were quite pushy and they wanted to come and pick up the furniture the next day, which I was quite excited about because it was a $700 sale and my husband said that was way too expensive,” she told news.com.au.

Little did the 31-year-old mum know she was being hounded into a trap.

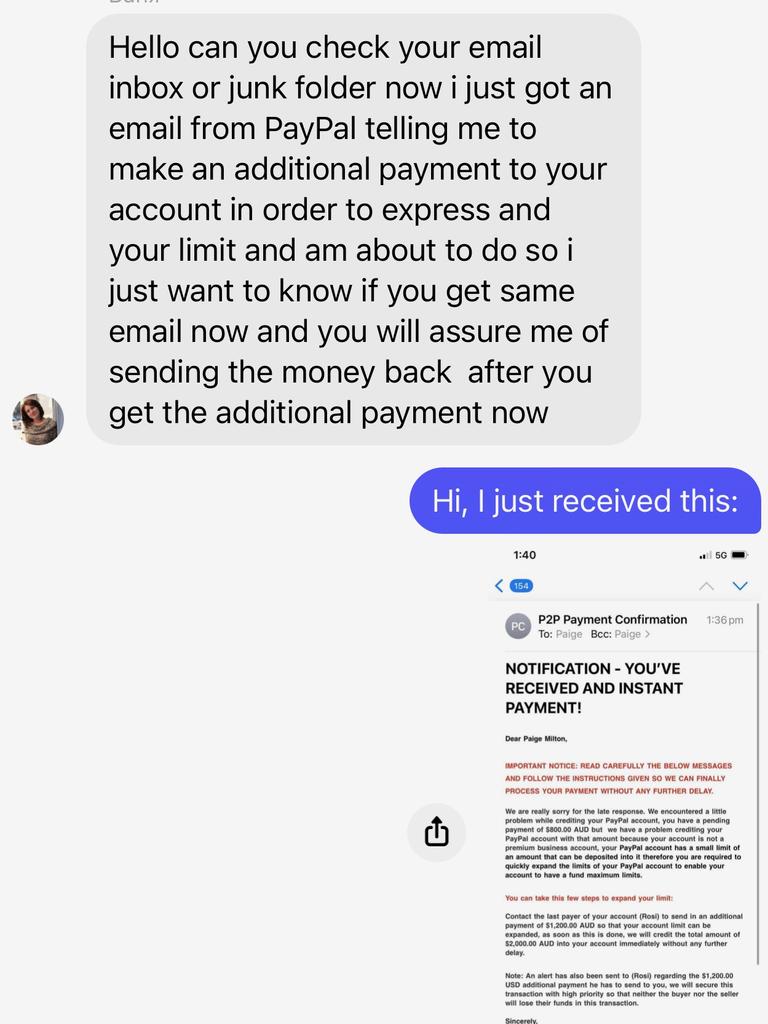

The buyer, whose account posed as a middle-aged woman named ‘Rosi’, first demanded Ms Hinson transfer $500 money into a holding PayPal business account that they would use to confirm she was “legitimate” before the money was released back to her, along with $700 for the furniture.

“They asked for an email address, which I gave thinking you can’t possibly get scammed with just an email address,” Ms Hinson said.

“Then I got a very legitimate-looking email from PayPal with all the details to transfer the money into, so I started doing that.”

In messages seen by news.com.au, Rosi told the Sydney mum that transferring the extra funds was the “only way” the sale could be completed. But Ms Hinson replied she had “never heard of that before”.

Even so, Ms Hinson complied with Rosi’s fervent requests for action and proof of her PayPal account – she even apologised for Rosi’s impatience at her stepping away from the interaction to put her baby to sleep.

The young mum told news.com.au she was seconds away from transferring the money requested when she had a “gut feeling” something was wrong – “because they were desperate to get this money”. She called her bank, which confirmed her hunch.

“I was essentially about to hit transfer, so I was quite lucky,” Ms Hinson said.

“I think the trick was it was so intense and quick, you don’t have time to think. They’re like ‘is this available?’, ‘can I come and pick it up tomorrow?’

“Once she realised I was open to selling, it was just about getting that money.”

The 31-year-old is part of a growing group of hidden scam victims falling prey to a new breed of “quick fire marketplace scammers” who, experts say, are targeting well-meaning Australians multiple times every day.

And many of them, including Ms Hinson, never report to authorities.

The Australian Competition and Consumer Commission (ACCC) estimates Australians lost more than $3 billion to scammers in 2022, a record high and 80 per cent increase to what was lost in 2021.

But new data commissioned by local start-up Sell Securely has revealed the hidden cost of scams is much higher – closer to $9.3 billion.

The national survey concluded that although more than 52 per cent of Australians have been scammed, some more than once, two-thirds (66 per cent) of those victims have never reported it.

It means, potentially, 6.7 million Australians are going without compensation or support after being scammed.

Sell Securely founder and Director Rob Neely told news.com.au what was perhaps more alarming about the “crazy” data was that it showed only 20 per cent of people report to the ACCC.

“Most of the people think it’s a waste of time telling the ACCC what’s happened. They don’t believe the government can do anything,” he said, adding that people more often than not go to their bank.

Also alarming to Mr Neely was the increase in social media scams, particularly on Facebook and its marketplace feature.

Sell Securely found almost 45 per cent of Australians were scammed on social messaging and marketplaces.

“In Australia the ACCC reported only 20 per cent of scams happen on social media, but we found almost half of the scams are coming from social media,” he said, adding it reflected alarming overseas findings from Lloyds Bank London, that eight in 10 scams were coming from Facebook.

“We know what’s happening is there are mums and dads who have never done anything wrong in their life trying to sell furniture or, say, a wedding dress, on Facebook marketplace, and they’re getting stung.”

He said the data reflected the growth in the “Quick Fire” scam on online marketplaces, where humble sellers are targeted by shysters as soon as they post a sale.

“And because you can only directly contact the seller, not comment, they can shoot rapid-fire messages to multiple people 20, 30 times a day,” Mr Neely said.

“And then, because the vast majority of scams are under $100, which is what the ACCC found, people think it’s not that much so I won’t report it. But these scammers are doing this again and again.”

Even Ms Hinson, who almost lost $1200 through the scam, said she did not report the scam to the ACCC, thinking she needed to “actually lose the money, and a significant amount”.

“I told a few friends, but I wasn’t actually scammed, and it wasn’t something we actually talk about,” she said.

“Then a week later one of my friends put up a story on Facebook and I thought: this happened to me, so I wanted to warn people, too.”

She added that she thought the issue was that sellers were too trusting: “you don’t think someone who’s buying is going to be a scammer, until it’s too late”.

Sell Securely found both buyers and sellers were being scammed in marketplace settings – 48 per cent and 28 per cent, respectively, had fallen victim.

Mr Neely said there were a number of things users can do t prevent scams, including using Sell Securely to complete their transactions.

The free-to-use platform holds transactions in escrow until the seller delivers the goods to the buyer, and the buyer approves the delivery. No financial details are seen or sent by either party.

“Yes, use us for guaranteed security. But sometimes it’s just a case of: if it’s too good to be true, it probably is,” Mr Neely said.

“If they’re pressuring you, don’t fall for it. Don’t send the deposit. Verify their identity, ask for identification, make sure they’re not a fake account.”

And if you do get scammed, Mr Neely said, tell everyone, especially the ACCC – “that’s the very least you should do, no matter the loss”.

“It’s worrying that if we hadn’t done this survey we wouldn’t know there are about 6.7 million Australians missing from the ACCC’s data because they just don’t report being scammed,” he said.