A young couple from Adelaide reveal how they spent over $3000 in one week

A young couple from Adelaide reveal how they spent over $3000 in one week and why they aren’t “proud” of it.

An Gen Z influencer has shared how she spent over $3,000 in one week without doing anything lavish.

Ella Maegraith, 27, is an online content creator based in Adelaide who candidly discusses her finances, breaking down how she and her partner managed to spend $3428.26 within a typical week.

Ella works part-time as a travel agent and devotes the rest of her time to her social media empire. Meanwhile, her husband Nick has just scored his first post-university job as a junior lawyer.

The couple’s joint income before tax hovers around $180,000 but varies yearly because of Ella’s content creator role.

They have no kids, own their home and spend thousands a week, with Ella explaining precisely how.

If you want to share your weekly budget or continue the conversation please email mary.madigan@news.com.au

Ella clarified she wasn’t “proud” of spending this much in a week but chalked it up to the fact that sometimes things get expensive.

Firstly, the pair had their fortnightly mortgage due, $1783.04, and their bills came to $248.13.

Ella explained they spent $42.97 on subscriptions, $118.57 on eating out, $133.90 on petrol and bought groceries for $112.01.

The Adelaide local explained they keep their grocery bill down by mostly eating vegetarian during the week because meat is expensive, and they shop at Aldi in another effort to keep the bill low.

Interestingly, one of the couple’s biggest splurges wasn’t on anything fancy, but instead their coffee intake which set them back $69.85.

“I know not everyone understands our coffee obsession, but honestly, it is just our way to spend time together,” she said.

Finally, the couple went a little wild on buying home stuff including christmas decorations and ended up spending $919.79, which is how their week hit over $3000.

Ella said she understands she and her partner are in a very “lucky” financial position, but despite their $3k week, they are trying to stick to a budget.

The creator keeps a spreadsheet of their spending so she can understand where their cash is going. She revealed their monthly breakdown is $1,000 on bills, $4,000 on every day costs, and $4500 on their mortgage and car loan.

Ella said while the $3,000 amount sounds like heaps of money, it wasn’t on anything extravagant if you look at how they spent their cash in that particular week.

“When you break down our spending, the majority is going on needs instead of wants,” she told news.com.au.

The content creator said the cost of living crisis is making it nearly impossible to save.

“It is getting harder and harder, and I have been making financial content for a while, and looking back, everything is increasing,” she said.

Plus, Ella revealed, their mortgage has tripled within the last year. Thankfully they’d budgeted for it to increase.

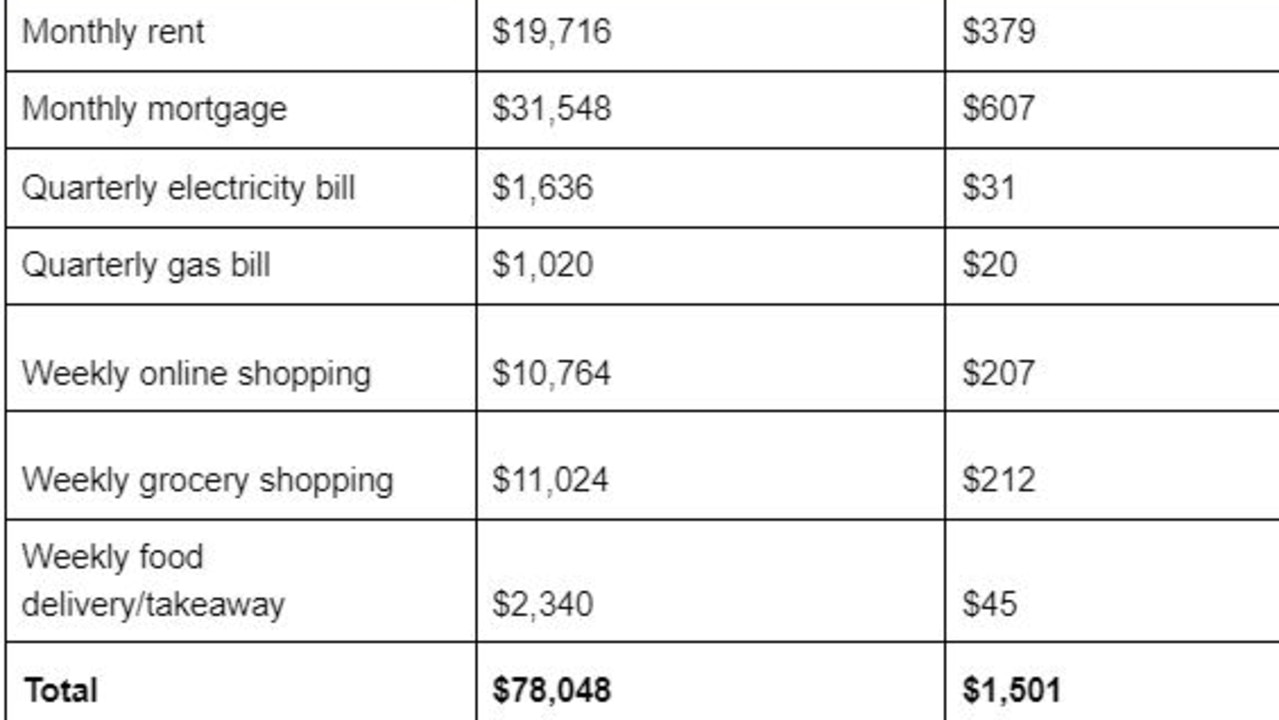

Graham Cooke, head of consumer research at Finder said that across the board Aussies are spending more this year.

“The cost of virtually everything is going up causing significant strain on household budgets. People are spending drastically more than what they were 12 months ago – whether it be on their rent, mortgage, groceries, or utilities bill,” he explained.

More Coverage

Mr Cooke said it is important to remember that spending more isn’t anyone’s fault, but there are steps you can take.

“While most of it is out of your control, there are ways to bring down spending. Start off by creating a realistic budget. This will allow you to track where all your money is going so you can reel back on unnecessary spending.

“Also look at culling subscriptions you don’t use daily – while only a few dollars here and there every month, it adds up over the course of a year,” he advised.